-

European and US stocks continue to push higher

-

USD weaker across the board after Michigan data

-

Precious metals supported by weaker US dollar

European and US equity markets continue to push higher and higher despite some worrying signals from the global economy. Most European blue chip indices finished the day higher and the German DAX (DE30) was even trading above 16,000 pts for the first time in history! The pan-European STOXX 600 gained for the 10th straight session, which is an astonishing result. Major US indices continue the rally as well, reaching new record levels. One might assume that equities are supported by a strong Q2 earnings season, however there are also some alarming reports that investors should be aware of.

Preliminary University of Michigan data for August was a huge miss as it showed that the consumer sentiment for the US slumped to 70.2 (vs exp. 81.2), the lowest since December 2011. Also, long-term inflation outlook rose from 2.8% to 3.0% - another worrying signal given recent high PPI figures and supply chain disruptions. Apart from that, investors were also focused on numerous CPI reports from the Old Continent, but these were mostly revisions.

The US dollar is weaker across the board after disappointing UoM report. EURUSD is currently testing the 1.18 mark while USDJPY returned below 110.00. Precious metals gain on the dollar’s weakness. Gold is trading above $1,770 an ounce again while silver prices were testing the $23.80 level. Oil markets experience a pullback as supply chain disruptions and ports shutdowns in China may raise concerns about the demand for oil. Cryptocurrency traders start the weekend in upbeat mood as most digital assets advance. Bitcoin is adding roughly 5%.

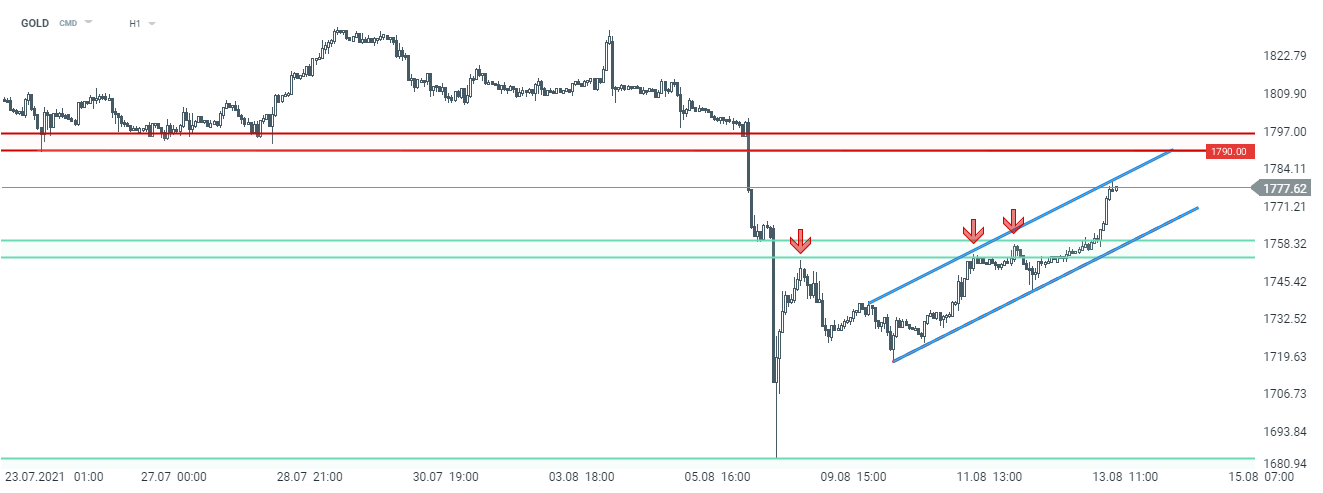

Taking a look at H1 interval, gold prices continue to move in a short-term upward channel. However, bulls were not able to smash through the upper limit of the pattern today. The next important resistance (apart from the mentioned upper limit of the pattern) may be found near $1,790 - $1,795 an ounce (local lows from July). Source: xStation5

Taking a look at H1 interval, gold prices continue to move in a short-term upward channel. However, bulls were not able to smash through the upper limit of the pattern today. The next important resistance (apart from the mentioned upper limit of the pattern) may be found near $1,790 - $1,795 an ounce (local lows from July). Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.