- UK eases COVID-19 related restrictions

- Dow Jones hits new ATH, but S&P and Nasdaq under pressure

- Pound rallies over $1.40

European indices finished today's session flat, near their record highs as the market continues to benefit from the upward momentum seen last week. ECB Chief Economist Philip Lane told a French newspaper that the central bank could still increase bond purchases at its June meeting if such a move is needed to keep borrowing conditions favored. Meanwhile Scottish Nationalist Party did not manage to secure a majority in the new Scottish Parliament, but there is still a chance for another referendum on independence. British pound surged after Prime Minister Boris Johnson announced the next phase of reopening from the COVID-19 lockdown, with the ban on international travel being lifted and indoor hospitality resuming on May 17th. Dax rose 0.02%, CAC40 finished flat and FTSE100 fell 0.08%.

The Dow Jones extended recent gains as miners and energy stocks led gains after a major US fuel pipeline network on the East Coast was shut down following a cyberattack. Meanwhile S&P 500 and the Nasdaq came under pressure, dragged by tech stocks lower as investors worried that rising commodity prices and supply chain issues could negatively affect future earnings.

Both WTI crude and Brent rose 0.1% and are trading respectively at $64.95 a barrel and around $68.34 a barrel. Elsewhere gold rose to $1845/oz early in the session, the highest level since February, however buyers failed to uphold momentum and price pulled back to $1,836.00 / oz, while silver is trading flat, around $ 27.40 / oz amid weaker dollar and higher Treasury yields which rose to 1.60%.

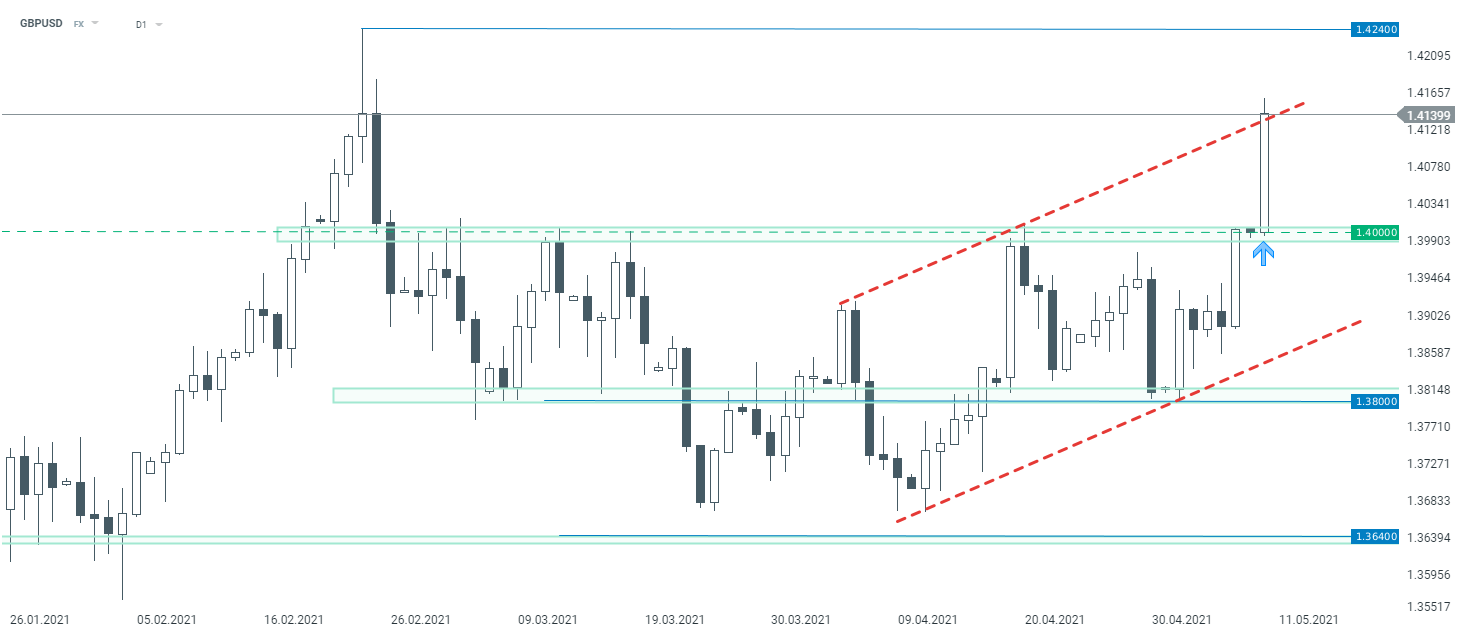

When it comes to the forex market, the British pound is undoubtedly the star of the session, gaining more than 1% against the US dollar. The upward movement accelerated after the break of the resistance at 1.40. Currently, the GBPUSD pair has reached another resistance resulting from the upper limit of the upward channel, which may lead to a local correction. However, if buyers manage to maintain the current momentum, an attack on the February summits cannot be ruled out.

GBPUSD D1, interval. Source: xStation5

GBPUSD D1, interval. Source: xStation5

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.