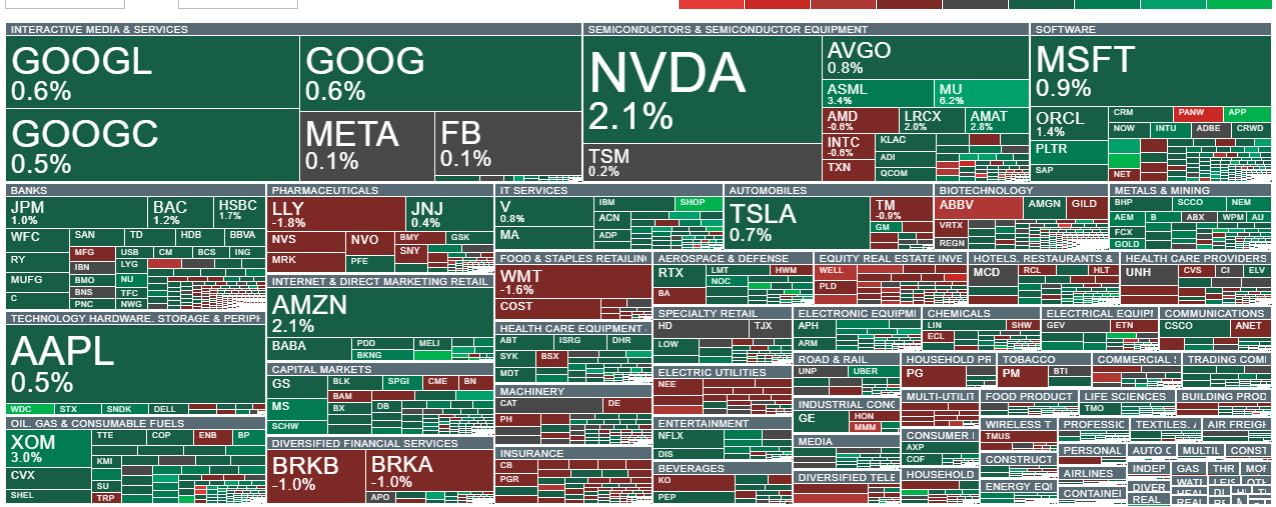

US100 is up more than 1%, with US indices regaining ground after Wednesday’s sell-off. US data — from building permits to industrial production and durable goods orders — beat expectations, supporting the US dollar.

According to Citadel Securities, retail investors have been buying software stocks at a record pace on Citadel’s platform (data tracked since 2017). As the firm put it: “Net notional on our platform has reached levels we have never observed before.”

Citadel added that the scale, persistence and breadth of the buying have materially exceeded prior peaks, highlighting retail as a key source of incremental demand in early 2026. Average daily dollar demand for US equities on the platform (Jan 2–Feb 13) was roughly 25% above the previous record set in 2021 and about twice the 2020–2025 average.

The momentum has also spilled into options. Retail participation in 2026 is already running at historically high levels. Average daily options volume year-to-date is nearly 50% above the 2020–2025 average and more than 15% above last year’s pace. Retail options investors have been net buyers in 41 of the past 42 weeks, pointing to sustained risk appetite rather than sporadic positioning.

Interestingly, despite a stronger USD index (USDIDX) today and EURUSD down nearly 0.5%, precious metals are rising. Gold is up almost 2.5%, attempting to break decisively above the psychological $5,000/oz level, while silver is jumping as much as 5%. This move may also have a meaningful retail-flow component.

US data

-

Industrial production (m/m): 0.7% (Exp: 0.4%; Prev: 0.4%; Rev: 0.2%)

-

Industrial production (y/y): 2.3% (Prev: 1.99%)

-

Manufacturing output (m/m): 0.6% (Exp: 0.4%; Prev: 0.2%)

-

Capacity utilization: 76.2% (Exp: 76.6%; Prev: 77.3%; Rev: 75.7%)

-

Durable goods orders (m/m): -1.4% (Exp: -1.8%; Prev: 5.4%)

-

Core durable goods (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Durable goods ex-defense (m/m): -2.5% (Prev: 6.6%)

-

Durable goods ex-transportation (m/m): 0.9% (Exp: 0.3%; Prev: 0.4%)

-

Building permits: 1.448m (Exp: 1.400m; Prev: 1.411m)

-

Housing starts: 1.404m (Exp: 1.310m; Prev: 1.272m)

Cocoa is sharply lower, down more than 6%. Year-to-date, prices are down over 45%. Ghana (the second-largest producer) cut its farmgate prices by nearly 30% last week. Ivory Coast (the largest producer) says it will keep farmgate prices unchanged through the end of the current main season (March 31), though reports suggest it is considering a cut.

Markets are also pricing a higher risk of military escalation in the Middle East after the US moved additional military equipment into the region. Oil is gaining more than 3.5% on these concerns.

(summary in progress)

Source: xStation5

Fed minutes released 🗽Key takeaways

Western Digital shares gains 8% reaching new all-time high 📈

Gold surges 2.5% nearing $5000 per ounce 📈

Strong Quarter for Analog Devices and Record Outlook

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.