-

US economy added 850k jobs in June (est. 700k)

-

Wall Street climbs to new record highs

-

European stock indices mixed

-

OPEC+ talks drag on, oil prices swinging

Friday was all about key jobs data from the United States and OPEC+ talks. The NFP report showed that the US economy added 850k jobs in June (vs exp. 700k). Average hourly earnings increased 0.3%, below forecasts of 0.4% so the report eased inflation fears a bit. As the headline number topped expectations, US equity markets hit fresh all-time highs.

The initial reaction on the FX market following the NFP release was rather mixed. However, several hours after the publication the US dollar is weakening against most of its peers as the risk of rapid monetary tightening eased (due to wage growth miss). The CAD is the strongest among major currencies. Gold and silver prices are also moving higher amid weaker USD.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appEuropean stock markets finished the day mixed. The German DAX added 0.30% while blue chip indices from the UK, France and Italy closed more-or-less flat. Oil traders are still staying on the sideline as OPEC+ delayed its decision. The meeting started late and, according to commodity markets correspondents, has not finished yet. Brent and WTI prices are swinging near the flatline at press time.

Commodity traders will stay on watch today due to OPEC+ meeting. Apart from that, one should expect thinner volume on Monday as Americans will celebrate Independence Day and US stock markets will be closed. Regular trading in US stocks and bonds will resume on Tuesday.

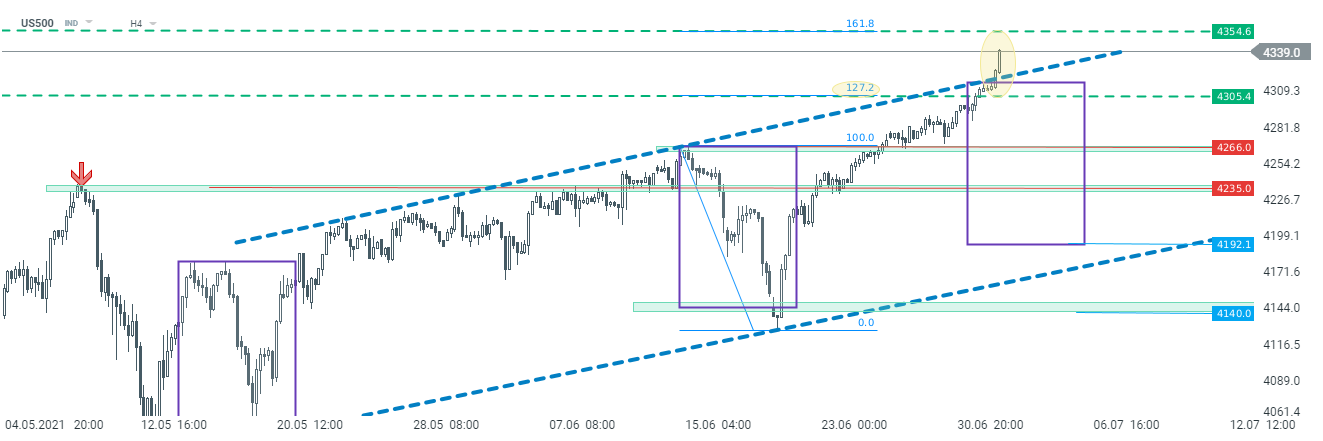

US500 advanced and hit new all-time highs after long-awaited NFP data, which topped expectations. The index climbed above the upper limit of an upward channel. Currently there are 2 near-term levels to watch: 4,354 pts (the 161.8% Fibonacci retracement) and 4,305 pts (the 127.2% Fibonacci retracement) of the recent drop. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.