- European stocks closed sharply lower

- Wall Street extends declines

- Energy commodities prices rose sharply

- Bitcoin tested $ 45,000 level

European indices finished today's session sharply lower, with Germany’s DAX down 3.5% to a 1-year low below the 14,000 level, as the war in Ukraine escalates. Despite heroic resistance, Russian actions are becoming more aggressive and bloody. There are reports of Russian attacks on hospitals, schools and other civilian buildings. Many observers believe that what is happening now in some Ukrainian cities should be treated as war crimes. Such escalation has a very negative effect on investors who are selling off riskier assets around the world. The stock market in Russia has not been opened yet, but it is worth remembering that Russian companies that are also listed in London have suffered further heavy losses today. In addition, the ruble is not traded on the international market. Meanwhile, the sanctions are starting to take effect as more large foreign entities such as BP, Shell, Total are making decisions to cut off all ties with Russia. Maersk introduced a stoppage of almost all container ships sailing to Russia (except for those with food and medical supplies). Maersk owns approximately 1/3 of the shares in the Russian port operator that manages 6 terminals in that country. All this causes traders have problems with making payments for Russian oil. An increasing number of ships also do not want to transport Russian oil, and some ports prohibit the entry of Russian ships. Fees for the transport of Russian oil are rising to astronomical levels, which makes trade less profitable, despite the fact that the price per barrel in global markets has exceeded $ 100. Meanwhile, Ukraine asked the European Union to join its ranks as soon as possible, although it is known that even in an accelerated form it will take many years. Nevertheless, thanks to the community's efforts, Ukraine will likely be provided with combat aircraft to help further repel the Russian regime.

Negative moods prevail on Wall Street as well, with the Dow Jones tumbling more than 2.0% and the S&P 500 and the Nasdaq down more than 1.6% as the situation in Ukraine is becoming more difficult by the hour with Russian troops bombing cities and enclosing the capital city of Kyiv. Financial stocks which may be the most impacted by sanctions took the biggest hit during today's session. Bank of America, JP Morgan, Wells Fargo and Visa fell over 4%.

Upbeat moods prevail today in commodity markets despite a stronger dollar. US 10-year Treasury fell below 1.69%, while gold jumped to $1942 level. Silver also recorded strong gains and is approaching resistance at $25.40. WTI jumped above the psychological $100.00 level while US natural gas futures rose more than 4% to almost reach $4.6 per million British thermal units. Major cryptocurrencies also moved higher today. Bitcoin rose at one point over 4.0% and tested $ 45,000 level while Ethereum bounced off psychological resistance at $3000.

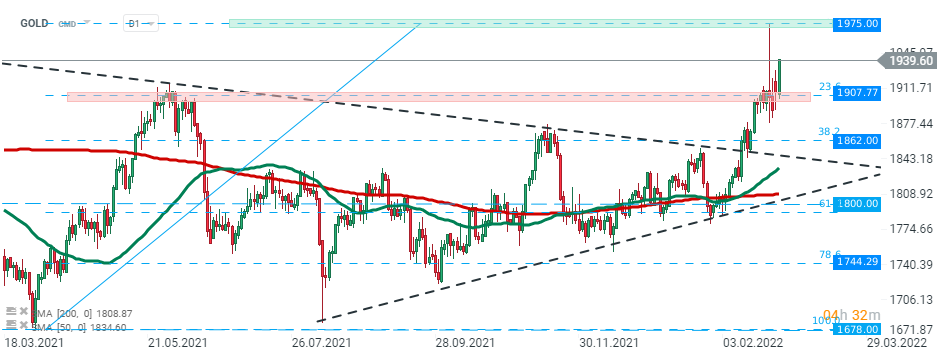

Gold price managed to stay above local support at $1907 yesterday and resumed upward move during today's session. If current sentiment prevails, the resistance zone around $1975 may be at risk. Source: xStation5

Gold price managed to stay above local support at $1907 yesterday and resumed upward move during today's session. If current sentiment prevails, the resistance zone around $1975 may be at risk. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.