- European equities climb for fourth straight session

- Continuing claims hit new pandemic-era low

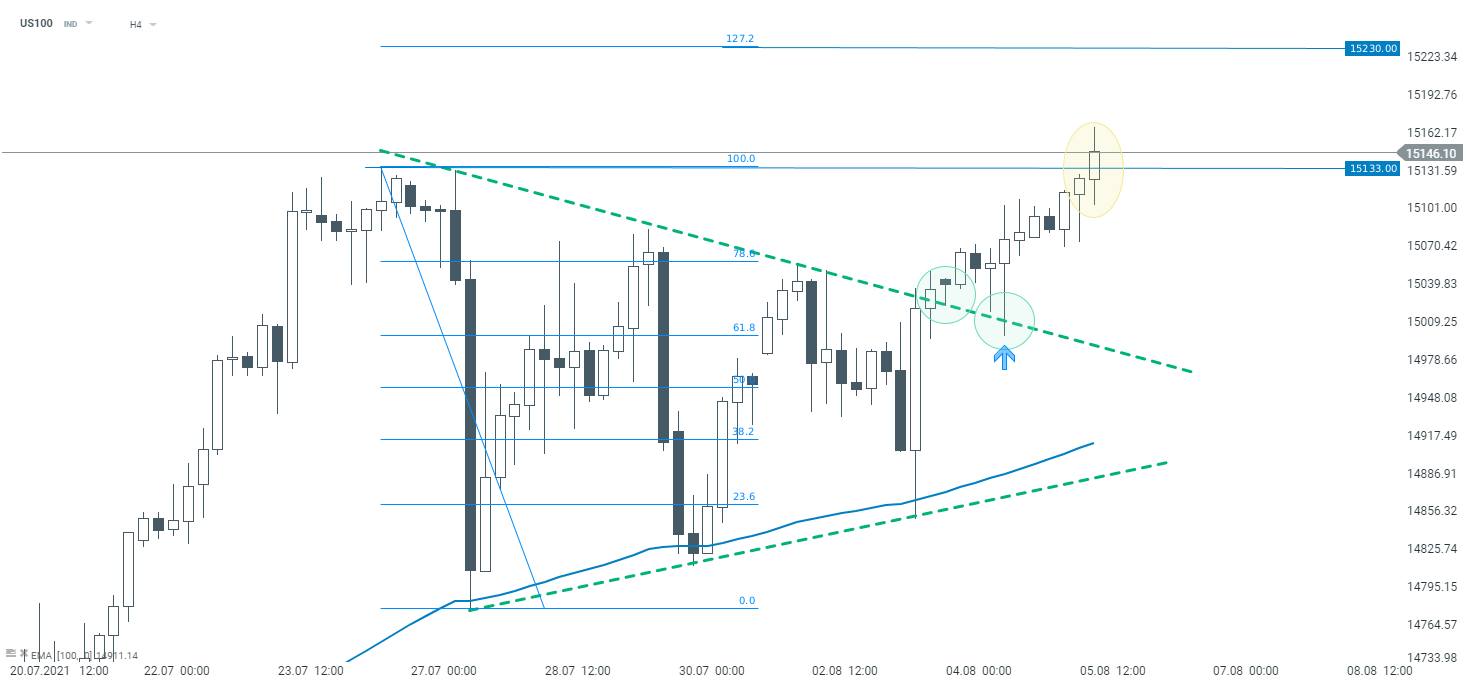

- US100 hit new all-time high

European indices extended winning streak amid another batch of upbeat quarterly earnings. Danish pharmaceutical company Novo Nordisk recorded solid quarterly earnings and lifted its full-year guidance similar to Adidas. Other German heavyweight Siemens lifted its profit guidance for the third time this year. Meanwhile the Bank of England left interest rate at 0.1% and its bond-buying program unchanged as widely expected. However, officials signaled some modest tightening of monetary policy over the next two years was likely to be necessary if the economy continues to improve. The central bank also said it would start reducing its stock of bonds when its policy rate reaches 0.5% by not reinvesting proceeds and it would start considering selling stock of purchased assets when the rate reaches at least 1%.

US indices are trading higher, with Nasdaq 100 at new all-time highs amid solid quarterly earnings and upbeat claims report. Of the 340 companies in the S&P 500 that have reported earnings so far, a record 87.6% have beat profit estimates. On the data front, US weekly jobless claims dropped to 385k and broadly in line with market expectations of 384k. Continuing jobless claims, which measure unemployed people who have been receiving unemployment benefits for a longer period of time, reached a fresh pandemic low of 2.930 million. The trade deficit reached new record levels as imports hit a new high. It is worth noting, however, that today the movements in the stock markets were limited, it is clearly visible that investors are waiting for tomorrow's data from the US labor market.

WTI crude rose 1.20% and is trading slightly below $69.00 a barrel, while Brent fell 1.10% and is trading above $71.00 as a result of renewed tensions in the Middle East, seen as a backward step in talks about a nuclear deal between Iran and the world powers, which offset concerns over lower demand and rising inventories. Elsewhere gold fell 0.35% and is trading slightly above $ 1,804.00 / oz, while silver is trading 0.50 % lower around $ 25.22 / oz.

As for the currency market, the dollar did not perform well on Thursday. The US currency lost over 0.2% against the British pound and the Australian dollar. The USD also depreciated less than 0.3% against CAD and NZD, but gained 0.25% against the Japanese yen. On the other hand, the USDCHF and EURUSD currency pairs were oscillating in the afternoon in the regions of the reference level. It seems that the forex market is also waiting for tomorrow's NFP report.

US100 hit a new all-time high during today's session. The upward move could be caused by a breakout from the triangle formation, which, according to the classic assumptions of technical analysis, heralds the continuation of the trend. If the current sentiment prevails further upward impulse towards resistance at 15,230 points could be launched. This level is marked with the external 127.2% Fibonacci retracement. Source: xStation5

US100 hit a new all-time high during today's session. The upward move could be caused by a breakout from the triangle formation, which, according to the classic assumptions of technical analysis, heralds the continuation of the trend. If the current sentiment prevails further upward impulse towards resistance at 15,230 points could be launched. This level is marked with the external 127.2% Fibonacci retracement. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.