- Indexes on Wall Street are currently posting intraday declines. The Nasdaq is losing 0.43%, while the S&P500 is down 0.19%. Intel shares are currently losing nearly 12.5% on weak earnings forecasts for Q1 2024.

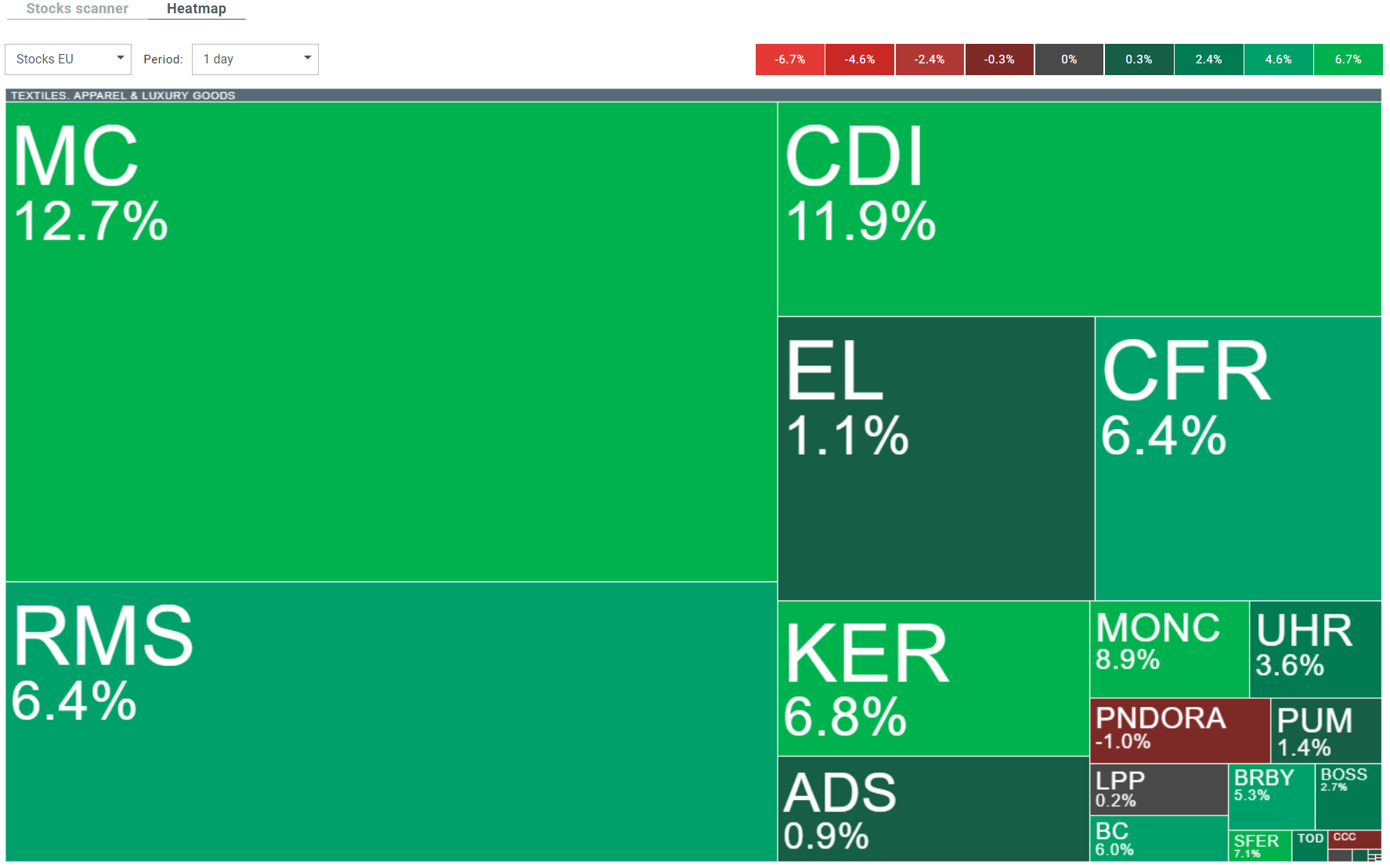

- In Europe, investors' attention was focused on the luxury goods sector, which saw powerful gains following the release of LVMH's better-than-expected quarterly results. Shares of the world's largest fashion company ended today's session nearly 13% higher. Also, another luxury companies stocks like Kering, Richemont and Hermes surged today

- The Fed's preferred measure of core PCE inflation, for December 2023, came in at 2.9% versus 3% forecast and 3.1% previously. The headline reading came in at 2.6%, in line with forecasts and coinciding with the previous reading. The monthly dynamics turned out to be in line with forecasts

- Americans' personal income in December rose 0.3% m/m and turned out to be in line with forecasts (previous reading of 0.4%). Spending rose 0.7% vs. 0.5% estimates and 0.4% previously. In real terms, they also turned out to be 0.2% higher than forecasts

- White House economic advisors Boushey and Brainard spoke optimistically about the U.S. economy, highlighting the limited risk of external shocks and solid readings suggesting higher productivity, despite lower inflation

- The reading of pending home sales data for January brought a big upward surprise. The number of pending home sales in the U.S. rose significantly, by 8.3% y/y vs. 2% forecast and 0% growth previously

- EURUSD is trading up a modest 0.15%, but the largest currency pair erased some of the initial gains. S&P analysts stressed that the risk of a recession in the US has declined, but remains elevated

- In the FX market, the Swiss franc is currently doing best. The largest declines are currently seen in the Japanese yen and the New Zealand dollar.

- Wheat contracts traded on the CBOT are trading down nearly 2% after traders reacted to higher inventory readings, and covering short positions failed to produce the expected wave of price rebound. As a result, wheat once again settled below $6 per bushel, with pressure intensified by higher ship activity at Ukrainian ports and declines in Russian grain prices

- The mood of the cryptocurrency market is positive, with Bitcoin gaining nearly 5% and trading near $42,000, after data indicated that selling pressure from Grayscale is beginning to ease.

- The SEC dismissed the iShares Ethereum Trust application from BlackRock in the current term, but the second largest cryptocurrency did not react to the news with a drop, as the decision did not disappoint analysts and investors. Ethereum is currently gaining 2%.

WHEAT (M15)

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.