- European stocks post their best week since November 2020

- Wall Street gains following Biden-Xi phone call

- Crypto bulls become more active

European indices finished today's session higher tand recorded best weekly performance since November 2020 despite lack of progress of Ukraine-Russia peace talks. Also Russia paid US$117 million in interest due on two sovereign dollar bonds, easing doubts about its ability to honour external debt after harsh sanctions imposed by the West. Meanwhile Ukrainian President Zelensky called for additional sanctions against Putin’s regime as Russian troops started to attack Lviv, a city located not far from the Polish border. On the corporate front, German arms manufacturer Rheinmetall stock jumped nearly 5% after UBS, Deutsche Bank, and HSBC lifted their target prices for its shares. Yesterday Ukrainian Prime Minister Denys Shmyhal urged Nestle CEO Mark Schneider to rethink the company's decision to continue its operations in Russia. DAX 30 finished the week around the 14,400 level and posted its second weekly gain.

Major Wall Street indices cut early losses and resumed upward movement following the phone call between U.S. President Joe Biden and his Chinese counterpart Xi Jinping over Russian aggression in Ukraine. China stated that the current conflict is convenient for everyone and that all states should focus on bringing peace as soon as possible. Biden described the consequences if China provides material support to Russia and reassured that US policy on Taiwan has not changed. On the other hand, today's session was full of hawkish speeches by FOMC committee members. Waller pointed to a 50bp hike at the next FED meeting, Kashkari said that the pace of balance sheet reduction should be doubled. Barkin called for caution and a thorough analysis of the current economic situation. However, he stated that if inflation did not start to normalize, a 50 bp hike would be advisable. US100 index trades 1.5%higher, while the US500 and US30 rose 0.60% and 0.205 respectively.

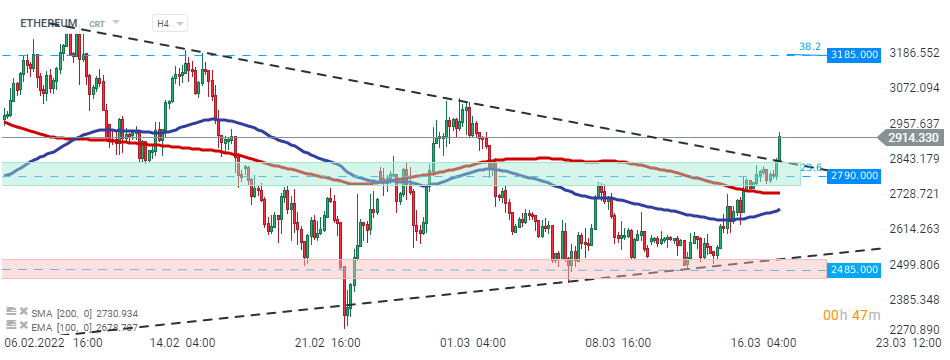

The commodity market is relatively diversified today. On the one hand, the so-called soft commodities, i.e. coffee, sugar or cotton recorded gains. Meanwhile wheat and corn fell more than 2%. Gold prices drop below the $ 1,930 barrier due to improving sentiment in the US market. Brent and WTI crude oil prices remain above the psychological barrier of $ 100 a barrel amid weaker dollar and elevated treasury yields. Upbeat moods prevail on the cryptocurrency market. Bitcoin is testing resistance at $41,500 while Ethereum managed to break above resistance at $2900.

Ethereum managed to break above the major resistance zone around $2790.00, which is marked with lower limit of the triangle formation and 23.6% Fibonacci retracement of the last downward correction. Upward move was sparked by possible supply shortage. Nearly 10% of the altcoin's supply has been pulled out of circulation through staking in the ETH2 contract. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.