- Major European indices finished today's session mostly lower, with Dax closing slightly below the flatline as traders brace themselves for the release of critical PMI data for the eurozone and the US due tomorrow before the publication of FOMC minutes later on Wednesday.

-

ECB's Rehn said rates should be raised after March and the terminal rate could be reached this summer.

-

Magnitude 6.3 earthquake hits Turkey/Syrian border.

-

Goldman Sachs lifted the terminal rate for ECB to 3.5%.

-

SNB Vice Chair Schlegel said Swiss central bank is still willing to be active in FX markets

-

US markets are closed today due to observance at Presidents Day therefore liquidity conditions in the afternoon are thinner. US index futures trade slightly lower.

-

Rising geopolitical tension weighed on market sentiment as Washington warned Beijing of consequences should China provide material support to Russia's invasion of Ukraine. Meanwhile President Biden visited Kiev and pledged further support for Ukraine. At the same time Chinese top diplomat Wang Yi, is due in Moscow and possibly for a meeting with Putin.

-

Facebook-owner Meta unveiled a new paid subscription service.

-

Mixed moods prevail on energy commodity markets. Oil price rose 1.0% as analysts expect China's oil imports to hit a record high in 2023. NATGAS price hovers near recent lows driven primarily by concerns over excessive supply in the US as well as in Europe as winter period draws to a close.

-

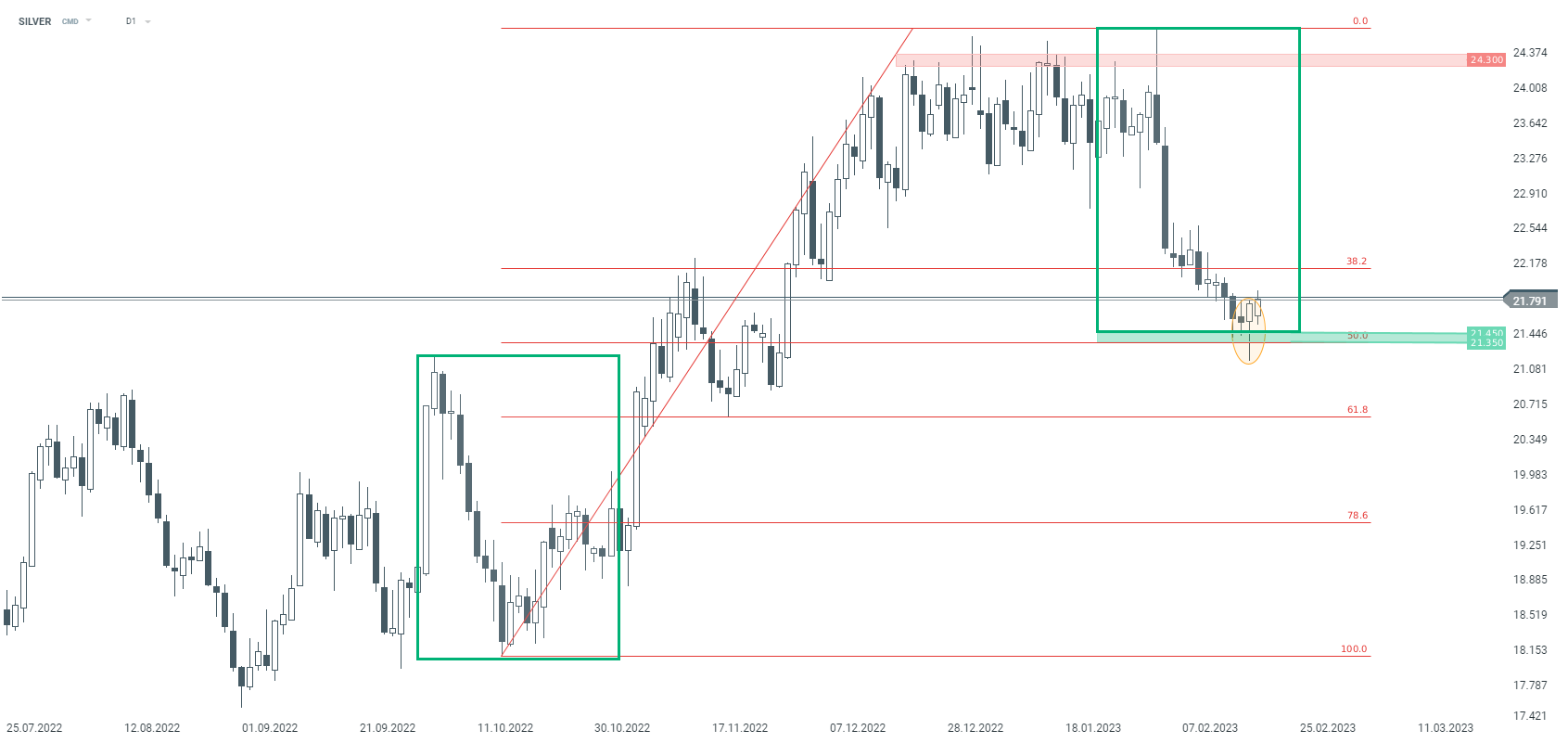

Precious metals are trading higher amid a weaker US dollar. Gold price bounced off the major support zone between $ 1820-1830 level, while silver tested local resistance at $21.80.

-

Dollar index pulled back from a six-week high around 104.00, while the EURUSD pair managed to defend support at 1.0660.

-

Major cryptocurrencies are trading higher, however pulled back from intraday highs. Bitcoin failed to stay above key resistance at $25,000, while Ethereum again pulled back below the $1700 mark.

Silver bounced off the key support zone around $21.35-21.45 on Friday, which is marked with the lower limit of 1: 1 structure and 50% Fibonacci retracement of the last bullish wave. Moreover, a hammer formation has appeared on the D1 interval, which may be a sign that recent downward correction may have come to an end. Source: xstation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.