- FOMC minutes turned out to be a largely non-event. Document noted that almost all participants saw lower rates at the end of 2024 than currently. However, it was also noted that circumstances may lead to rates being kept at high levels for longer than currently anticipated

- Minutes lacked strong, dovish hints and were seen as somewhat disappointing. Market reaction was hawkish but limited. USD gained while gold and equities moved lower

- Wall Street indices trade lower - S&P 500 drops 0.6%, Dow Jones trades 0.5% lower, Nasdaq declined 1% and small-cap Russell 2000 plunges over 2%

- European stock market indices traded lower today - German DAX and Italian FTSE MIB dropped 1.4%, French CAC40 moved 1.6% lower, Spanish IBEX declined 1.3% and UK FTSE 100 closed 0.5% lower.

- A bomb attack killed over 100 people at the memorial for Qasem Soleimani, Iranian commander killed in US drone strike in 2020, in Kerman, Iran. No country or party took responsibility for the attack, but Iran vowed to punish those responsible, sparking fears of further escalation in Middle East hostilities

- Oil jumped as it was reported that Sharara oil field in Libya begun a full shutdown in response to protests

- OPEC+ issued a joint statement re-affirming commitment to unity, following Angola's exit from the group last month

- Bitcoin slumped in the early afternoon on media reports suggesting that SEC will reject all Bitcoin spot ETFs in January, and a final approval of such vehicles may not come before Q2 2024

- However, Bitcoin recovered part of the losses later on after Fox reporter tweeted that SEC is set to meet with US exchange operators to finalize comments to Bitcoin spot ETF applications

- Fed Barkin said that there is a potential for additional rate hikes. Barkin also said that case for soft landing is developing in the data, but it is not inevitable

- US manufacturing ISM index climbed from 46.7 to 47.4 in December (exp. 47.1). Employment subindex came in at 48.1 (exp. 46.5), New Orders subindex dropped to 47.1 (exp. 49.1) and Prices Paid subindex dropped to 45.2 (exp. 49.5)

- US JOLTS report showed job openings at 8.79 million in November (exp. 8.85 million). However, October's data was revised higher from 8.73 million to 8.85 million, meaning that job openings dropped in November compared to the previous month

- German unemployment rate stayed unchanged at 5.9% in December, in-line with market expectations

- Turkish CPI inflation accelerated from 62.0 to 64.8% YoY in December (exp. 65.1% YoY). PPI inflation accelerated from 42.2 to 44.2% YoY

- Major cryptocurrencies haven't fully recovered from early-day declines - Bitcoin trades 5.4% lower on the day, Ethereum drops 6.3% while Dogecoin plunges 10.5%

- Energy commodities trade higher - oil gains 3% while US natural gas prices advance 3.9%

- Precious metals drop amid USD strengthening - gold trades 1.2% lower, platinum drops 1.3%, palladium declines 0.8% while silver slumps 3%

- GBP and USD are the best performing G10 currencies, while JPY and AUD lag the most

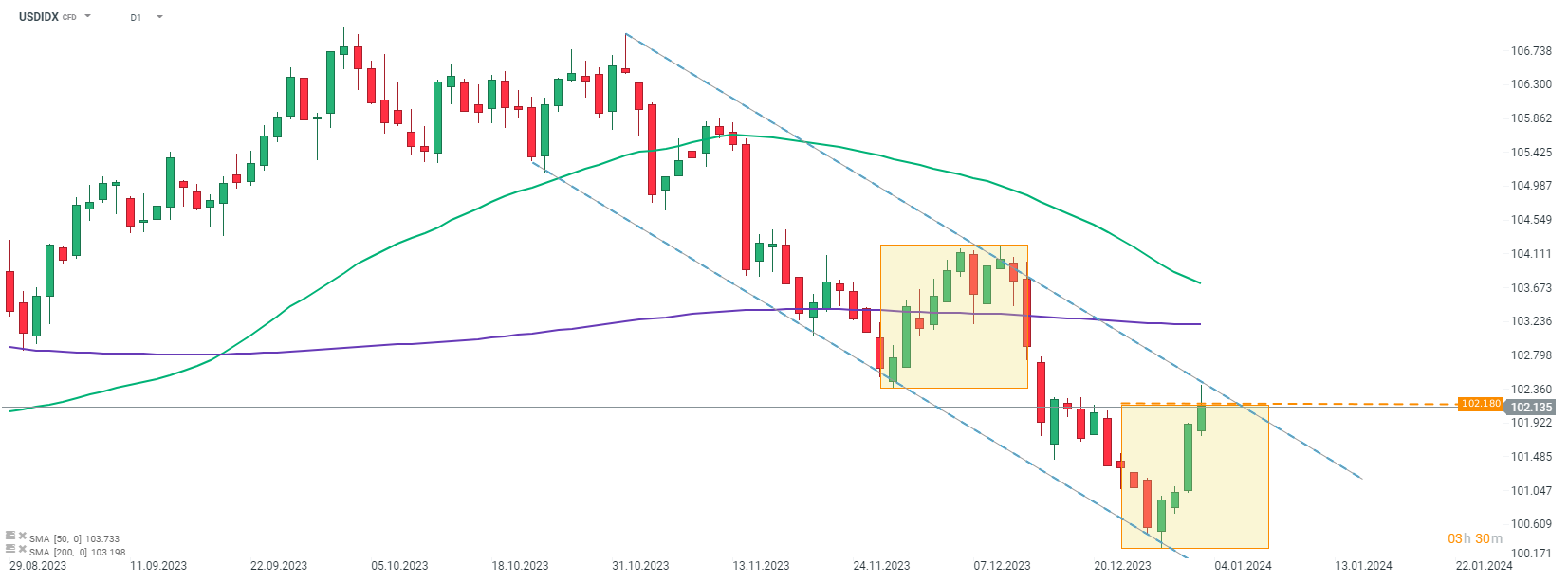

US dollar index (USDIDX) continues to gain and is attempting to close the day above the upper limit of a market geometry. Index tested the upper limit of the bearish channel earlier today but failed to break above. Source: xStation5

US dollar index (USDIDX) continues to gain and is attempting to close the day above the upper limit of a market geometry. Index tested the upper limit of the bearish channel earlier today but failed to break above. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.