Economy and Currencies

-

Eurozone: Q4 2025 GDP grew 0.3% q/q and 1.3% y/y, matching preliminary data and market expectations. The foreign trade balance rose for the first time in three months to €11.6 billion (forecast: €11.7 billion; seasonally adjusted).

-

Poland: Consumer inflation (CPI) fell less than expected, moving from 2.4% to 2.2% (forecast: 1.9%). The slowdown was primarily driven by cheaper fuel and transport, while upward pressure came from excise goods (tobacco, alcohol). The reading remains below the NBP's target midpoint of 2.5% (+/- 1 pp).

-

US Dollar: The Dollar Index is gaining for the third consecutive day (USDIDX: +0.15%), still supported by the strong NFP report despite anticipation of the upcoming CPI report (forecast: 2.5%, previous: 2.7%). A tight labor market and solid business activity data suggest a risk of "sticky" inflation; dollar gains may reflect positioning for a potential upside surprise.

-

FX Moves: The Australian dollar (AUDUSD: -0.5%) and yen (USDJPY: +0.5%) are seeing the largest corrections. EURUSD has retreated 0.1% to 1.186, while USDPLN is gaining 0.1% to 3.553.

Indices

-

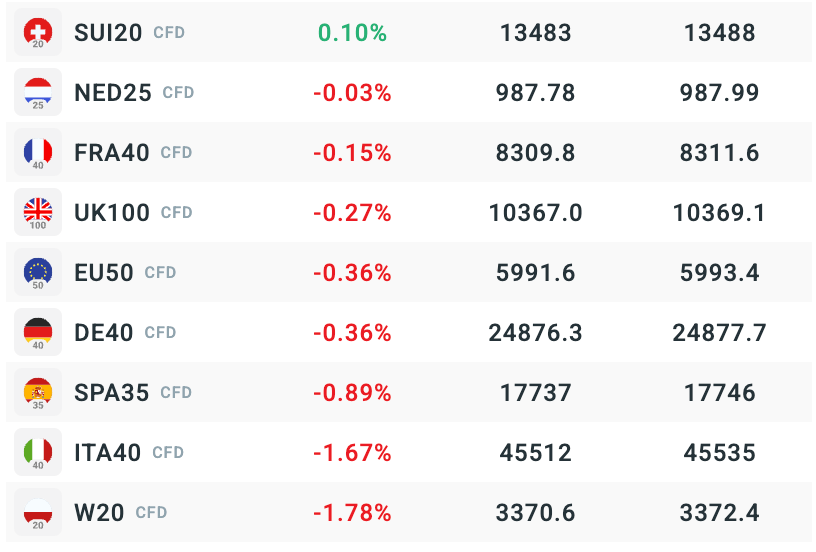

Market Sentiment: European index futures are trading mostly in the red, extending losses from yesterday's Wall Street sell-off (EU50 & DE40: -0.35%).

-

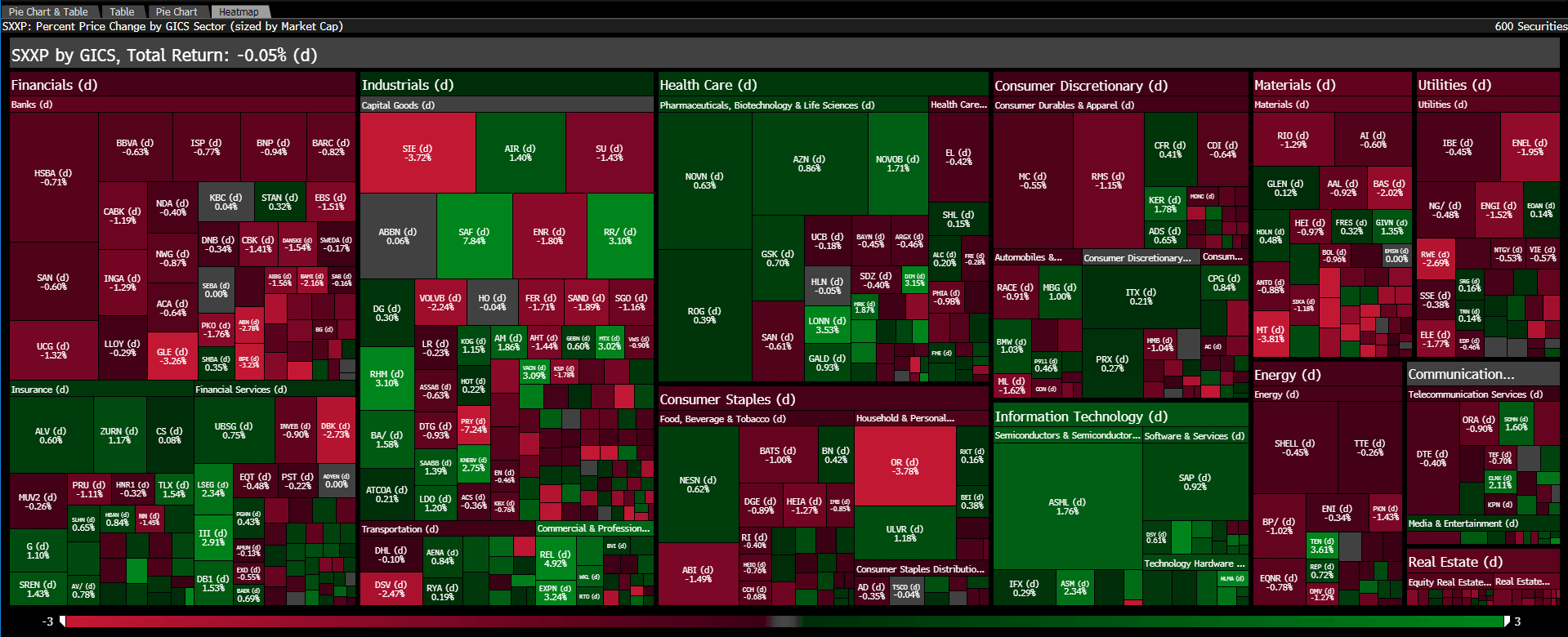

Sectors: declines are concentrated in financials, materials, energy and utilities. These are being partially offset by gains in major pharmaceutical, industrial and technology firms.

-

W20 (Poland): Leading losses at -1.8%.

-

SUI20 (Switzerland): The lone "green" exception at +0.1%.

The changes in stock index futures. Source: xStation5

Individual Stock Highlights

-

Siemens (-3.7%): Undergoing a sharp correction, completely erasing gains made after yesterday's initial positive reception of its financial results.

-

L’Oreal (-3.6%): Sliding after Q4 results showed marginal sales growth in China (0.6% vs. 5.6% forecast). Strong demand in North America and Europe (6% total growth) was not enough to satisfy investors.

-

Safran (+8.5%): Soaring after H2 2025 revenue hit €16.6 billion (+16% y/y). While EPS was softer, Free Cash Flow (€2.1 billion) significantly beat consensus. The market reacted positively to significantly raised 2028 targets.

-

Capgemini (+4.4%): Beat its 2025 revenue target (€22.47 billion) with strong Q4 growth (+10.6%) fueled by the WNS acquisition. AI-driven solutions remain the primary engine of growth, with a major restructuring planned to pivot fully toward AI services.

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

Today's performance of stocks and sectors of Stoxx 600 index. Source: Bloomberg Finance LP

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.