-

Stocks in Europe post small gains

-

Wall Street trades higher, banks gain after Fed stress test results

-

CAD leader among G10 currencies, GBP top laggard

-

Bitcoin drops below $32,000

-

US PCE accelerates to 3.9% in May

-

Corn and soybean drop on US Supreme Court ruling

Final trading session of the week was a rather calm one. Stock markets in Europe did not experience any major price moves and the majority of benchmarks from the Old Continent finished the day little changed. More upbeat moods can be spotted on Wall Street, where S&P 500 retested all-time highs. Nasdaq-100 is a laggard among US indices trading near yesterday's closing level.

US PCE inflation data, Fed's preferred price growth measure, showed an acceleration from 3.6% YoY in April to 3.9% YoY in May. Core gauge moved from 3.1% to 3.4%. Data did not trigger a major market reaction as it was in-line with expectations. USD lost some ground with EURUSD jumping above 1.1970. However, the move has been erased by now and the main currency pair trades little change on the day.

Declines can be spotted on grain markets, especially corn and soybean. Situation is a result of a US Supreme Court ruling that said a number of refineries may be exempt from biofuel quotas.

Precious metals trade with minor gains after erasing most of the intraday upward move. Oil gains ahead of OPEC+ meeting scheduled for next Thursday.

Cryptocurrencies paused recovery from the latest sell-off with Bitcoin dropping around 8% and pulling back below $32,000 area. Ethereum retested the $1,800 area while Ripple pulled back below $0,65.

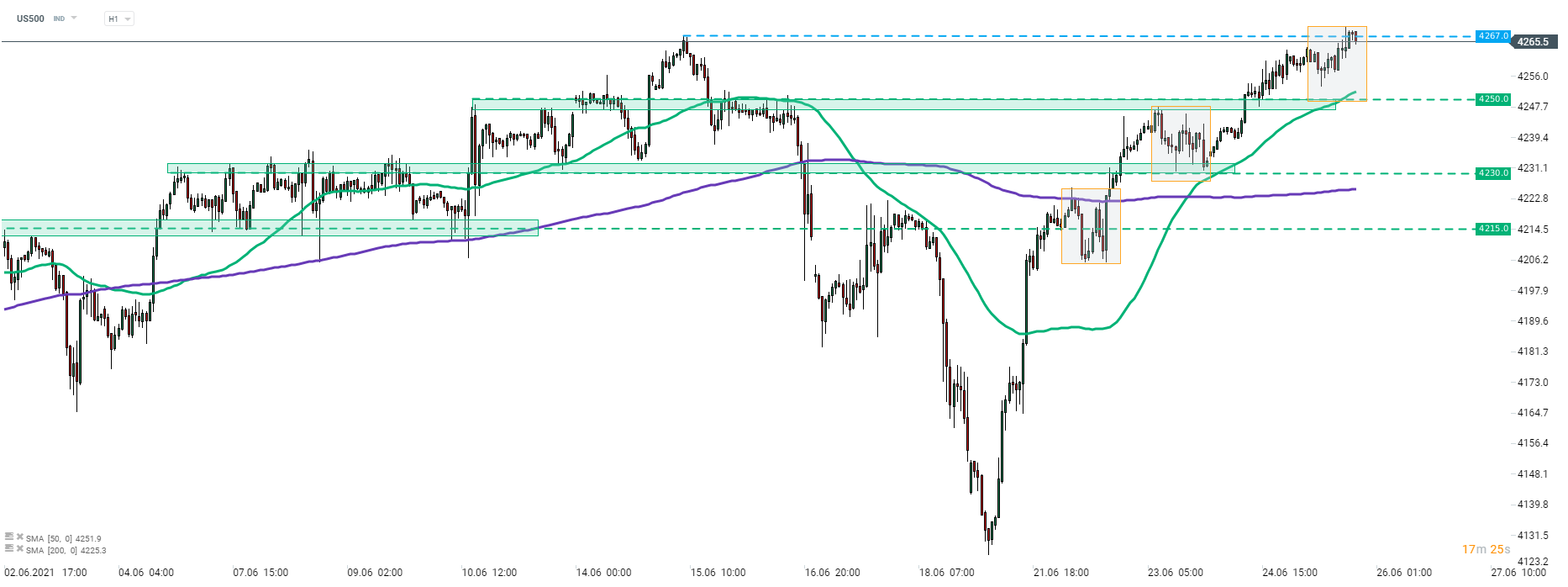

US500 painted a fresh record high today as investors welcomed PCE print that "only" matched 3.9% forecast instead of exceeding it. Source: xStation5

US500 painted a fresh record high today as investors welcomed PCE print that "only" matched 3.9% forecast instead of exceeding it. Source: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

3 markets to watch next week (05.12.2025)

US100 gains after PCE data 📈

Santa Claus Rally – myth, statistics or a real market opportunity in 2025?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.