- Wall Street indices are trading lower today, with sentiment being pressured by weakness in tech shares. S&P 500 drops 0.8%, Dow Jones trades 0.2% lower, Nasdaq slumps 1.4% and small-cap Russell 2000 plunges 1.6%

- Nvidia drops 6% today as traders trim their positions in the stock amid uncertainty ahead of a highly anticipated fiscal-Q4 earnings report, which is scheduled for release tomorrow after close of the US session

- European stock market indices finished today's trading mixed. German DAX dropped 0.14%, UK FTSE 100 declined 0.12%, Dutch AEX slumped 0.88%. Meanwhile, French CAC40 added 0.34%, Italian FTSE MIB moved 0.08% higher and Spanish IBEX surged 0.94%

- BoE Governor Bailey said he is comfortable with a market interest rate path outlook that includes rate cuts but added that he is unable to say when or by how much rates will be cut. However, Bailey did not rule out cutting rates before inflation hits target

- BoE Deputy Governor Broadbent said that current wage growth and services inflation is double the rate consistent with sustainable CPI inflation

- Russia's deputy prime minister Novak said that Russia intends to be in full compliance with OPEC+ quotas in February

- CAD dropped after Canadian CPI inflation report for January showed headline inflation gauge decelerating from 3.4 to 2.9% YoY (exp. 3.3% YoY)

- People's Bank of China left 1-year lending prime rate unchanged at 3.45% (exp. 3.40%) while lowering 5-year lending prime rate was lowered from 4.20 to 3.95% (exp. 4.10%). This was the biggest cut to the 5-year rate in history

- RBA minutes showed that Australian central bankers discussed raising rates by 25 basis points or leaving them unchanged at the meeting in February

- US leading index dropped 0.4% MoM in January (exp. -0.3% MoM). December's reading was revised lower from -0.1% MoM to -0.2% MoM

- Poland's employment declined 0.2% YoY in January (exp. -0.2% YoY) while wage growth accelerated from 9.6 to 12.8% YoY (exp. 11.2% YoY)

- Gains could be spotted on the cryptocurrencies market earlier today, with Bitcoin testing $53,000 mark and Ethereum testing $3,000 area. However, gains were later erased and now Bitcoin trades 0.7% lower and Ethereum drops 1.2%

- Energy commodities trade mixed - oil drops 1% while US natural gas prices climb 1.5%

- Precious metals benefit from USD weakness - gold gains 0.5%, silver trades 0.4% higher, platinum adds 0.6% and palladium surges 3.2%

- NZD and EUR are the best performing major currencies, while CAD and USD lag the most

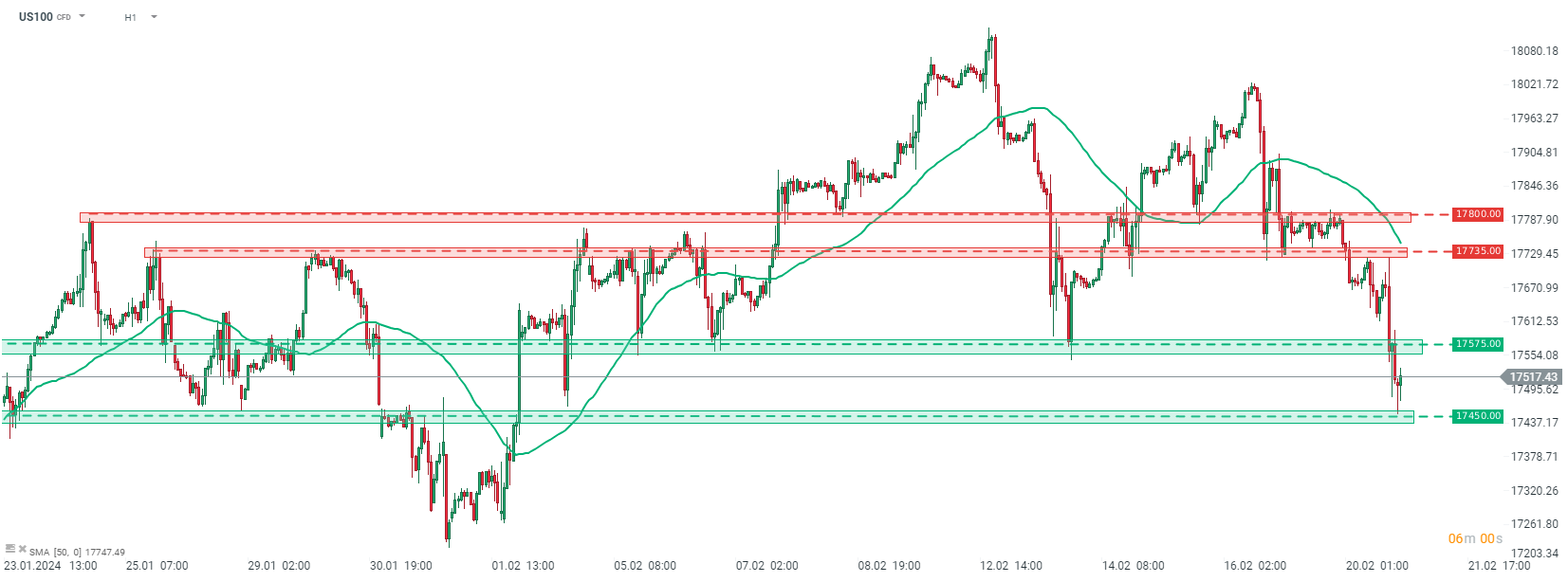

US100 dropped to the lowest level since the beginning of February amid weakness in large-cap techs. Source: xStation5

US100 dropped to the lowest level since the beginning of February amid weakness in large-cap techs. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.