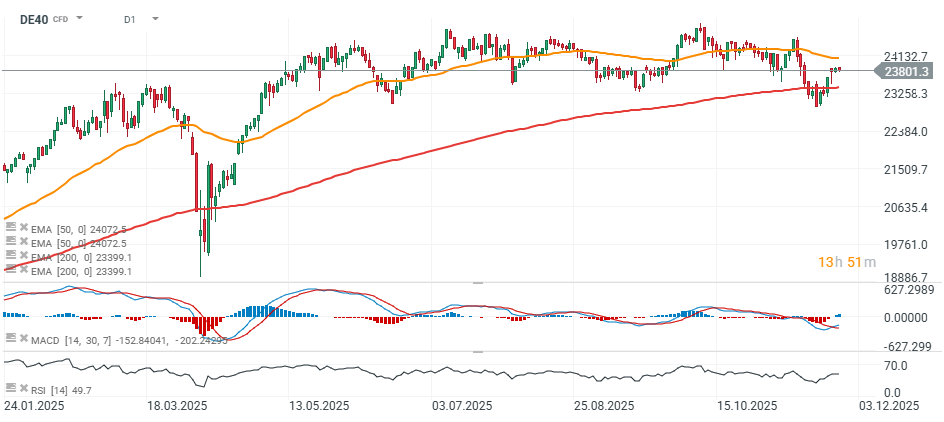

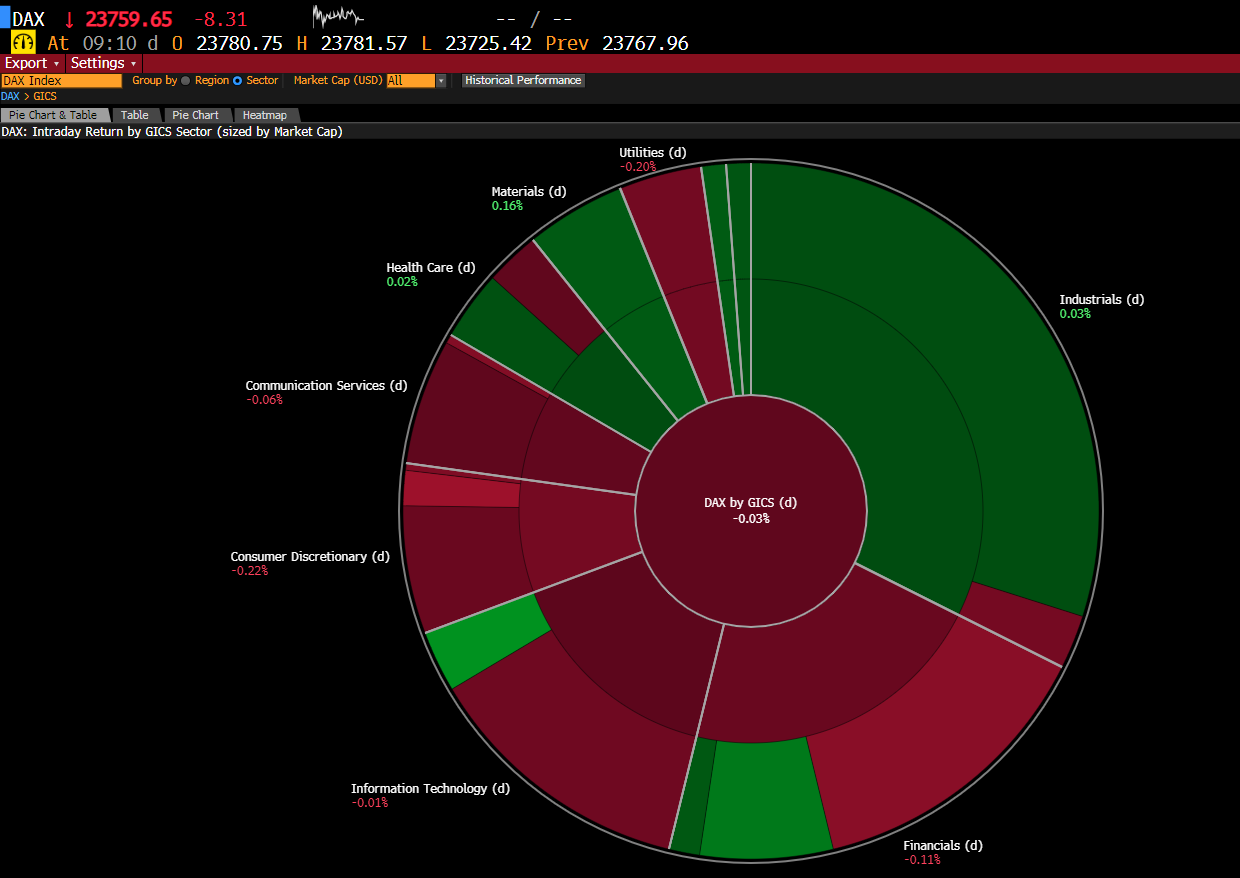

European indices are posting slight declines at the start of the second hour of trading. The key data from Europe today will be Germany’s CPI, scheduled for release at 2:30 p.m. Shares of Deutsche Börse (DB1.DE), Infineon and Merck are leading the gains in the index, while Rheinmetall (RHM.DE) continues to decline.

Source: xStation5

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Deutsche Borse rebounds on speculation about an Allfunds Group acquisition

Deutsche Borse entered the final stretch of the year with a statement that immediately drew the market’s attention. The group confirmed it is in an exclusive round of talks regarding the acquisition of Allfunds Group, one of the largest European providers of fund distribution and fund-services infrastructure. The announcement alone was enough for Allfunds shares to rebound after recent declines, reflecting how investors interpret the potential value of the deal. Discussions concern the acquisition of all issued and to-be-issued share capital of Allfunds Group Plc.

- The Allfunds board unanimously agreed to enter the exclusivity period based on Deutsche Börse’s non-binding proposal.

- The offer implies a total valuation of €8.80 per share, consisting of €4.30 in cash and €4.30 in new Deutsche Börse shares, calculated using the group’s 10-day VWAP.

- Additionally, Allfunds shareholders would be entitled to dividends: €0.20 for 2025, up to €0.20 (pro-rated to the closing date) for 2026, and €0.10 per quarter for 2027.

- The transaction remains subject to standard conditions such as due diligence, the finalization of binding documentation and approval from the boards of both companies. There is no guarantee the process will result in a completed agreement.

- Any final deal would also require regulatory approvals.

Although the statement does not yet include financial details regarding synergies, the structure of the process and the company’s messaging indicate a clear strategic direction: Deutsche Börse aims to reinforce its position as a key operator of financial market infrastructure in Europe. The main strategic objectives can be summarized as follows:

- The merger with Allfunds would create a harmonized, pan-European ecosystem for fund services, reducing market fragmentation.

- The company points to potentially significant operational savings and cost synergies, although it has not disclosed figures or a time frame.

- The acquisition is expected to improve operational efficiency, enhance investment capacity within the fund-services segment and accelerate the rollout of new products and technologies.

- The project fits into the broader plan of strengthening the region’s financial standing while building a platform with global reach.

At this stage, it is premature to assess the impact of the deal on Deutsche Börse’s financial results in the coming years, given the lack of synergy estimates and timeline details. What is already evident, however, is that the company continues its expansion trend through acquisitions, aiming to consolidate the highly fragmented fund-services market. Should the transaction go ahead, it may significantly reshape the competitive landscape of the European financial-infrastructure sector.

DB1.DE (D1 interval)

Shares of the Frankfurt stock exchange operator continue to rebound today after a months-long sell-off, returning to levels last seen at the beginning of October. They are still trading around 5% below the 200-day moving average

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.