Tech Megacaps Lead the Charge

The technology sector has once again seized the leadership mantle on Wall Street, lifting Nasdaq 100 futures by more than 1%. Market uczestnicy are reacting with optimism to reports that a consortium led by Oracle Corp. is moving forward with the acquisition of TikTok. Sentiment is further bolstered by continued momentum in Micron Technology and Nvidia Corp., with the latter leading the charge among tech megacaps.

Supporting this upward trajectory is a near-record deluge of capital into US equity markets. According to fund flow data, US equities saw inflows of approximately $78 billion in the week ending December 17, the most significant weekly entry of capital in a year and one of the largest on record. Notably, technology stocks saw positive net inflows for the first time in three weeks.

The Triple Witching Factor

Market dynamics today are further amplified by "triple witching," the quarterly expiration of stock options, index options, and futures contracts. Analysts estimate that roughly $7.1 trillion in notional open interest is set to mature, a mechanical event that often triggers elevated volume and significant price swings.

Beyond the immediate technicals, investors are increasingly focused on the "Santa Claus rally," a statistical phenomenon where markets tend to rise in the final fortnight of the year. Historical data indicates that since 1928, the S&P 500 has advanced 75% of the time during this specific period. Strategists at leading financial institutions, including Goldman Sachs, suggest that despite recent volatility, the underlying fundamentals for a year-end recovery remain robust.

Technical Outlook: Testing New Heights

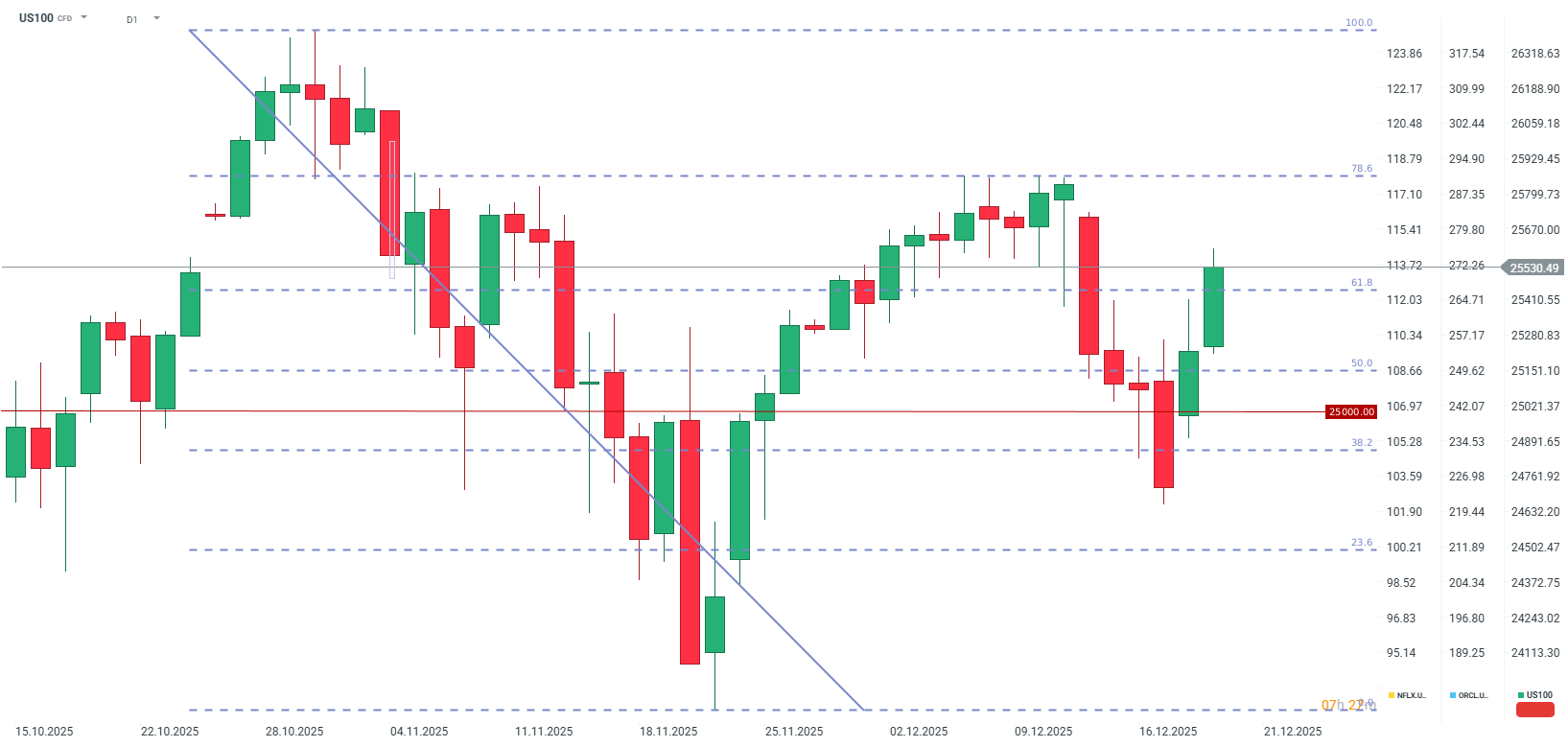

The US100 has advanced 1% today, building on the gains established during Thursday’s session. Following the recent contract rollover, the index is currently testing the 25,500 level. A sustained move above this threshold would mark a fresh weekly high and push the monthly return into positive territory, reversing the jittery sentiment seen earlier in December.

Morning Wrap - Oil price is still elevated (07.03.2026)

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.