- European equities finish slightly higher

- House begins debate over impeaching Trump for Capitol riot

- US crude inventories drop for 5th straight week

European indices finished todays’ session slightly higher as investors awaited the accounts of the ECB monetary policy meeting due tomorrow. At the same time, investors remained concerned over the rising number of coronavirus infections and the extension of the lockdowns in some countries. The Netherlands extended lockdown to February 9th and Chancellor Angela Merkel warned Germany may need 8 to 10 weeks of lockdown extension. Even with much of the 19-member euro area in lockdown, ECB President Lagarde continued to forecast a recovery, provided that economic restrictions can be lifted from the second quarter and the bloc can overcome a "laborious" start to vaccinations. In her opinion, Europe has all the tools needed to overcome the crisis. Meanwhile private sector economists are already cutting their growth projections, with Bank of America (BAC.US) now expects only 2.9% expansion - a full percentage point below its previous forecast. DAX 30 rose 0.3%, CAC 40 gained 0.2% and FTSE 100 finished near the flatline.

US stocks were little changed on Wednesday as the market struggled for direction for a second day amid rising rates, political uncertainty and rising coronavirus cases. The S&P 500 rose 0.2%, and the Nasdaq Composite climbed 0.6%. The Dow Jones is trading around the flatline. US House will vote to impeach President Trump for the second time and at least five Republicans have said they would join Democrats to impeach him. Meanwhile, 10-year Treasury yield reached 1.18%, a level not seen since March. Expectations for additional fiscal stimulus is one of the reasons behind the steady move higher in yields. Joe Biden is expected to provide more details regarding his trillions of dollars economic package tomorrow. According to Bloomberg, President-elect will try to make a deal with Republicans, rather than trying to ram a package through without their support. Covid cases also continue to increase in the U.S. At least 253,000 new Covid-19 cases and 3,300 virus-related deaths were recorded each day, based on the seven day average calculated using Worldometers data. On the data front, annual inflation rate rose to 1.4% in December, from 1.2 percent last month and slightly above market expectations of 1.3%.

US crude futures are trading 0.50% lower at $52.90 per barrel, while Brent contract fell 0.90%. US crude oil inventories fell by 3.247 million barrels, a fifth consecutive period of decline, compared with analysts' forecasts of a 2.266 million fall, according to the EIA report. Elsewhere, gold futures are trading near the flat line at $ 1,855.00 / oz, while silver is trading 0.45% lower near $ 25.346 / oz. Bitcoin fell below $ 35,000 level.

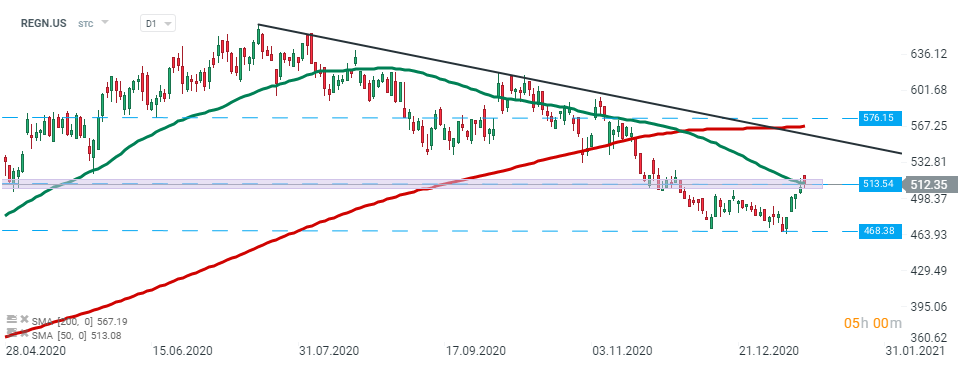

Regeneron (REGN.US) stock rose 1.5% as the U.S. government said it would buy 1.25 million additional doses of the company's COVID-19 antibody cocktail for about $2.63 billion. Source: xStation5

Regeneron (REGN.US) stock rose 1.5% as the U.S. government said it would buy 1.25 million additional doses of the company's COVID-19 antibody cocktail for about $2.63 billion. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.