Germany's DAX lost 0.3%, while the CAC40 and FTSE100 indices jumped 0.36% and 1.3% respectively after the Bank of England, as expected, raised its interest rate by 0.25%, as did the Fed yesterday. Unlike the US central bank, the BoE reverted to a dovish narrative and lowered its forecast to reach a 2% interest rate by the end of 2022, as the UK economy faces challenges from greater reliance on energy imports. Meanwhile, geopolitical tensions continue to weigh on market sentiment. The Russian government said a report of significant progress in talks on Ukraine was "wrong" but that negotiations would continue. Meanwhile, Ukraine's representative said the government had not changed its position that international borders that have existed since 1991 should continue to be recognised. On the data front, Eurozone inflation rose to a record 5.9% last month, slightly higher than the initial estimate (5.8%).

Wall Street is doing relatively well today, despite further reports of possible chemical weapons use in Ukraine and hawkish comments during yesterday's US interest rate hike decision. The US100 returned above the 14,000 point barrier. However, sentiment began to weaken shortly after the Secretary Blinken notified that China was considering supporting Russia with arms and ammunition. The White House has warned that China's possible military support will not go unanswered.

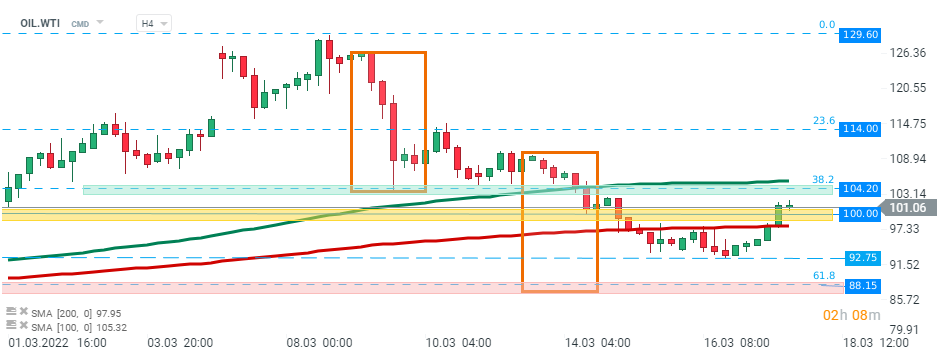

The commodity market is seeing gains today, driven by the return of war pessimism and Powell's hawkish tone in commenting on the interest rate hike decision yesterday. US 10-year bond yields jumped to 2.17%. The biggest increases today belong to energy commodities, where Brent and WTI crude oil returned above the psychological barrier of $100 per barrel. Good sentiment also persists in the precious metals sector, with palladium gaining over 4% and gold returning to the $1,950 area.

Cryptocurrencies have also regained some ground, with Bitcoin back above $40,000. Ethereum is doing much better, posting a more than 2% gain and returning above the $2,800 barrier.

Despite recent selling pressure, WTI crude oil managed to bounce off local support at $92.75 and break the psychological level of $100.00, which now acts as the nearest support. WTI crude oil jumped more than 7.0% during today's session and if the current sentiment continues, resistance at $104.20 could be threatened. This level is marked by the 38.2% Fibonacci retracement of the last upward wave. Source: xStation 5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.