- European equities post first monthly drop since January

- US initial jobless claims unexpectedly rise for a third week

- Potential US government shutdown weighs on market sentiment

- Oil moves higher after China ordered energy firms to "Secure supplies at all costs"

European indices finished today's session lower, with DAX widening September losses to 3.3%, the first monthly drop in 8 months as investors remain concerned about the supply chain disruptions and rising inflation. According to today's figures, consumer prices in Germany advanced 4.1% YoY this month, the fastest pace since December of 1993. Meanwhile ECB upholds its dovish rhetoric while the FED is expected to begin tapering in the near future. Other economic data releases showed, Germany’s jobless rate remained unchanged at 5.5% in September, while the Eurozone jobless rate fell slightly to 7.5% in August, in line with market estimates.

US indices erased early gains and all the major US indexes are trading lower at the end of third quarter as investors await end of negotiations regarding infrastructure bill and hope a government shutdown could be avoided. On the data front, initial claims unexpectedly rose for the 3rd week, Chicago PMI reading slightly disappointed, while a report from the Commerce Department revised second-quarter growth to be slightly higher.

Oil is trading higher after the Chinese government ordered state-owned energy companies "Secure supplies at all costs" for the incoming winter season. Also soaring natural gas prices provide additional support for oil prices. Earlier in the session, oil prices came under selling pressure after disappointing factory activity figures from China. Precious metals are trading higher, attempting to erase recent losses. Gold surged more than 2% and silver rose over 3%. The rebound in precious metals prices was not accompanied by stronger movements of the US dollar or bond yields. Gold may have reacted to Powell's slightly softer tone during his speech before Congress today. Either way, the Fed does not seem to be changing its stance, although it is certain that the key player will have a lot to say. That player is Wall Street. If the downward movement becomes stronger, we can rather forget about tapering.

The dollar itself was very strong today and the EURUSD pair fell below 1.16 level! Even slightly weaker jobless claims data did not affect the dollar. The most important currency in the world is now also gaining due to the negative sentiment that currently prevails on the stock market.

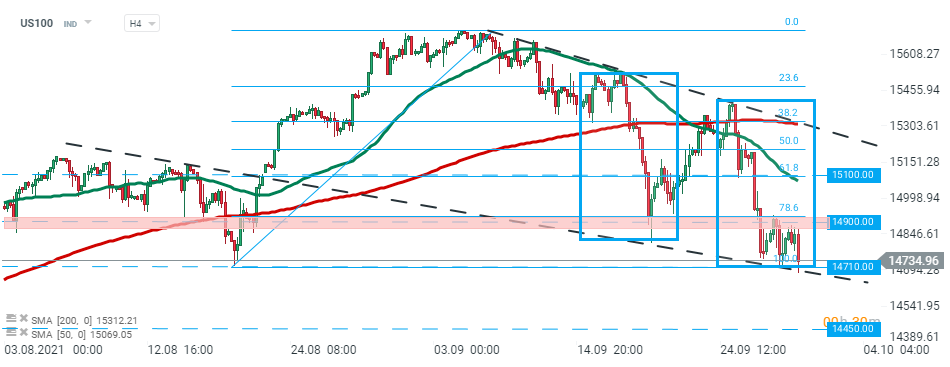

US100 launched today’s session higher however buyers again failed to break above resistance at 14,900 pts and index retreated towards major support at 14,710 pts which is marked with the lower limit of the 1:1 structure and lower bound of the wedge formation. Should break lower occur, then the next target for sellers is located around 14,450 pts. Source: xStation5

US100 launched today’s session higher however buyers again failed to break above resistance at 14,900 pts and index retreated towards major support at 14,710 pts which is marked with the lower limit of the 1:1 structure and lower bound of the wedge formation. Should break lower occur, then the next target for sellers is located around 14,450 pts. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.