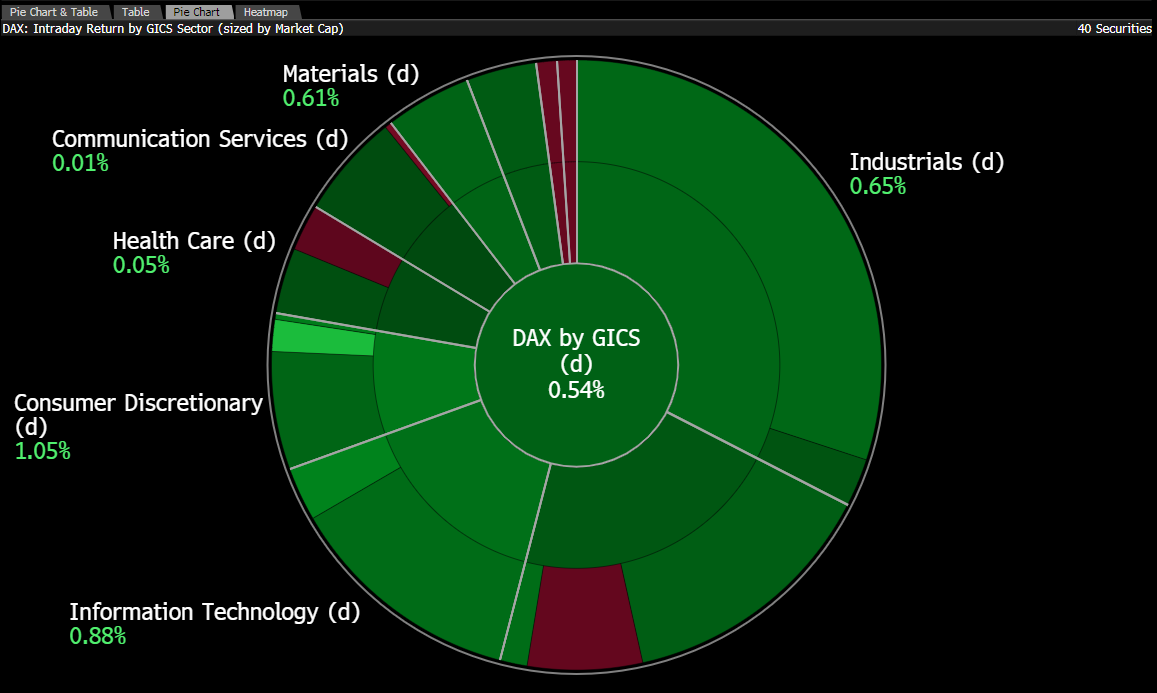

- Futures on the DAX are trading higher today, and the cash DAX is up nearly 0.5 percent. Almost all sectors in the index are posting gains.

- Strong earnings from Lululemon Athletica (LULU.US) supported sentiment toward German footwear and apparel companies Adidas (ADS.DE) and Puma (PUM.DE).

- AQR Capital has disclosed a short position in BASF (BAS.DE), yet shares of the chemical giant are trading higher today regardless.

- EasyJet (EZJ.UK) was downgraded to “hold” from “buy”; the price target was cut to 520 pence (from 650 pence). Shares of the company are rising despite the downgrade.

DE40 Index (D1 timeframe)

DAX futures are maintaining upward momentum on the last trading session of the week. The main challenge for the bulls today is to push above 24,500 points, which could potentially open the path to new record highs.

Source: xStation5

Source: Bloomberg Finance LP

Lufthansa shares gain after Kepler Cheuvreux report

Lufthansa shares are up as much as 6.9 percent, reaching their highest intraday level since August 2023. Kepler Cheuvreux upgraded the German flagship carrier to “buy” from “hold,” pointing to an increasingly attractive risk-to-reward profile and supportive factors heading into next year. The price target was raised to 11 euros (from 7.50 euros).

- The upside potential, analysts note, is “hard to ignore,” highlighting the successful restructuring, a possible recovery in the U.S. economy, and the potential reopening of Russian airspace.

- Additionally, industry-wide capacity constraints and low fuel prices create a supportive market backdrop.

- At the same time, challenges remain, including pressure from labor unions, competition from Middle Eastern carriers, the group’s complex structure, and operational risks.

Source: xStation5

Market Wrap: Capital Flees Europe 🇪🇺 📉

RyanAir shares under pressure amid Middle East conflict 📉

Oil surges 6% 📈Will it repeat 2022 scenario?

🚩US500 loses ahead of the US open, VIX surges 6%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.