-

Oil stable after events in Venezuela – the market sees an opportunity for an increase in supply, but only in the very long term.

-

European stock markets in good spirits – the Euro Stoxx 50 index is up 0.65%, with Germany's DAX remaining the leader in terms of growth.

-

DAX breaks out of consolidation – possibly paving the way for new records, with the long-term upward trend continuing.

-

ASML breaks records – shares rise 4.5% after Bernstein raises its recommendation and strong forecasts for the DRAM market.

-

European defense companies are becoming more expensive – investors are reacting to increased tensions following US attacks on Venezuela.

-

Airbus exceeds delivery plan – 793 aircraft in 2025, despite earlier problems with the A320 model; shares +2.2%.

-

Oil stable after events in Venezuela – the market sees an opportunity for an increase in supply, but only in the very long term.

-

European stock markets in good spirits – the Euro Stoxx 50 index is up 0.65%, with Germany's DAX remaining the leader in terms of growth.

-

DAX breaks out of consolidation – possibly paving the way for new records, with the long-term upward trend continuing.

-

ASML breaks records – shares rise 4.5% after Bernstein raises its recommendation and strong forecasts for the DRAM market.

-

European defense companies are becoming more expensive – investors are reacting to increased tensions following US attacks on Venezuela.

-

Airbus exceeds delivery plan – 793 aircraft in 2025, despite earlier problems with the A320 model; shares +2.2%.

The initial market reactions following the weekend events in Venezuela may come as something of a surprise. At the beginning of the day, crude oil lost value, but very little, and then regained ground compared to Friday's closing prices, which may mean that the market actually sees a greater chance of increased activity in Venezuelan oil fields and, consequently, an increase in global supply of the commodity, but in the very long term. It should be remembered that Venezuela mainly has heavy, almost bituminous crude oil, which is completely different from that extracted in Saudi Arabia, for example. It is expensive to extract and requires advanced refining technology to be transported by pipeline to market. The slight declines indicate that the market sees an opportunity for a slow and long-term development of this industry in Venezuela with the help of US capital, but it will still take a long time for this to actually happen.

On the stock market, however, sentiment is very good, with European trading floors gaining an average of 0.65% (Euro Stoxx 50). The mining and technology sectors are performing particularly well, while we are seeing weakness in the fuel market, where the share prices of major companies are predominantly falling. We are waiting for the reaction of the US markets at 3:30 p.m.

The German DAX (on the cash market) is currently gaining nearly 0.65%, while the French CAC40 is up 0.12% and the British FTSE100 is up 0.24%. The German stock market is primarily driven by the rising value of Rheinmetall (RHM.DE) shares.

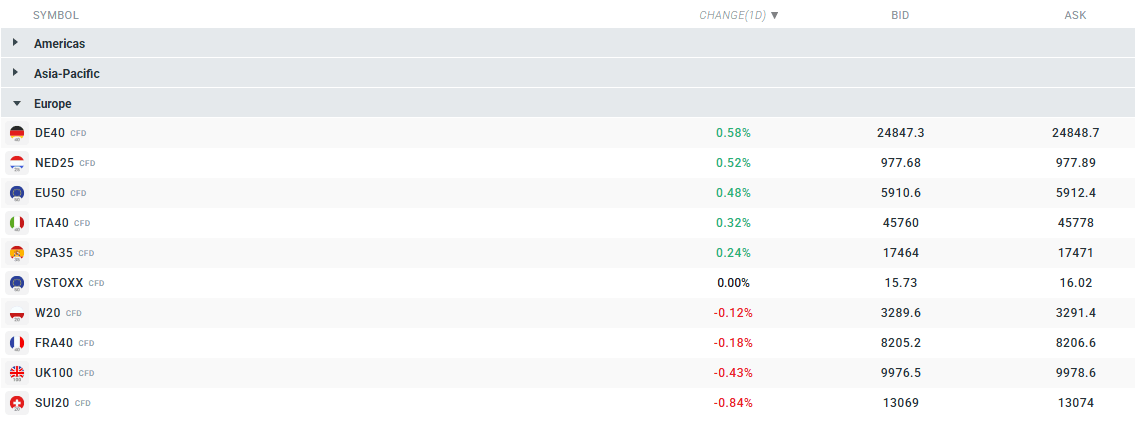

Current quotes for major contracts. Source: xStation

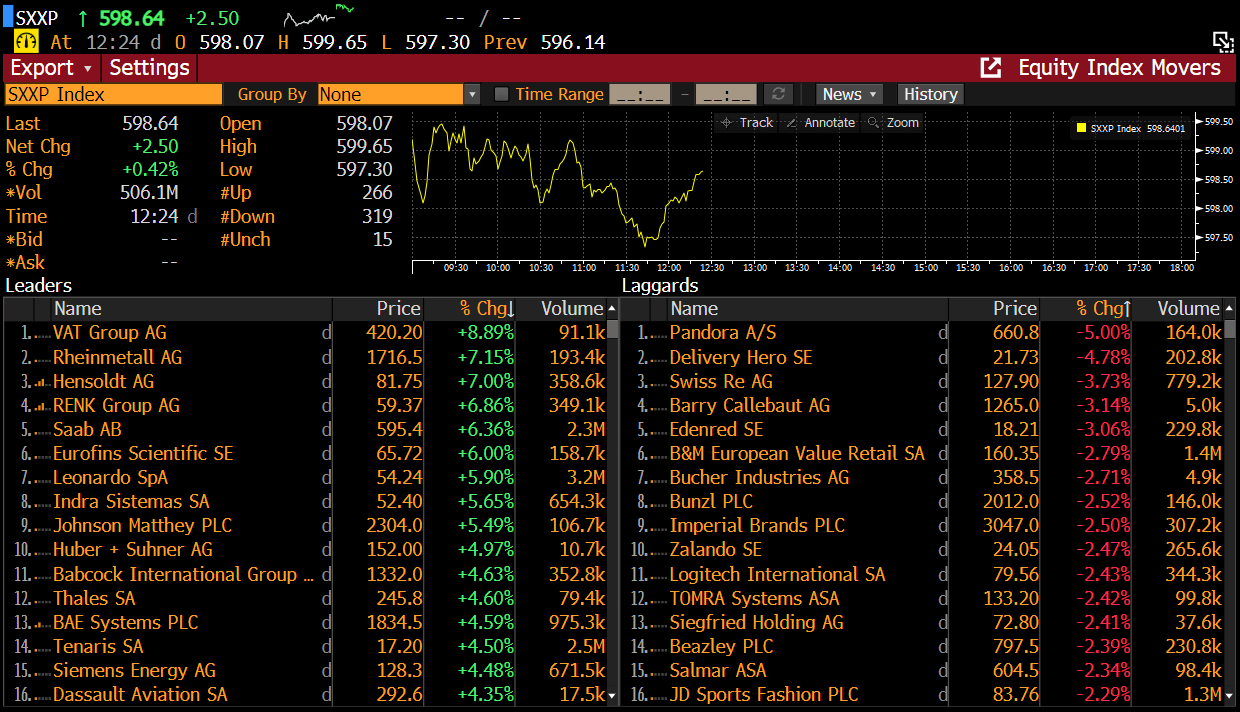

Current volatility observed on the broader European market. Source: xStation

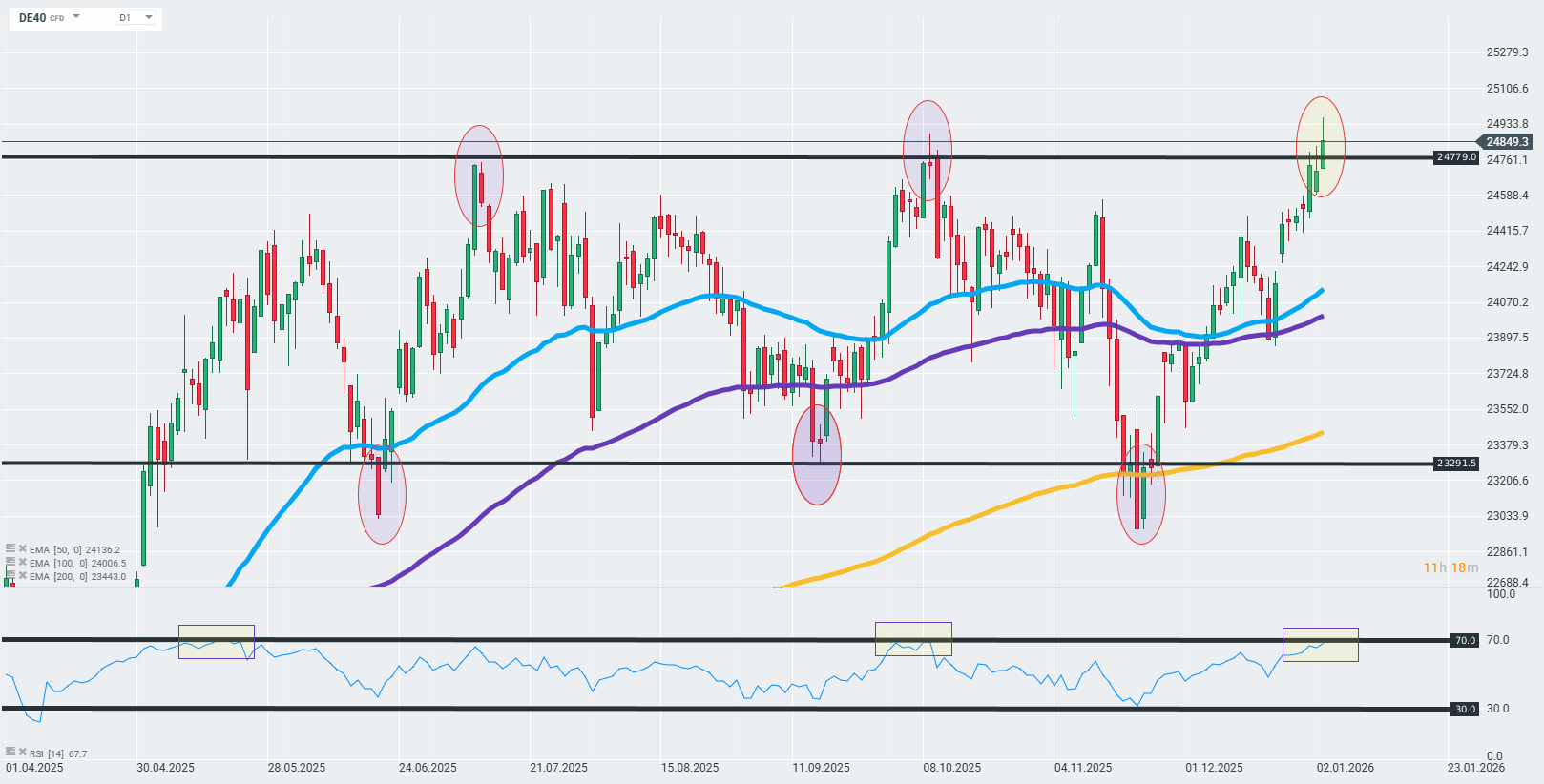

At the beginning of the week, the DAX is gaining dynamically and breaking above the main upper limit of the broad consolidation zone that limited the DE40 in 2025. If today's session closes the upper body of the intraday candle above this zone, it could mean that the previous barrier has been broken and the DE40 is paving the way for further gains towards the ATH. However, a pullback below this structure may resemble the earlier behavior of the 2025 contract, when stronger pullbacks began from these levels. Technically, however, looking at the 50- and 100-day EMAs, which remain below the DE40 quotations, the long-term uptrend remains unshaken. Source: xStation

Company news:

ASML (ASML.NL) is seeing strong growth today, with the company's shares rising by as much as 4.5% to a record high after Bernstein analysts raised their recommendation to "outperform" from "market perform," pointing to the underestimated growth potential in the DRAM memory segment. Bernstein believes that although many investors associate ASML's growth mainly with logic chip manufacturers (CPU, GPU), the upcoming investment cycle in DRAM and HBM (High Bandwidth Memory) could become a strong growth driver for the company in 2026-2027, which analysts describe as "big years for EUV technology." Bernstein raised its target price for ASML from €800 to €1,300. The company will publish its quarterly results on January 28 before the market opens.

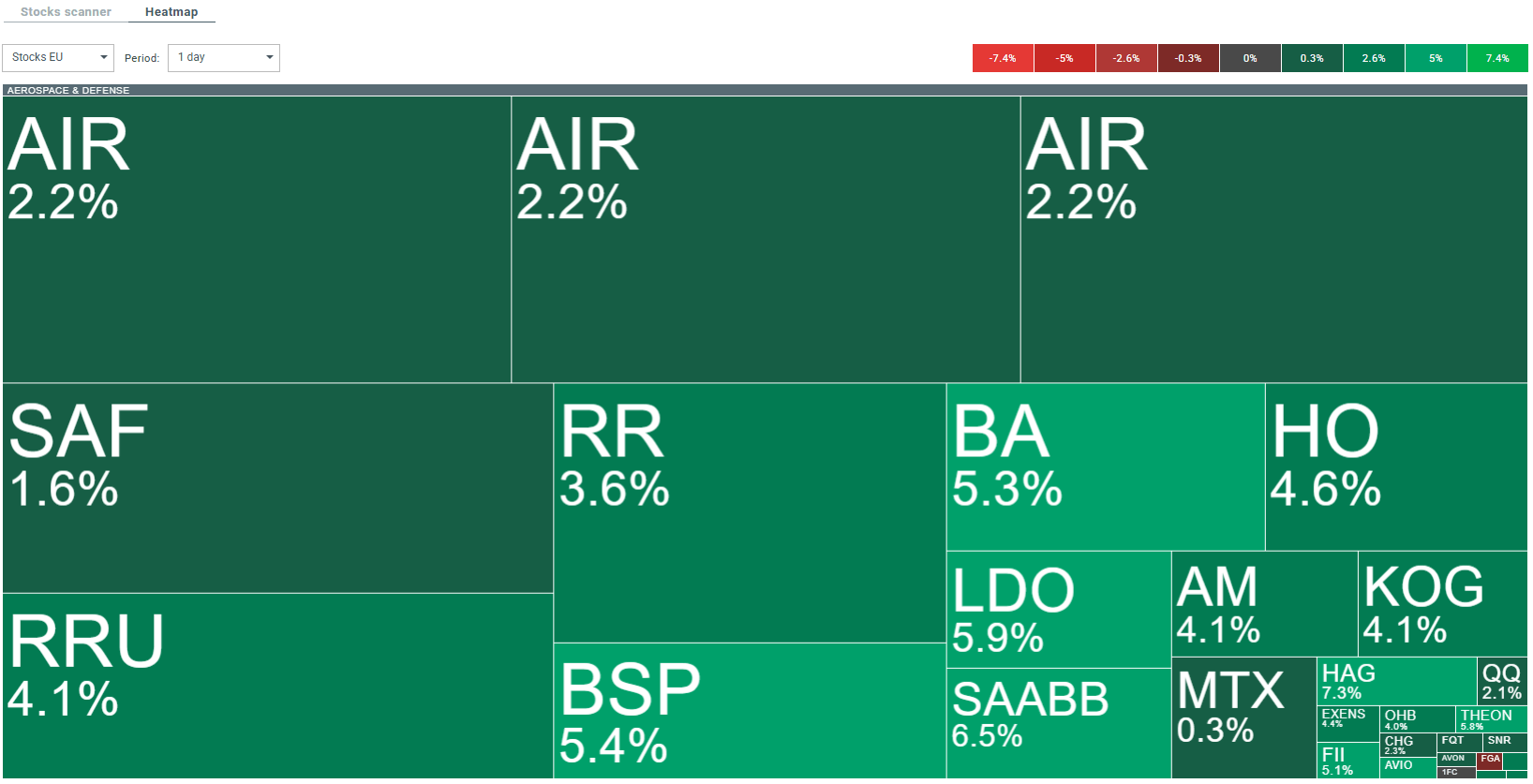

As in Asia, European defense companies are also gaining value following the US attacks on Venezuela and the capture of President Nicolás Maduro. Share price increases in the defense sector are a typical market reaction at times of heightened geopolitical tensions, and the situation in South America is currently acting as a strong demand stimulus for companies linked to the military industry.

Source: xStation

Airbus (AIR.DE) exceeded its delivery target for 2025, delivering 793 aircraft against a revised forecast of around 790, according to Bloomberg sources. This result was achieved thanks to an intensification of deliveries in the last days of the year, although the data is preliminary and may be subject to minor adjustments. In December, Airbus lowered its previous delivery plan from approximately 820 aircraft after problems with the A320 model, including the need for extensive software updates and additional inspections of the fuselage skin, which did not meet technical standards. The manufacturer will publish data on the final number of deliveries and orders on January 12 after the stock markets close. The company's shares are up 2.2% today.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.