- Major European indices finished today's session slightly higher, with DAX rising about 0.35% to a highest level since February 2022, after the ZEW sentiment index moved into positive territory in January for the first time in nearly a year, while final CPI reading suggested cost pressure eased in December.

-

Moods improved in the afternoon on news that ECB may consider slower hikes in the near future. According to ECB sources, the idea of a slower move in March is 'gaining support' and some expect a 50 bps hike at the next meeting and then 25 bps afterwards.

-

FTSE 100 pulled back from recent highs as recent UK employment data showed wages rose the most on record when excluding the height of the pandemic, but real earnings continued to drop due to high inflation.

-

Markets shrugged off recession fears after the release of downbeat GDP figures from China and a survey released at the Davos summit showed that two-thirds of private and public sector economists expected a global recession this year.

-

Mixed moods prevail on Wall Street as traders digest fresh reports from two big US banks. Currently Dow Jones is trading over 1.0% lower, S&P 500 fell 0.10%, while Nasdaq rose 0.17%.

-

Goldman Sachs profits plunged in Q4 by 69% YoY due to heavy losses in its investment banking unit and asset management revenue, while Morgan Stanley positively surprised investors on the upside after its trading business got a boost from market volatility.

-

Oil prices rose over 2.0% early in the session on upbeat OPEC. In its latest monthly report, the group wrote that demand for oil should increase by 2.22 million bpd, or 2.2% in 2023 due to rising consumption in China and a recovery in economic activity among advanced economies. Nevertheless OIL.WTI erased roughly half of today's gains as buyers failed to break above resistance at $81.00.

-

Precious metals pulled further away from recent highs despite a weaker dollar. Gold is trading 0.65% lower and is moving towards the $1900 mark, while silver fell below the $24.00 level.

-

As for the forex market, Tuesday's session brought a slight weakening of the euro, which caused the EURUSD pair fell below the major support at 1.0800. A daily close below this level may have serious technical implications, at least in the short term. In this scenario downward correction may deepen, even towards support at 1.0600 or even 1.0500.

-

Other major currencies benefited from the weaker dollar, which means that the euro is clearly lagging behind today. The dollar lost the most on Tuesday against NZD (0.7%), GBP (0.6%) and AUD (0.4%).

-

Major crypto currencies are trading slightly higher in volatile session. Bitcoin pulled back from its highest since September 2022 after an unsuccessful attempt to break above $21400 level, while Ethereum price failed to stay above $1600 mark.

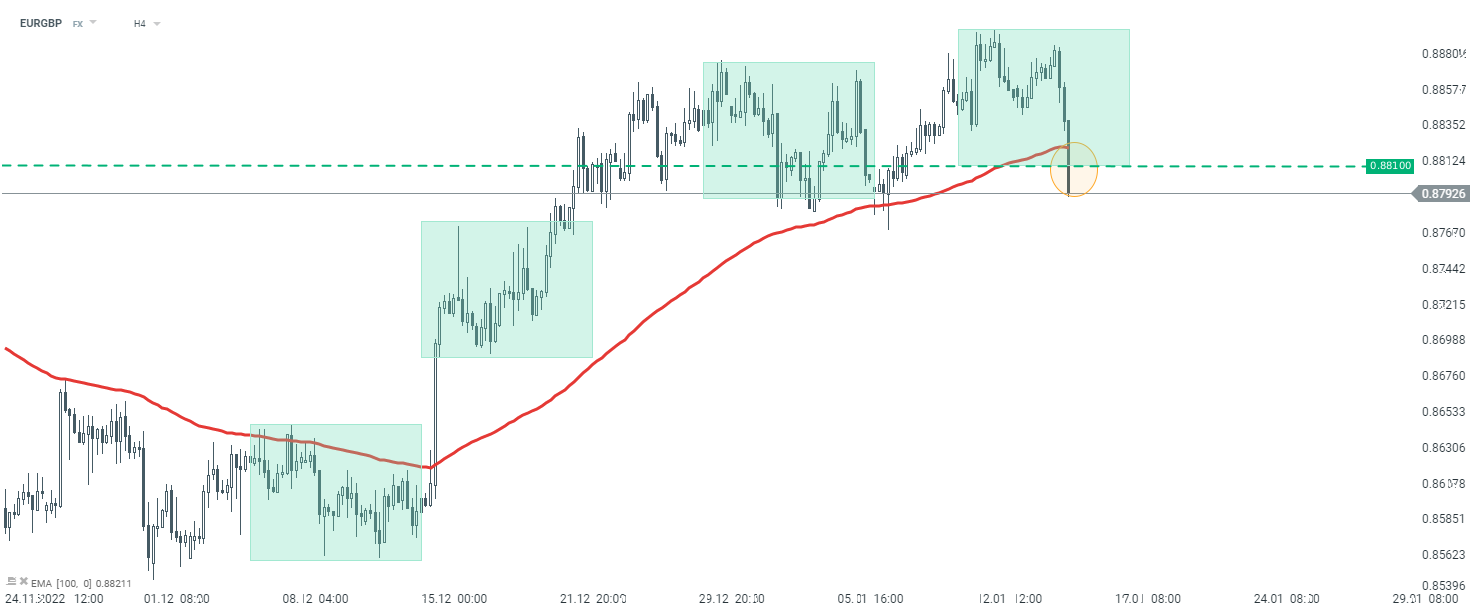

EURGBP pair came under selling pressure on Tuesday and broke below key support at 0.8810, which is marked with the lower limit of the 1:1 system and the EMA100. Source: xStation5

EURGBP pair came under selling pressure on Tuesday and broke below key support at 0.8810, which is marked with the lower limit of the 1:1 system and the EMA100. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.