• ADP report showed 20.2 million drop in private payrolls

• European stocks close lower on weak data

European shares closed lower today, after the European Commission latest economic forecasts showed the Eurozone economy might shrank by a record 7.7% this year due to the coronavirus pandemic. Also German industrial orders and Eurozone's retail sales fell at record rates. DAX 30 declined 1.1%, CAC 40 dropped 1.3 % and FTSE 100 rose only 0.1 %.

US indices are trading mixed. The S&P 500 and Nasdaq gain amid hopes of a pickup in business activity as states are planning to ease coronavirus-related lockdowns. However Dow Jones index came under pressure from declines in oil giant Chevron Corp (CVX.US) as crude prices fell. The S&P 500 energy sub-index dropped 2.2%. Also investors are trying to digest a record 20 million drop in U.S. private payrolls last month. During today's session Dow Jones lost 0.02 %, S&P500 rose 0.14% and Nasdaq gained 1.22%

Macroeconomic data still point to a serious global recession, analysts warn of further declines, especially if the reopening of economies causes another wave of infections. "We knew this was going to be bad, so it matches the jobless claims. A lot of the bad news for April is pretty much factored in," "But markets are looking at a potential recovery here, we've got a lot of states opening up. Businesses are starting to get going again, but the question is, is it too fast?" said Scott Brown, chief economist at Raymond James in St. Petersburg, Florida.

Oil prices overlooked recent bullish EIA Crude Oil Stocks inventory report as markets took a breather after the recent huge rally. Oil inventories rose by 4.6 million barrels for the week ended May1, the EIA said. That compared with expectations for a build of about 7.8 million barrels. Inventories at national storage hub at Cushing, Okla., increased by 2.07 million barrels, which is the lowest increase in six weeks. However WTI futures dropped 5.4% to $ 23.23 and Brent fell over 6.0% at $ 28.90 amid concerns about oversupply and falling demand after weak ADP data.

Gold dropped below $1,700 and is trading in the consolidation zone for the last five weeks despite a steady flow of funds into gold-backed exchange-traded funds. Holdings in SPDR Gold Trust (GLD), the world’s largest gold-backed ETF, rose 0.4% to 1,076.39 tons on Tuesday, their highest since April 2013.

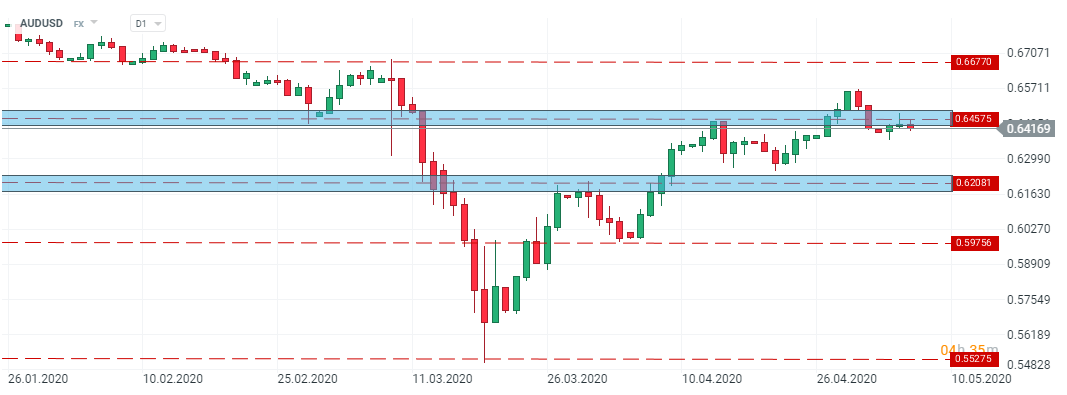

AUDUSD bounced of the local resistance level at 0.6457. Should downbeat moods prevail, resistance at 0.6208 may come into play. Source: xStation5

AUDUSD bounced of the local resistance level at 0.6457. Should downbeat moods prevail, resistance at 0.6208 may come into play. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.