-

A rather hawkish FOMC minutes release, combined with a streak of better-than-expected US data today, led to strong risk-off moods on global equity markets

-

Wall Street indices managed to recover from daily lows but continue to trade significantly lower on the day. Dow Jones drops 1%, S&P 500 and Nasdaq drop 0.9% while Russell 2000 plunges around 2%

-

European stock market indices slumped today - German DAX dropped 2.7%, UK FTSE 100 moved 2.2% lower, French CAC40 plunged 3.2%, Italian FTSE MIB dropped 0.6% and Spanish Ibex moved 1.2% lower

-

BoE governor Bailey said that moves by regulators on retail prices will help lower UK inflation

-

Fed Logan said that she would have been okay with a rate hike at June meeting and that more rate hikes are likely necessary

-

ECB Nagel said that he cannot say where interest rates will peak but they will have to remain high for a longer period. Nagel also said that he does not see threat of overtightening

-

US services ISM index jumped from 50.3 to 53.9 in June (exp. 51.0)

-

JOLTS report for May showed job openings at 9.824 million, down from 10.32 million in April (exp. 9.9 million)

-

US Challenger report showed lay-offs in June dropping to a 7-month low of 40.7k, down from 80.1k in May

-

ADP reported for June turned out to be a huge positive surprise and showed a jobs gain of 497k while market expected 230k increase

-

US jobless claims came in at 248k (exp. 246k). Continuing claims came in at 1.72 million (exp. 1.734 million)

-

US trade balance for May came in at -$68.98 billion (exp. -$69.0 billion)

-

Atlanta Fed GDPNow model now points to a 2.1% growth in Q2 2023, up from previous 1.9%

-

Canadian trade balance for May came in at -C$3.44 billion (exp. +C$1.2 billion)

-

German factory orders surged 6.4% MoM in May (exp. +1.2% MoM)

-

Euro area retail sales dropped 2.9% YoY in May (exp. -2.7% MoM). Retail sales were flat month-over-month (0.0% MoM) while market expected a 0.2% MoM increase

-

Saudi Arabia lifted export prices for light, medium and heavy oil deliveries to Asia. Prices for Mediterranean countries, North-West European countries and the United States were increased as well

-

EIA report showed a 1.51 million barrel drop in US oil inventories (exp. -1.7 mb), gasoline inventories declining 2.55 mb (exp. -1.0 mb) and distillate inventories dropping 1.04 mb (exp. -0.5 mb)

-

Threads, text-based communications app by Meta Platforms that is seen as Twitter's rival, has already attracted 30 million users, less than 24 hours after launch

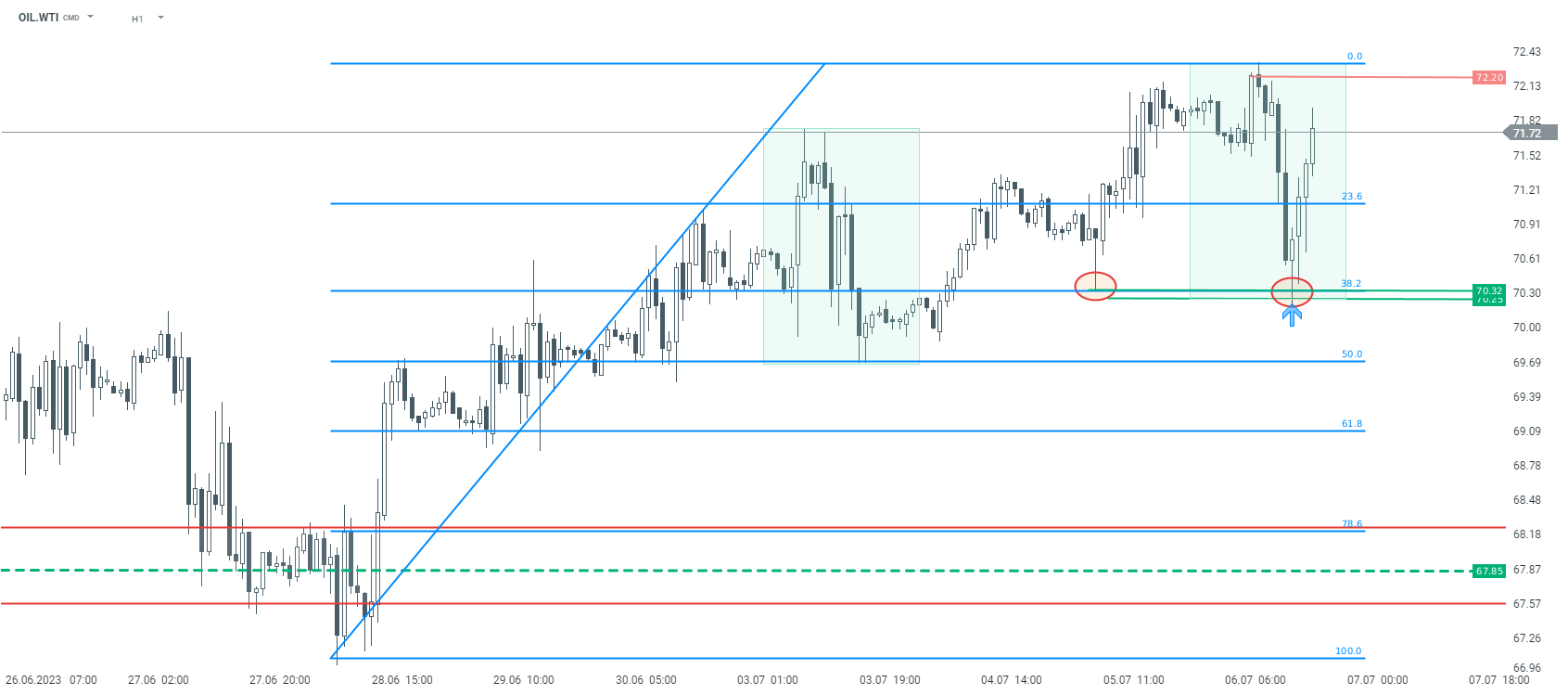

Oil has been pulling back earlier today on overall risk-off moods. However, things change in the afternoon as big inventory draw in EIA report encouraged buyers. OIL.WTI bounced off the $70.30 support zone, marked with the lower limit of the Overbalance structure, and is looking towards a $72.20 resistance zone. Source: xStation5

Oil has been pulling back earlier today on overall risk-off moods. However, things change in the afternoon as big inventory draw in EIA report encouraged buyers. OIL.WTI bounced off the $70.30 support zone, marked with the lower limit of the Overbalance structure, and is looking towards a $72.20 resistance zone. Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.