- European stocks near records

- FOMC minutes did not surprise the markets

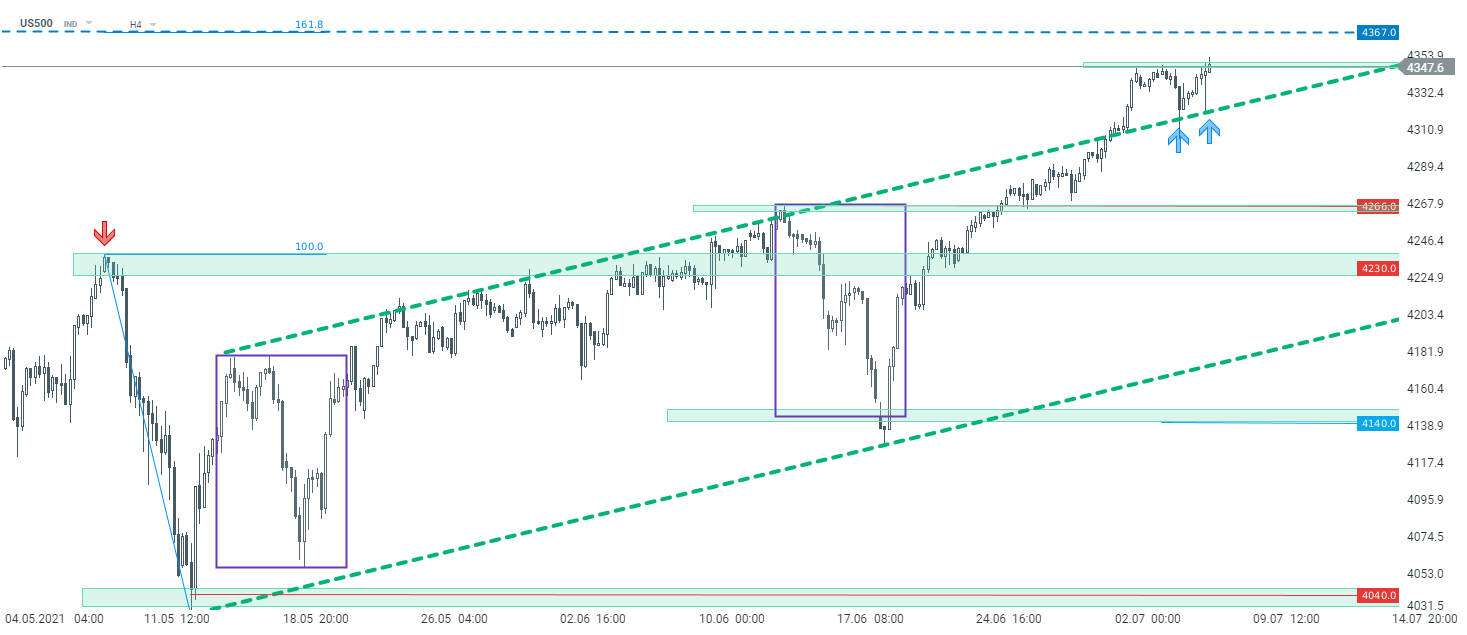

- US500 hit new all-time high

- Crude oil price fell sharply

European indices finished today's session higher near record-high levels after the European Commission revised upwards its Eurozone GDP and inflation forecasts for 2021 and 2022. DAX 30 added 1.17%, CAC 40% rose 0.31% and FTSE100 finished 0.71% higher. Meanwhile US indexes are trading higher after the Federal Reserve’s FOMC minutes showed FED officials felt that substantial further progress on the economic recovery was generally seen as not having yet been met suggesting the Fed would keep its monetary support for now. The S&P 500 and Nasdaq hit a fresh record high as big tech stocks gained after the yield on the benchmark 10-year Treasury note edged lower towards 1.3%, hovering around its lowest level since mid-February.

There is little volatility in the Forex market today. Mixed moods persist towards the end of the session. Only the NZDUSD currency pair deserves attention, where we observe a 0.3% increase. The GBPUSD and AUDUSD pairs both rise around 0.1%. The US dollar appreciates slightly against CAD, EUR and CHF, however moves oscillate here around 0.1%.

Much more was happening in the crude oil market today, where we could observe another day of declines. Brent crude oil fell by 1.9%, while WTI is trading over 2% lower. The declines intensified after information about a potential increase in production by the UAE. It's worth noting, however, that the WTI price hit the key support at $ 72.50.

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

Daily summary: Wall Street and EURUSD rise ahead of tomorrow’s Fed decision 🗽 Oil gains

US100 gains 0.8%📈

U.S. dollar sell-off 🚨 USDIDX slumps nearly 1%

Natural gas rebounds attempt 📈 U.S. East Coast weather in focus

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.