-

Wall Street indices traded higher today following US CPI data for May. S&P 500 trades 0.8% higher, Nasdaq adds 0.9% and Dow Jones advances 0.6%. Small-cap Russell 2000 is the best performing Wall Street index with an around-2% gain at press time

-

US CPI inflation report for May turned out to be mixed. Headline CPI slowed more than expected, from 4.9 to 4.0% YoY (exp. 4.1% YoY), while core gauge slowed from 5.5 to 5.3% YoY and matched expectations

-

Markets took the US CPI report as dovish with USD dropping while equity indices and gold gained. Market odds for a Fed June rate hike dropped following the release

-

Money markets currently price in a less-than-10% chance of 25 bp rate hike tomorrow and around 60% chance of a 25 bp rate hike at July meeting

-

European stock markets traded higher today - German DAX gained 0.8%, UK FTSE 100 moved 0.3% higher and French CAC40 added 0.5%. Polish WIG20 was an outlier among EUropean blue chips indices with a 0.9% drop

-

Russian President Putin said that Russia is considering withdrawing from Black Sea grain deal as Russian conditions for the extension have not been met

-

The People's Bank of China cut the 7-day repo rate by 10 basis points, to 1.90%. This was the first repo rate cut since August 2022 and serves as a strong hint that PBoC will also cut medium-term lending facility rate on June 15, 2023

-

UK jobs data for April turned out to be a positive surprise. Unemployment rate dropped from 3.9% to 3.8% (exp. 4.0%) while headline wage growth accelerated from 6.1% YoY to 6.5% YoY (exp. 6.1% YoY)

-

GBP gained after data releases as it was clearly hawkish and may encourage Bank of England to tighten more

-

German ZEW Expectations index improved from -10.7 to -8.5 in June (exp. -12.5). Meanwhile, the Current Situation index dropped from -34.8 to -56.5 (exp. -40.2)

-

Final German CPI inflation for May came in at 6.1% YoY, matching preliminary release

-

Final Spanish CPI inflation for May came in a 3.2% YoY, matching preliminary release

-

Energy commodities trade higher with oil jumping over 3% and natural gas trading 2.6% higher

-

Precious metals moved higher following US CPI data release but has since given back those gains. Gold trades 0.7% lower, silver drops 1.5% and platinum declines 1.3%

-

GBP and CAD are the best performing major currencies while JPY and USD lag the most

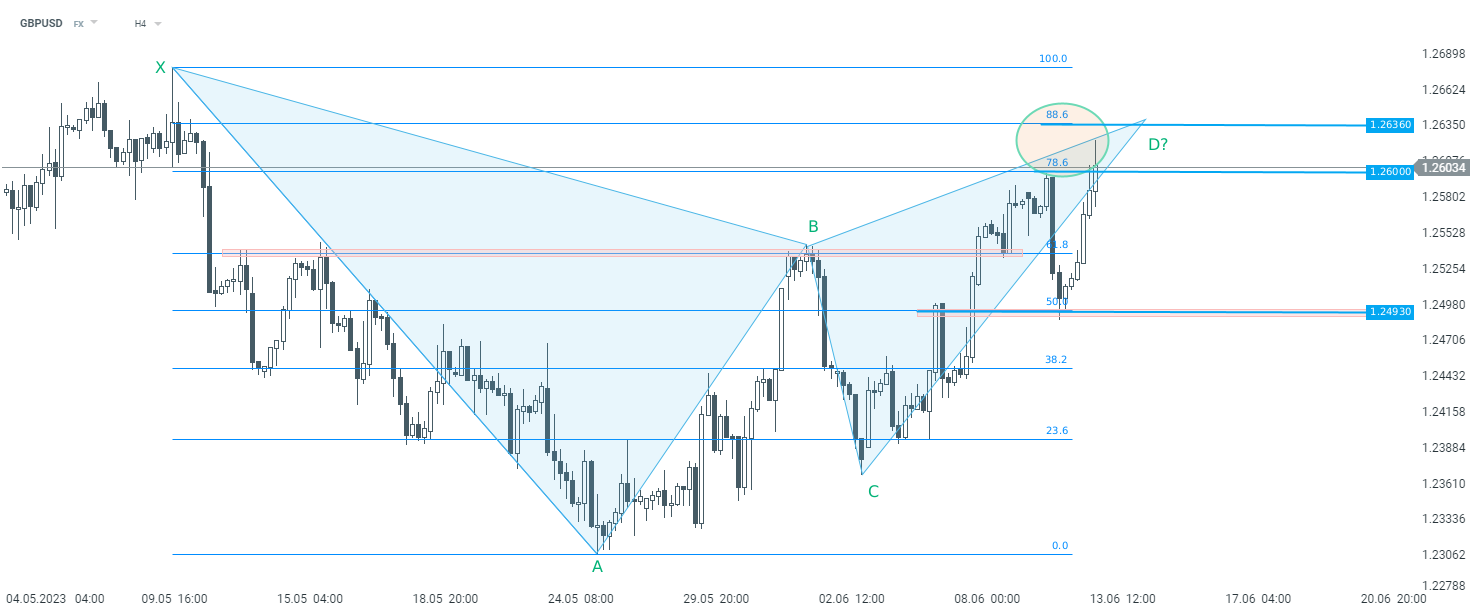

A potential harmonic XABCD pattern can be seen building up on GBPUSD. Taking a look at the chart at H4 interval, we can see that the pair is testing a resistance zone marked with 78.6% and 88.6% retracements. Should a supply side reaction occur here, one cannot rule out a bearish trend reversal. On the other hand, a break above 1.2636 may pave the way for more gains and a new local high. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.