-

The dollar is currently undergoing a correction, with the U.S. currency significantly strengthening during today's session. The GBPUSD pair has tested support at 1.2850, while EURUSD is trading around 1.1120.

-

The Swiss franc struggled the most today, depreciating over 1% against the dollar, and the USDCHF pair has already rebounded more than 100 pips from the low set on Tuesday.

-

Positive sentiments dominated the European stock market, with the main indices of the Old Continent closing the session higher. The DAX gained 0.6%, while the CAC added 0.8%, and London's FTSE100 closed 0.75% higher.

-

On Wall Street, there is a pullback with the tech-heavy Nasdaq suffering the most, with losses exceeding 1%.

-

The Central Bank of Turkey (CBRT) has only raised interest rates to 17.5%, though it was expected that it could even reach 20%. Previously, the rate was 15%, though it was 8.5% not long ago.

-

Jobless Claims came in below expectations at 228,000, with expectations of 242,000 and previously 237,000, which the market took as hawkish due to the strong job market.

-

The Philadelphia Fed Index was slightly below expectations at -13.5 points, compared to expected -10 and previously -13.7. After the data publication, EURUSD started a correction breaking the 1.12 level.

-

Quarterly results were announced yesterday by Netflix and Tesla after the session close, while companies like TSMC, IBM, and United Air published their results today.

-

Blackstone became the first private equity firm to manage $1 trillion following the publication of its quarterly results.

-

The People's Bank of China decided to keep interest rates unchanged, with the one-year loan rate remaining at 3.55%.

-

WTI Crude Oil is trading around $75 per barrel. Precious metals depreciated due to the stronger dollar. Gold fell below $1970, and silver fell below $24.80.

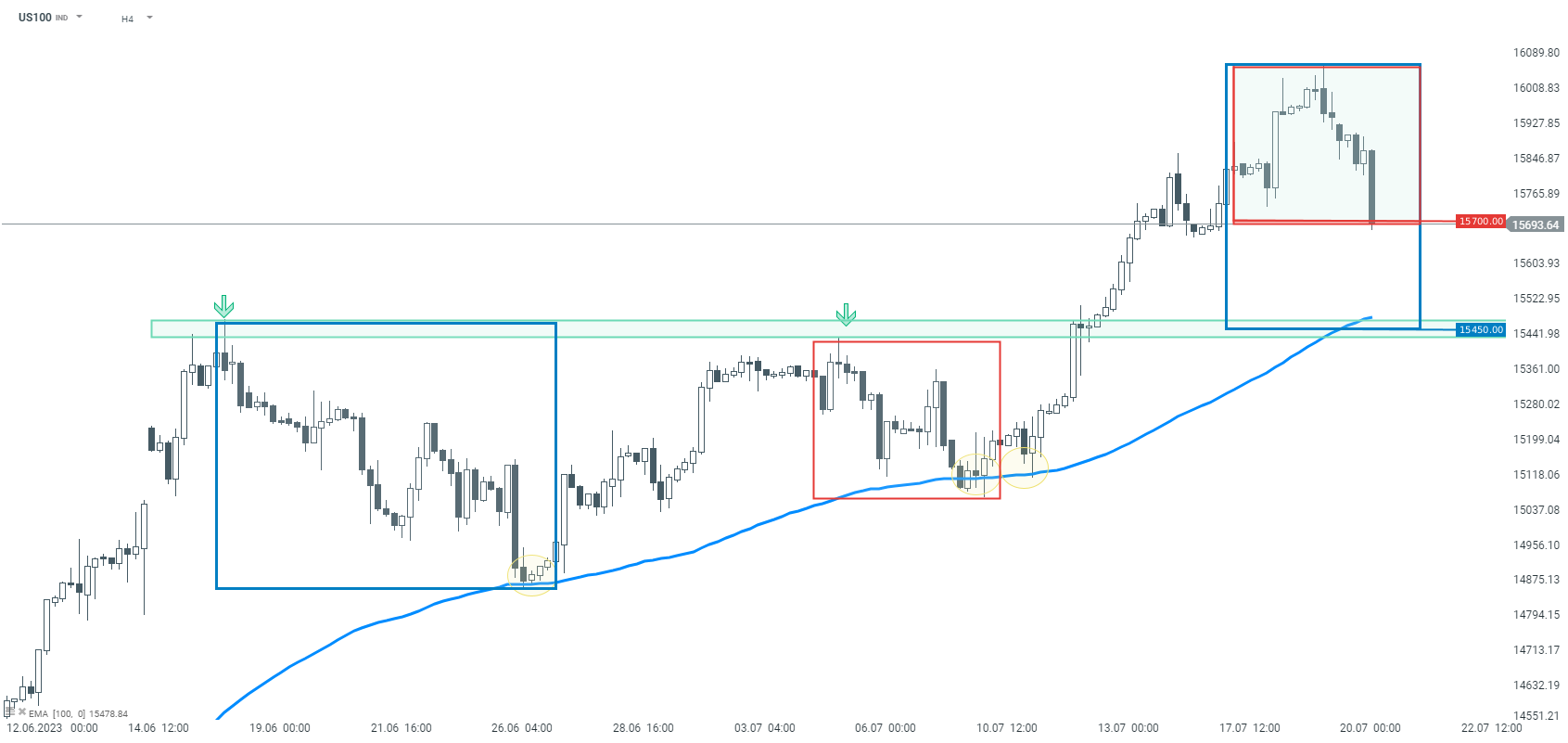

US100 experienced a dynamic downward correction. If the support at 15700 points were to be negated, the declines could head towards the next support level at 15450 points, which arises from broad geometry and previous price reactions. Source: xStation5.

US100 experienced a dynamic downward correction. If the support at 15700 points were to be negated, the declines could head towards the next support level at 15450 points, which arises from broad geometry and previous price reactions. Source: xStation5.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.