- European indexes recorded monstrous rebound

- Upbeat moods on Wall Street

- Commodities under pressure, crypto surges

European indices finished today's session sharply higher, with Germany’s Dax jumped over 7% to close above 13,700, which is the biggest daily percentage gain since March 2020 as investors welcomed signs that the conflict between Ukraine and Russia could be resolved in a diplomatic way. President Zelensky said Ukraine is prepared for certain compromises but other sides also need to be willing to do the same. The Kremlin announced that it will take necessary steps to ensure Ukraine's neutral status and would prefer to do that through negotiations. Moscow announced a new ceasefire in Ukraine to let civilians flee besieged cities, however this once again turned out to be empty words. Also Putin spoke to German Chancellor Scholz to discuss diplomatic efforts aimed at ending hostilities in Ukraine and the creation of humanitarian corridors, the Interfax news agency reported. Earlier news emerged that Germany is opposing measures against Russian oil imports and port access. Berlin is also against banning Sberbank from SWIFT. This Russian bank accounts for a large portion of Russian oil and gas transactions. It seems that despite all the horrors of the last few days, the ties between Berlin and Moscow remain strong. Investors now await the highly-anticipated ECB meeting on Thursday for clues about the path of crisis-era stimulus.

On Wall Street sentiment was lifted by a fall in oil prices and easing geopolitical tensions. Beaten-down financial stocks regained significant ground while consumer-related shares bounced back as investors rushed to buy the dips. The Dow Jones rose 1.95%, while the S&P 500 and the Nasdaq 100 jumped 2.4% and 3.2% respectively. Tomorrow all eyes turn to the US inflation report for February, which might influence the pace of Federal Reserve tightening.

The commodity market witnessed increased volatility during today's session. Energy commodities and precious metals recorded significant declines. Brent and WTI crude oil prices fell by more than 12%, as we are dealing with information chaos. Declines were boosted by the possibility of lifting the Venezuelan sanctions and UAE call to increase production by the OPEC cartel. Still embargoes on Russian fuels introduced by the US and Great Britain, uncertainty regarding Russian counter-sanctions and progress of talks with Iran, bigger than expected decline of US crude stockpiles, China's order to halt exporting gasoline and diesel in April and ongoing uncertainty regarding war in Ukraine still supports the bulls. Sell-off also affected agricultural commodities and precious metals markets. Wheat fell more than 7.0%, while gold plunged nearly 3.5% below the psychological $2,000 level.

Bitcoin and other major projects also recorded sharp gains after President Biden issued executive order on cryptocurrencies. Many investors believe that the introduction of regulations will enable the creation of a long-awaited ETF based on the Bitcoin spot price. Currently major cryptocurrency is approaching 42,000 level, however Ethereum failed to break above resistance at $2800.

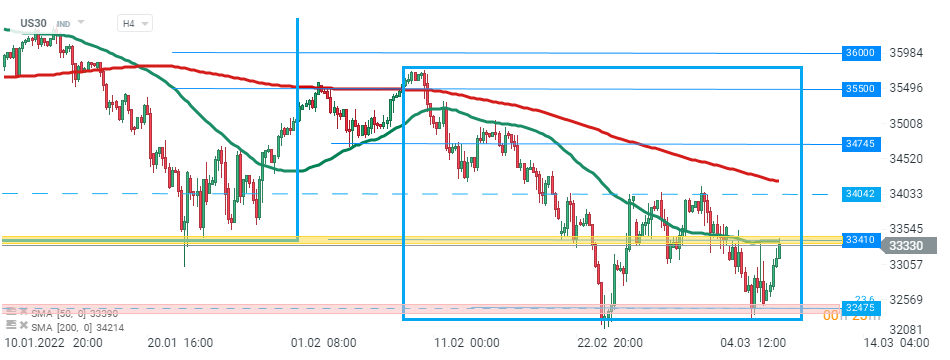

US30 fell sharply in recent weeks , however buyers once again managed to halt declines around the major support zone at 32475 pts, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Today the index rebounded sharply and is currently testing local resistance at 33410 pts. Source: xStation5

US30 fell sharply in recent weeks , however buyers once again managed to halt declines around the major support zone at 32475 pts, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the upward wave launched in March 2020. Today the index rebounded sharply and is currently testing local resistance at 33410 pts. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.