-

Wall Street indices traded lower today with small-cap Russell 2000 dropping over 1%, Dow JOnes trading 0.7% down and S&P/ASX 200 declining 0.3%. Nasdaq is an exception and manages to post a 0.1% gain

-

European stock markets traded lower today but the scale of declines was rather small. German DAX dropped 0.12%, French CAC40 trades 0.16% lower while UK FTSE 100 was 0.34% down

-

No breakthrough was made on the US debt ceiling and media reports hint that negotiations may drag

-

US President Biden wants to reach an agreement ahead of G7 meeting later this week but Democrats and Republicans are said to still be far apart on key issues

-

Fed Mester said that Fed remains committed to bringing inflation back to 2% and she does not think that central bank reached a spot to hold rates yet

-

Fed Barkin said that he likes optionality signaled by latest FOMC statement and that a lot may change in the outlook ahead of June meeting as a lot of key data will be released before it

-

Fed Williams said that inflation is gradually moving in the right direction and that economy is beginning to return to more normal patterns

-

ECB Holzmann said he would have preferred a 50 basis point rate hike at May meeting and said that rates need to go beyond 4% to combat inflation

-

US retail sales data for April came in mixed - headline retail sales missed expectations (0.4% MoM vs 0.8% MoM expected) while retail sales ex-autos matched analysts' expectations of 0.4% MoM

-

US industrial production increased 0.5% MoM in April (exp. 0.0% MoM)

-

Canadian CPI inflation accelerated from 4.3 to 4.4% YoY in April (exp. 4.1% YoY)

-

Chinese activity data for April turned out to be a disappointment. Retail sales were 18.4% YoY higher (exp. 21.0% YoY), industrial production increased 5.6% YoY (exp. 10.9% YoY) while urban investments rose 4.7% YoY (exp. 5.5% YoY)

-

UK jobs report for March showed 5.8% YoY increase in wages (exp. 5.8% YoY) as well as the unemployment rate ticking higher from 3.8 to 3.9% (exp. 3.8%)

-

Euro area GDP report for Q1 2023 showed a 0.1% QoQ expansion - in-line with preliminary release

-

German ZEW index dropped from 4.1 to -10.7 in May (exp. -5.3)

-

Polish Q1 GDP report showed a 0.2% YoY contraction (exp. -0.8% YoY). On a quarterly basis growth reached 3.9% QoQ (exp. 0.7% QoQ)

-

IEA boosted global oil demand growth forecast for 2023 to 2.2 million barrels per day, up from 2.0 mbpd previously

-

Atlanta Fed GDPNow model points to a 2.6% growth in Q2 2023, down from 2.7% in previous release

-

USD and CAD are the best performing major currencies while NZD and AUD lag the most

-

USD strengthening pressures precious metals with gold trading over 1% lower and dropping below psychological $2,000 mark

-

Energy commodities traded mixed today - oil dropped 0.7% while US natural gas prices climbed 0.8%

-

Cryptocurrencies traded lower today - Bitcoin dropped 1.1%, Dogecoin traded 0.4% down while Ethereum declined 0.1%

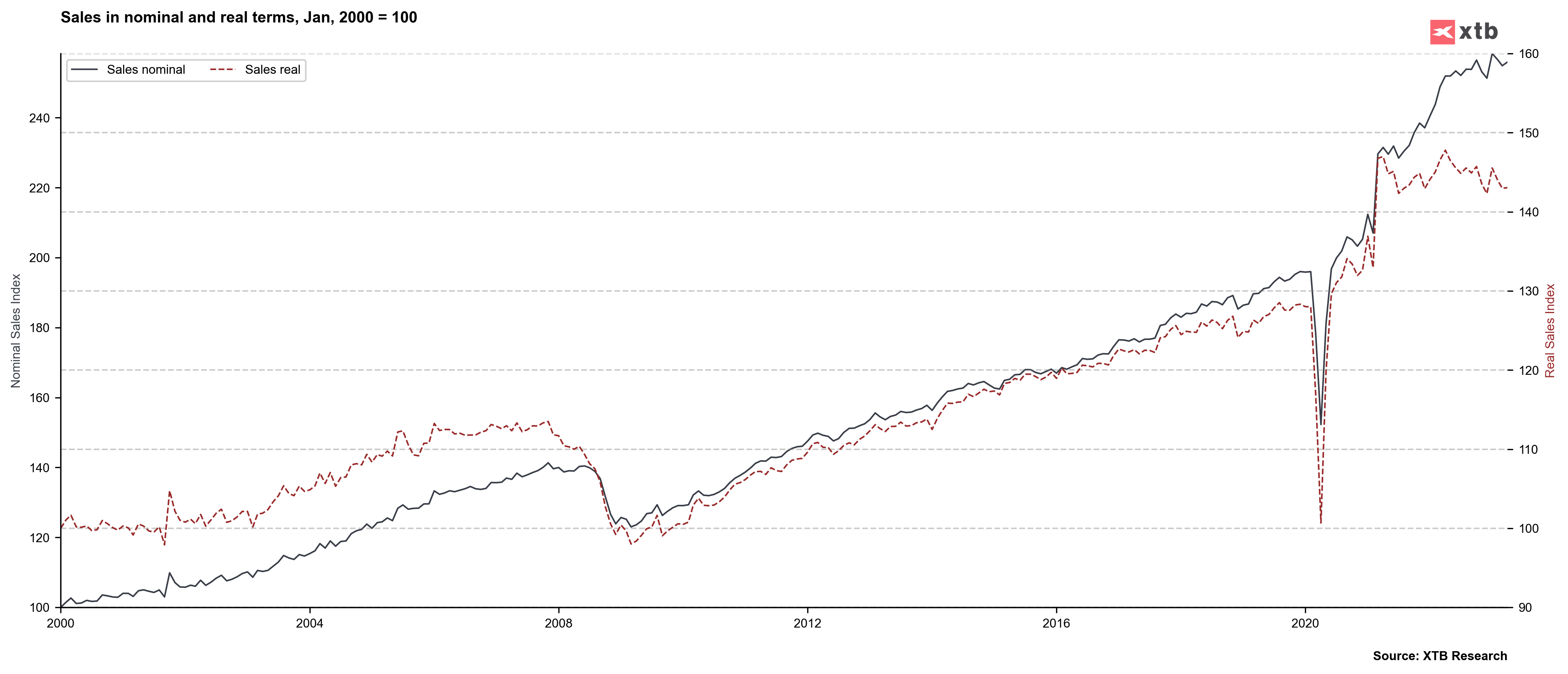

US retail sales climbed in April, following a drop in March. However, the situation looked less upbeat in case of real retail sales as gap between the two continues to grow. Source: Macrobond, XTB

US retail sales climbed in April, following a drop in March. However, the situation looked less upbeat in case of real retail sales as gap between the two continues to grow. Source: Macrobond, XTB

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.