• European equities mixed on Wednesday

• US stocks rose on hopes for piecemeal stimulus deal

• WTI Crude extend losses after EIA report

European finished today's session in mixed moods as investors remain concerned about surging numbers of new COVID-19 cases which may force European governments to implement further restrictions which would hurt block's economic recovery. On the data front, industrial output in Germany and Spain fell in August, while retail sales in Italy rebounded sharply. House prices in the UK rose 7.3% over a year earlier in September, the most since mid-2016. Dax 30 finished today’s session flat, CAC 40 fell 0.3% and FTSEE100 rose 0.1%.

Major US indices rose 1.5% higher on average today after US President Trump called for more economic relief, hours after his decision to halt stimulus talks until after the election. Airlines stocks rose after Trump urged Congress to pass a series of smaller, standalone bills that would include a bailout package for the battered airline industry and provide aid to small businesses and most individuals with payments of up to $1,200 under the Paycheck Protection Program. Speaker Nancy Pelosi signaled openness to a standalone airline relief bill in a conversation with Treasury Secretary Steven Mnuchin on Wednesday.

WTI crude fell more than 2.6% to trade around $39.6 a barrel and Brent dropped 2.3% to trade around $41.66 a barrel, pressured by US stimulus talks and a larger-than-expected rise in US crude oil inventories. Data from the EIA showed US crude oil stockpiles increased by 0.501 million barrels, following three consecutive weeks of declines and compared to analysts’ expectations of a 0.294 million rise. Meanwhile, energy companies evacuated offshore oil platforms as Hurricane Delta is expected to hit the US Gulf Coast as category 3.

Elsewhere, gold partially erased earlier gains to trade round $1885 an ounce while silver is trading 2.6% higher at $23.68 an ounce.

Investor focus will now turn to minutes from the Federal Reserve later in the day and from the ECB due tomorrow. Also Vice President Mike Pence and Democratic challenger Kamala Harris are set to square off today in their only debate.

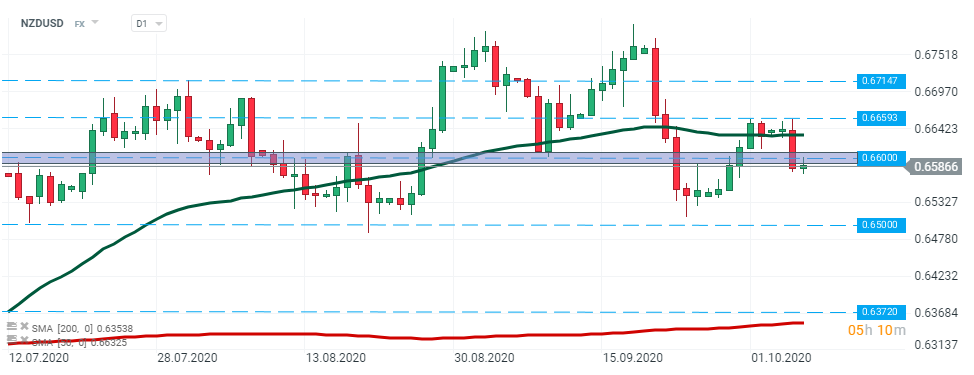

NZDUSD – yesterday sellers managed to broke below the major support at 0.66. Today pair retested the aforementioned level, however buyers failed to push the price above it. As long as the price sits below it, continuation of a downward trend seems more probable. The nearest support to watch lies at 0.65. However, if there is a change in market sentiment, then next local resistance could be found at 0.6659. Source: xStation5

NZDUSD – yesterday sellers managed to broke below the major support at 0.66. Today pair retested the aforementioned level, however buyers failed to push the price above it. As long as the price sits below it, continuation of a downward trend seems more probable. The nearest support to watch lies at 0.65. However, if there is a change in market sentiment, then next local resistance could be found at 0.6659. Source: xStation5

Chart of the day: USDJPY (24.12.2025)

Morning Wrap (24.12.2025)

Daily Summary: Holiday Commodity Fever

BREAKING: CB consumer sentiment bellow expectations!🔥📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.