-

Wall Street indices traded mixed today - Dow Jones and Russell 2000 traded lower while Nasdaq and S&P 500 gained, driven by solid performance of tech shares

-

Nasdaq is trading almost 1.8% higher at press time while S&P 500 gains 0.9%

-

Sentiment towards tech sector improved after Nvidia released earnings yesterday

-

Nvidia stock rallied over 25% today and reached fresh all-time highs after company released solid earnings yesterday after session close and provided an upbeat forecast

-

US House Speaker McCarthy said that negotiators made some progress on debt ceiling yesterday but he is not sure if deal will be reached today

-

Republican negotiator McHenry said that he does not think the deal will be reached today but list of outstanding issues is getting shorter

-

European stock market indices traded mostly lower today. German DAX dropped 0.31%, UK FTSE moved 0.74% lower and French CAC40 declined 0.33%. Dutch AEX was outperformer with 0.14% gain

-

Fed Collins said that a rate pause would give Fed time to measure impact of the already delivered tightening

-

ECB Knot said that there are no signs of underlying inflation abating. Knot also said that ECB needs to hike rates in June and July while staying open minded in September

-

BoE Haskel said that further rate increase in the United Kingdom cannot be ruled out. Money markets currently fully price in 100 basis points of cumulative BoE tightening by the end of 2023

-

German GDP growth for Q1 2023 was revised lower from 0.0% QoQ to -0.3% QoQ. On annual basis growth was -0.2% YoY, compared to +0.2% YoY in flash release

-

Central Bank of the Republic of Turkey left 1-week repo rate unchanged at 8.50% - in-line with market expectations

-

US GDP growth for Q1 2023 was revised higher from 1.1 to 1.3% (QoQ annualized). Core PCE was revised higher as well - from 4.9 to 5.0% QoQ

-

US jobless claims came in at 229k (exp. 245k) with last week's reading being revised lower from 242k to 225k

-

US pending home sales came in flat month-over-month in April while market expected a 1.0% MoM increase

-

EIA report showed a smaller-than-expected build in US natural gas inventories. Inventories increased by 96 billion cubic feet while market expected 100 bcf increase

-

South African rand (ZAR) dropped to a record low against US dollar after SARB delivered 50 bp rate hike but warned that South African economy and currencies is likely to stay under pressure amid global issue

-

USD is the best performing G10 currency, thanks to rising yields amid uncertainty over the debt ceiling

-

Stronger USD is pressuring commodities with oil, natural gas and precious metals trading lower today

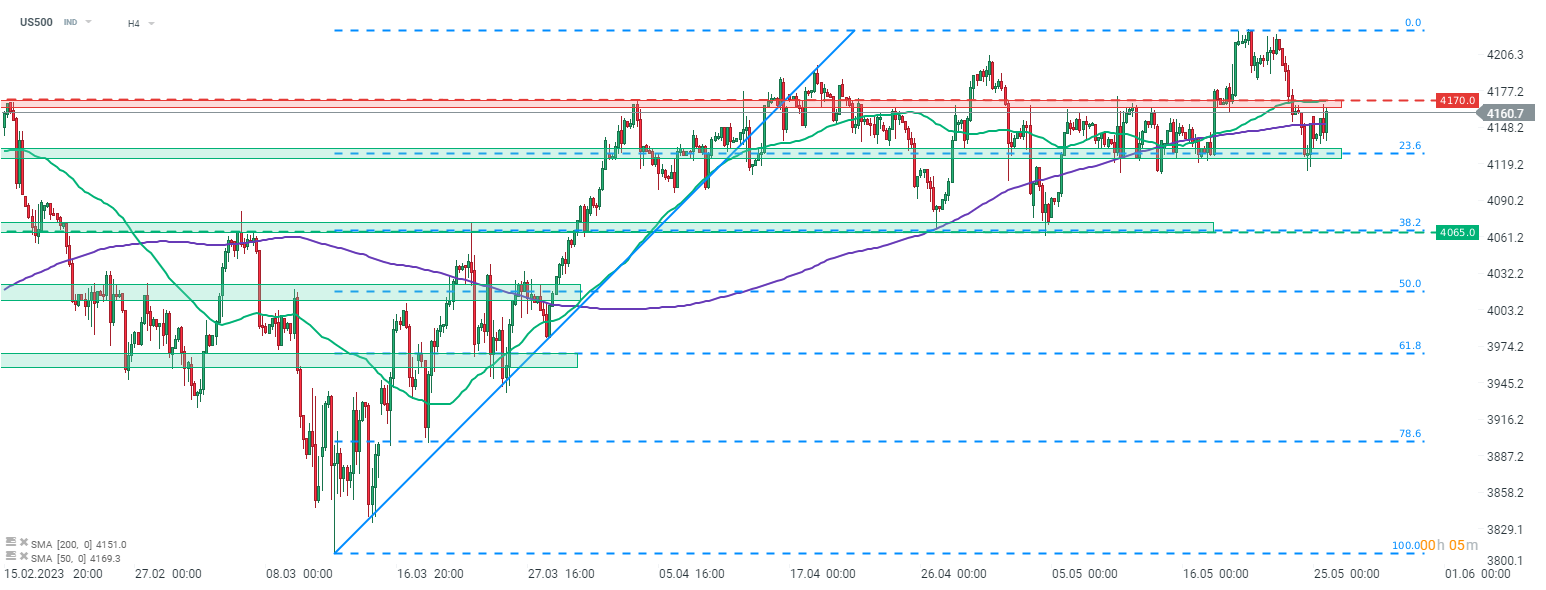

S&P 500 futures (US500) bounced off the support zone marked with 23.6% retracement yesterday in the evening as solid earnings from Nvidia lifted sentiment towards stocks. Index climbed above 200-period moving average on H4 interval and is now trying to break through 4,170 pts resistance zone. Source: xStation5

S&P 500 futures (US500) bounced off the support zone marked with 23.6% retracement yesterday in the evening as solid earnings from Nvidia lifted sentiment towards stocks. Index climbed above 200-period moving average on H4 interval and is now trying to break through 4,170 pts resistance zone. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.