- European bourses rebounded slightly after recent sell-off

- Wall Street resumes move lower

- Gold broke above $1850, Bitcoin rebounds

European indices finished today's session higher, following their worst sell-off since June 2020, as solid quarterly figures from Ericsson and Logitech lifted market sentiment slightly. DAX gained 0.75%, FTSE 100 jumped 1.04% and CAC40 finished 0.74% higher. On the data front, German business morale improved in January for the first time in seven months. Nevertheless ongoing geopolitical tension regarding potential military invasion in Ukraine limited the upward move.

Yesterday major Wall Street indices staged a massive reversal and managed to finish the day higher, however today sellers took the initiative once again after a set of mixed quarterly results and weak US CB Consumer Confidence data. At one point, Dow Jones fell over 2%, the S&P dropped 2.7%, and the tech-heavy Nasdaq Composite plunged 3.0% as higher yields negatively affected tech stocks. Nividia stock fell 5% and Amazon more than 3.0%. On the corporate front, GE stock dropped 6% after the company posted mixed quarterly results and 2022 guidance. J&J rose as much as 2% after the company outlined an expectation of $3 billion in Covid vaccine sales in 2022. On the other hand, American Express shares jumped over 7% on upbeat quarterly results. Microsoft will present its quarterly figures after market close. Tomorrow investors focus on the Fed's policy meeting and will look for updates on when the central bank will raise interest rates and by how much.

Mixed moods prevail today in commodity markets amid a slightly stronger dollar while the US 10-year Treasury rose to 1.78%. Gold jumped above $1,850.00 level while silver pulled back to support at $23.60. WTI oil rose more than 1% and tested $85.50 level while Brent jumped to resistance at $87.00. Major cryptocurrencies launched today's session in positive moods. Bitcoin jumped above $37 000 level while Ethereum is currently approaching $2500 level.

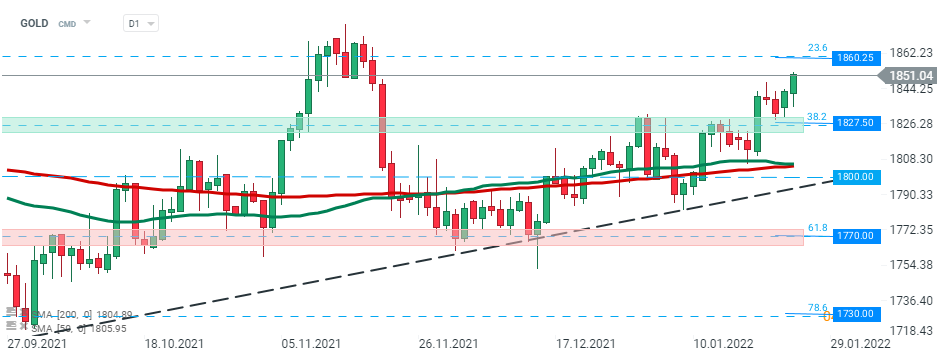

Gold price erased early losses and rose over 0.60% and is currently trading at $1850 which is the highest level since November 2021. If current sentiment prevails, the upward move may accelerate towards resistance at $1860 which coincides with 23.6% Fibonacci retracement of the upward move launched in March 2021. On the other hand, if bullish momentum fades away, the nearest support to watch lies at $1827.50 and is marked by 38.2% retracement. Source: xStation5

Gold price erased early losses and rose over 0.60% and is currently trading at $1850 which is the highest level since November 2021. If current sentiment prevails, the upward move may accelerate towards resistance at $1860 which coincides with 23.6% Fibonacci retracement of the upward move launched in March 2021. On the other hand, if bullish momentum fades away, the nearest support to watch lies at $1827.50 and is marked by 38.2% retracement. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.