- Wall Street starts the new year with gains

- High closing of indices in Europe

- US 10-year bond yields rise to 1.62%

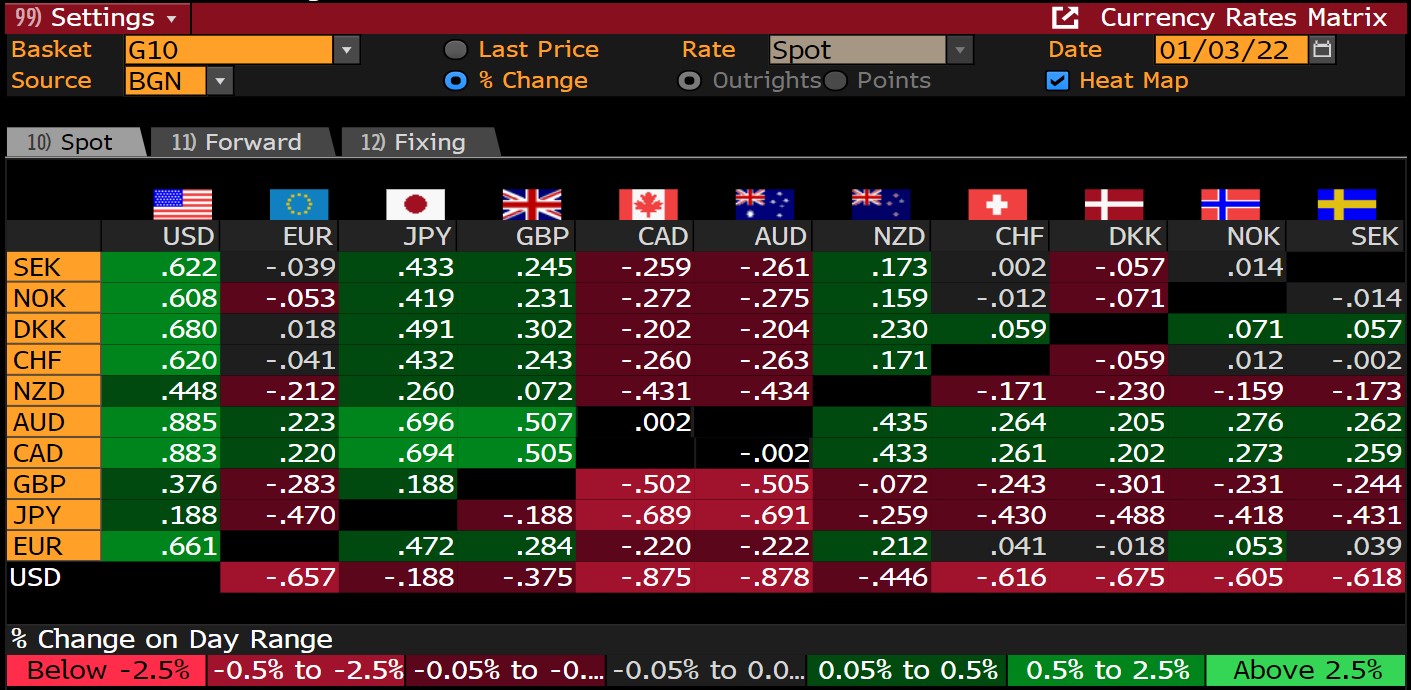

- Precious commodities fall strongly, dollar strengthens against other G10 currencies

- Bitcoin struggles to hold the $46,000 level

Indices on Wall Street are posting moderate gains during the first trading session this year. At the moment, the US2000 (+0.64%) and US100 (+0.82%) indices are the strongest risers. The US500 and US30 indices are trading close to Friday's closing levels. The company that generated the most buzz during today's session was undoubtedly Tesla (TSLA.US), which, despite the prevailing global supply chain problems, posted a much better-than-consensus number of electric cars delivered in Q4 and thus broke the company's previous record. The company's shares are currently up over 11%. This week, special attention should be given to Wednesday's FOMC minutes meeting.

The first session on the Old Continent turned out to be very positive for all major stock exchanges, posting gains of more than 0.5% in most cases. The German DE30 broke through the psychological barrier and rose above the 16,000 point level, rising by more than 0.86%. The Polish W20 also benefited from the good mood on the Old Continent and rose by more than 0.85%. Tomorrow, the Polish market will focus on the Central Bank's decision on interest rates. According to analysts' predictions, the NBP will raise the main reference rate by 50 bps, to 2.25%.

On the bond market, we see today a significant increase in the yield on 10-year treasury bonds (currently at 1.62%), which has caused a surge in the appreciation of the US dollar against other G10 currencies and a significant weakening in gold prices, which have fallen to below USD 1,800 per ounce. Declines are also reaching other precious metals, with silver, platinum and palladium prices falling by respectively: -2.1%, -1.3% and -4.25%.

Percentage change in G10 currencies. Strong strengthening of the dollar at the beginning of 2022. Source: Bloomberg

The cryptocurrency market, on the other hand, starts 2022 in a mixed mood. Last week, Bitcoin was unable to cross the $52,000 barrier and slipped below $47,000. Ethereum has also been hit by problems, and the coin is trading down more than 2% today. The current capitalization of the entire cryptocurrency market is $2.3 trillion.

Looking at the Bitcoin chart, we see a clear weakness in the largest cryptocurrency. The demand side was unable to overcome the resistance set by the 23.6% Fibo retracement, which resulted in a drop below $46,500. The bears are clearly pushing against the support near $45,500, which, if exceeded, could trigger a deepening of the cryptocurrency's declines. Source: xStation 5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.