-

Wall Street indices had a volatile session, dropping after FOMC decision and recovering during Powell's presser. Dow Jones trades 0.7% lower, Russell 2000 drops 1%, S&P 500 trades flat and Nasdaq gains 0.2%

-

FOMC decided to hold rates unchanged in the 5.00-5.25% range in an unanimous 11-0 vote

-

Decision triggered a hawkish reaction on the markets - USD rallied while equities drop

-

Hawkish reaction was driven by a new set of economic projections. Namely, new dot-plot suggested not one, but two more rate hikes this year

-

Swap market no longer prices Fed rate cuts in 2023

-

Powell said during press conference that nearly all Fed members see further rates hikes this year as appropriate

-

Powell said that Fed members did not discuss July meeting but he expects July to be 'live meeting'

-

General takeaway from the decision and Powell's presser was that pace of rate hikes is moderating but hikes are not over yet

-

Money markets see an around-60% chance of a 25 bp rate hike at July meeting

-

Markets made a U-turn during Powell's press conference and have erased majority of post-decision moves

-

European stock market indices traded higher today. German DAX gained 0.5%, UK FTSE 100 moved 0.2% higher while French CAC40 added 0.6%. Italian FTSE MIB jumped 0.9% while Spanish IBEX traded 1.2% higher.

-

Wall Street Journal reported that United States has resumed negotiations with Iran on prisoner exchange and nuclear issues

-

US PPI inflation slowed more than expected in May. Headline gauge slowed from 2.3% to 1.1% YoY (exp. 1.5% YoY) while core measure slowed from 3.1% to 2.8% YoY (exp. 2.9% YoY)

-

UK GDP report for April came in at 0.5% YoY (exp. 0.6% YoY), marking an acceleration from 0.3% YoY recorded in March

-

UK industrial production dropped 1.9% YoY in April (exp. -1.8% YoY)

-

Euro area industrial production increased 0.2% YoY in April (exp. 0.9% YoY)

-

Swedish CPI inflation decelerated from 10.5% to 9.7% YoY in May (exp. 9.5% YoY)

-

EIA report showed a massive 7.9 million barrel build in US oil inventories (exp. -0.5 mb). Gasoline and distillate inventories increased around 2.1 million barrel each, also more than expected

-

TRY gained after Turkish President Erdogan said that he accepted steps that finance minister Simsek and CBRT chief Ergan will take

-

NZD and CHF are the best performing major currencies while USD and CAD lag the most

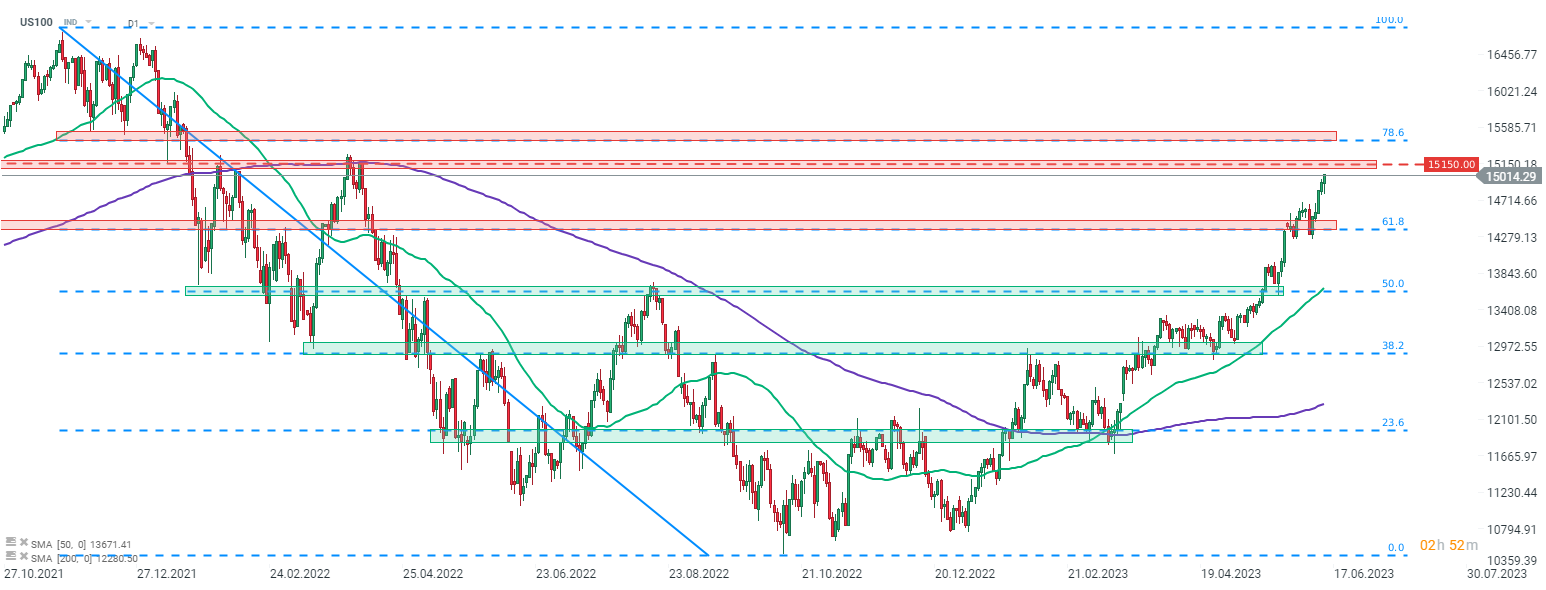

Nasdaq-100 (US100), just like other US indices, dropped in the aftermath of the FOMC decision. However, the index gradually recovered during Powell's presser and is trading back into positive territory near the 15,000 pts mark. Source: xStation5

Nasdaq-100 (US100), just like other US indices, dropped in the aftermath of the FOMC decision. However, the index gradually recovered during Powell's presser and is trading back into positive territory near the 15,000 pts mark. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.