-

NFP report for August well below expectations

-

USD tumbles after jobs data, precious metals gain

-

European equity markets pull back

Friday was all about key labour market report from the United States for August. The long-awaited data disappointed as the headline non-farm payrolls came in at just 235k, well below the consensus estimate of 750k. The report also showed that wage growth accelerated. As a result, the US dollar plunged against major currencies - it is said that weak jobs data may be an excuse for the Fed not to taper so soon as previously expected. EURUSD tested the 1.19 mark (+0,20%) while USDJPY fell to 109.65 (-0.25%).

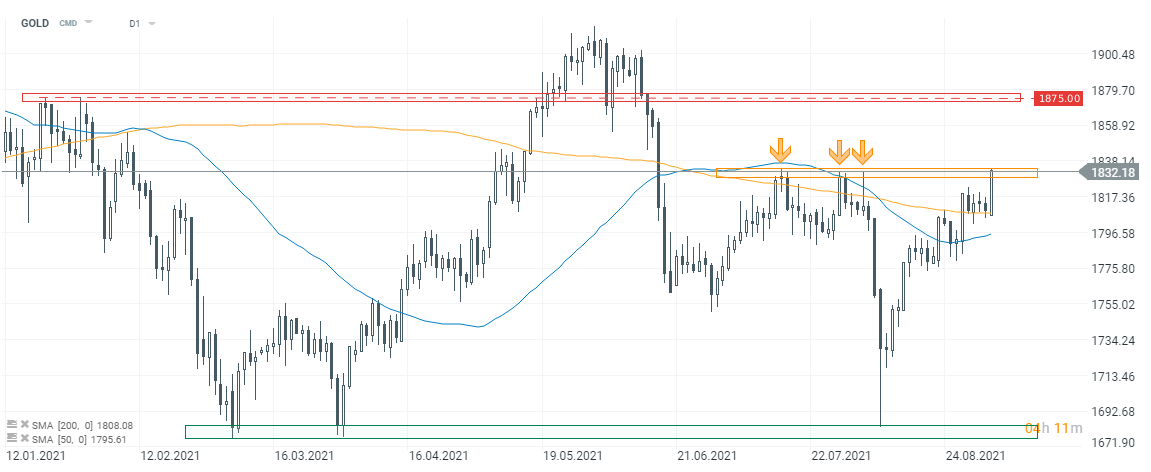

Precious metals gained on the weaker USD. The move on the gold market was significant indeed as the price jumped from $1,813 to $1,830 an ounce. Silver prices advanced as well. Meanwhile, European equity markets pulled back on Friday. The German DAX (DE30) plunged by almost 200 points, but managed to erase some losses. The cash index finished the day 0.37% lower. US indices declined after jobs data as well. Nasdaq100 (US100) has already recovered losses and is trading higher on the day while other major indices are lagging behind.

ISM services PMI data from the United States were interesting as well. The headline figure fell to 61.7 from 64.1 a month ago (but still, slightly above forecasts). "There was a pullback in the rate of expansion in the month of August; however, growth remains strong for the services sector. The tight labor market, materials shortages, inflation and logistics issues continue to cause capacity constraints", said Anthony Nieves, Chair of the ISM.

Traders from the United States and Canada will have a day off on Monday due to Labor Day. With no major events in economic calendar, Monday’s session is likely to be a muted trading day.

The situation on the gold market is getting interesting these days. The recovery move started in August continues and gold bulls are currently testing the $1,830 an ounce mark - a major resistance for now. Note that buyers were unable to smash through this level three times in July and August 2021. Should they succeed this time, the attention may shift towards next major resistance near $1,875. Gold prices could be impacted by central bankers’ speeches next week - 6 Fed members will deliver speeches on Wednesday alone! Traders will surely tune in. Source: xStation5

Daily Summary: Holiday Commodity Fever

BREAKING: CB consumer sentiment bellow expectations!🔥📉

BREAKING: US industry data slightly better than expected!🏭📈

BREAKING: EURUSD trades lower after US GDP Q3 report 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.