- European indices finished today’s session in upbeat moods, with DAX closing 2.17% higher while CAC40 and FTSE100 rose 2.50% and 1.44% respectively, led by energy, luxury, and auto sectors;

- US indices erased early losses and moved lower as investors were digesting recent inflation data which may force Fed to act more aggressively. Dow Jones trades 0.80% lower while S&P500 and Nasdaq fell 1.3% and 2.7% respectively,

- The annual inflation rate in the US slowed to 8.3% in April, less than market forecasts of 8.1%, while core CPI gained 6.2% compared to expectations of 6.0%.

- Gold jumped to $1,856/oz, after bouncing of the support at $1,830 region, while silver unsuccessfully tried to break above $22.00 level

- Brent crude futures surged more than 5.50% to around $107,40 per barrel, while WTI price rose 5.80% to $105.40 per barrel amid prospects of strong oil demand after coronavirus cases in China declined while the EU continues to work to move ahead with an embargo on Russian oil.

- US crude inventories unexpectedly increased by 8.487 million barrels, the most in four weeks, and compared to forecasts of a 0.457 million barrels decrease, EIA data showed.

- The 10-year US Treasury note fell to 2.92%, USD weakened;

- JPY and CHF are the best performing major currencies while EUR and GBP lag the most;

- Cryptocurrencies are trading lower. Bitcoin returned below $30,000, Ethereum is testing $2170, while Terra fell below $1.00;

- Coinbase stock plunged over 25% after the US largest cryptocurrency exchange reported a quarterly loss and a 19% drop in monthly users.

Today's session has brought tremendous volatility across all asset classes. Stocks in Europe managed to end today's trading at higher levels, while Wall Street resumed downward move pressured by inflation figures, which showed that price pressure may remain strong in coming months even despite rate hikes. The cryptocurrency market continues to bleed. Bitcoin broke through the psychological barrier of 30.000 USD, which caused panic among other projects. Terra (LUNA) fell by more than 90% today.

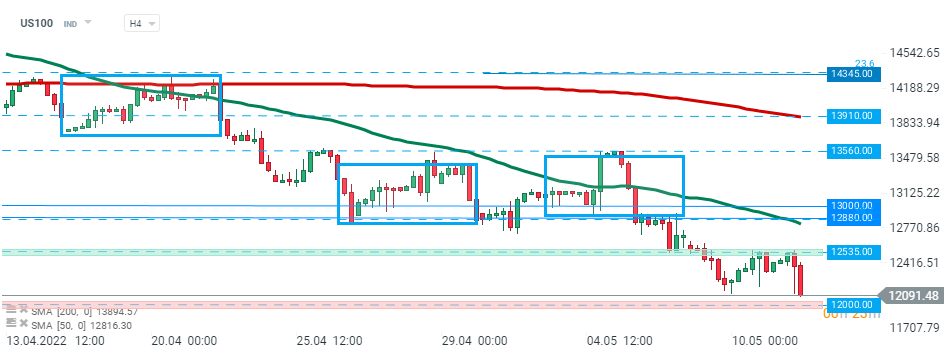

US100 entered the positive territory at the beginning of US session, however buyers failed to uphold momentum and index resumed downward move in the evening and made new low for the year. Nearest major support is located at 12000 pts. Source: xStation5

US100 entered the positive territory at the beginning of US session, however buyers failed to uphold momentum and index resumed downward move in the evening and made new low for the year. Nearest major support is located at 12000 pts. Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.