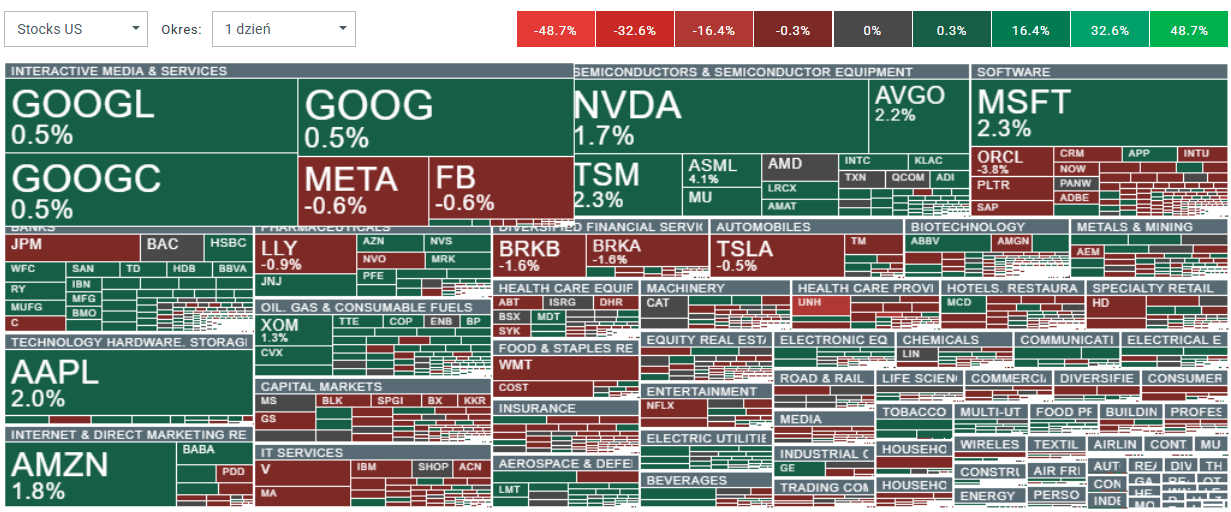

Shares of the largest U.S. technology companies are supporting gains in Nasdaq 100 (US100) futures ahead of tomorrow’s key risk events: the Fed decision (6 PM GMT, with Powell’s press conference at 6:30 PM GMT) and after-hours earnings from Meta Platforms (META.US) and Microsoft (MSFT.US). Both companies will report Q4 2025 results after the U.S. close and will likely shape expectations into what is effectively the “peak” of the current U.S. earnings season. Broader U.S. equity sentiment is also being helped by a sharply weaker dollar today.

- Big Tech is clearly outperforming the wider market. Nvidia, Apple, Amazon, and Microsoft are up close to 2%, while additional momentum is coming from semiconductors. Shares of Taiwan Semiconductor and ASML are rising even more than the flagship U.S. tech names, giving the index a meaningful tailwind.

- Strength in mega-cap chip stocks is more than offsetting visible weakness in software, where Oracle is down nearly 4%. The outperformance of large-cap leaders may also reflect a degree of portfolio rebalancing, after the “Mag 7” names were among the weakest parts of major U.S. indices for months.

- Looking at the S&P 500 companies earnings season so far (FactSet data as of January 23, with 13% of S&P 500 reported), 75% have beaten net profit expectations and around 70% have topped revenue estimates. Current year-over-year EPS growth for the S&P 500 is running near 8%, but after Big Tech reports that figure will likely rise materially, potentially toward roughly 15% YoY.

- This quarter marks the 10th consecutive quarter of year-over-year EPS growth for the index. The S&P 500 is currently valued at around 22x earnings, roughly 10% above its 5-year average and close to 15% above its 10-year average near 19.

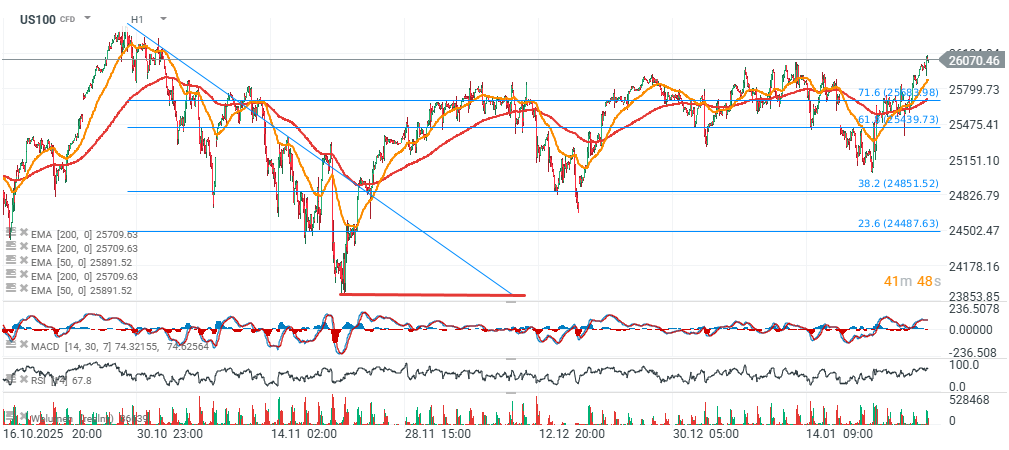

US100 (H1 timeframe)

Source: xStation5

Sentiment across the broader equity market is generally mixed today, but BigTech supports Nasdaq 100 momentum. Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.