- DAX fluctuates at 1-week high

- Symrise and SUSS MicroTec slide after earnings

- Nordex shares surge 19%

- Deutsche Borse stock well below EMA200 despite solid earnings report

- DAX fluctuates at 1-week high

- Symrise and SUSS MicroTec slide after earnings

- Nordex shares surge 19%

- Deutsche Borse stock well below EMA200 despite solid earnings report

Sentiments across the German stock market are slightly better today, amid positive sentiments on Wall Street. European stocks rise. German chancellor, Friedrich Merz backed up the Pan-European stock exchange initiative, aimed to rival US and Chinese stock markets.

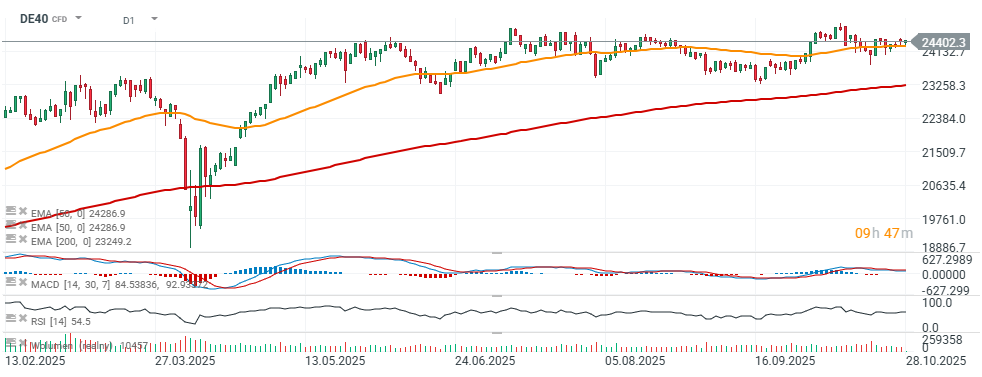

DE40

Futures on DAX (DE40) are up almost 0.3% today, rising above 24400 points, respecting EMA50 (the orange line).

Source: xStation5

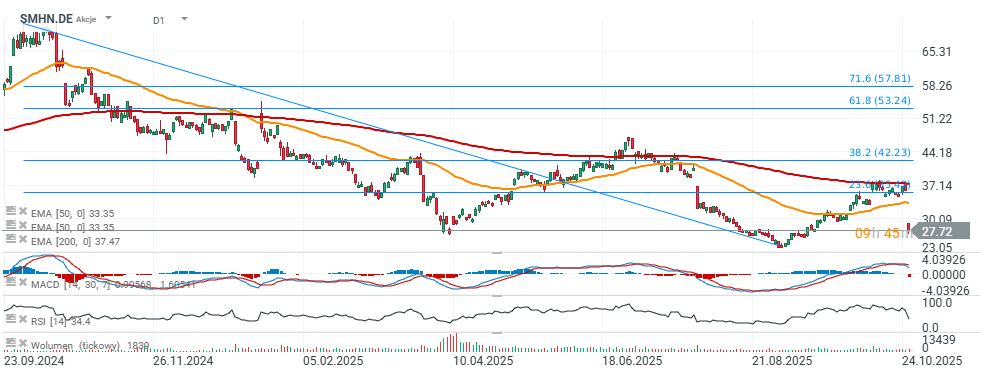

SUSS MicroTec (D1 interval)

Deutsche Bank has lowered its price target for SUSS MicroTec SE from €41 to €36, keeping a Hold rating after the company issued its second profit warning of 2025. While sales came in solid — around €118 million, about 4–5% above expectations — margins collapsed, revealing the real pain point. The gross margin dropped to 33.1%, well below the 38–39% range analysts had forecast, pulling the EBIT margin down to just 10.5%. According to Deutsche Bank, the sharp decline reflects both a less favorable product mix and ramp-up costs from the new Taiwan fab, which are weighing on near-term profitability. Top-line growth isn’t the issue — margins are. Actually, a stock is almost 30% below its EMA200.

Source: xStation5

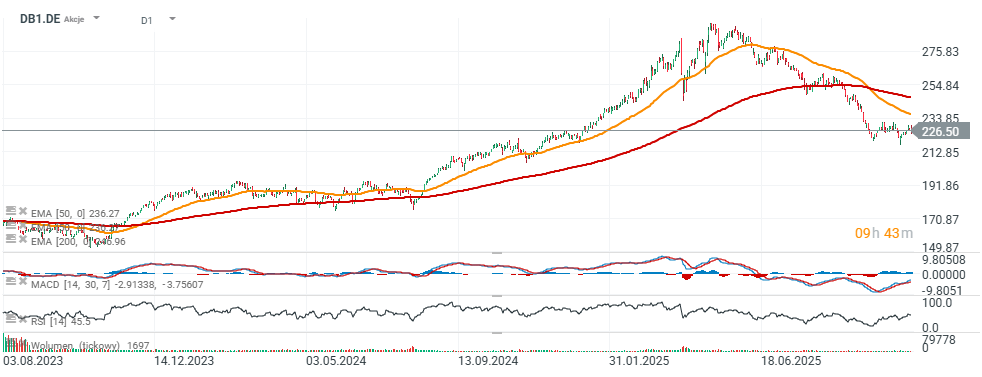

Deutsche Borse (D1 interval) Stock Beats Expectations, Calms Fears on Treasury Drag

Deutsche Boerse AG (DB1:GR) posted a solid Q3 2025 performance, edging past analyst forecasts and easing investor concerns over weak treasury results. Net revenue rose 3% year-over-year, while revenue excluding treasury results jumped 7%, signaling underlying business strength. Treasury income fell 19%, but the drop was less severe than markets anticipated.

- Tight cost control helped — expenses were 2% below estimates, lifting profitability. As a result, EBITDA beat consensus by 4% and EPS by 5%, marking a welcome return to earnings momentum. Deutsche Boerse reaffirmed its full-year 2025 outlook, currently trading at 18.3× 2026 EPS and 12× EV/EBITDA.

- Deutsche Börse delivered a strong third quarter, surprising analysts with better-than-expected results even amid low stock market volatility. The exchange operator earned €473 million in profit, a 6% increase year-over-year, exceeding consensus forecasts.

- According to new CFO Jens Schulte, earnings excluding treasury results rose 7%, showing the company’s resilience despite cyclical pressures in trading activity. For the full year, Deutsche Börse remains on track to meet its 2025 targets. Management continues to expect net revenue (ex-treasury) to climb roughly 9% to about €5.2 billion, while EBITDA should reach around €2.7 billion, up from €2.35 billion in the prior year.

In short, even with calmer markets, Deutsche Börse is proving it can generate steady growth — a reassuring signal for long-term. Deutsche Bank analyst maintained a Buy rating and €291 price target, saying the results “put an end to the recent negative earnings trends” and provide a strong setup for the December Capital Markets Day.

Source: xStation5

Symrise (SY1.DE, D1 interval)

Symrise Reports Slight Revenue Dip but Reaffirms Profit Targets

Symrise AG, the German producer of fragrances and flavorings, reported a modest decline in third-quarter revenue, reflecting slower market dynamics in parts of its portfolio. Revenue came in at €1.22 billion, down from €1.26 billion a year earlier, though organic sales still grew 1.4%. For the first nine months of the year, Symrise generated €3.78 billion in revenue, slightly below last year’s €3.82 billion, corresponding to 2.6% organic growth.

The company adjusted its full-year guidance, narrowing its organic growth forecast to 2.3%–3.3% (previously 3%–5%) but maintaining its EBITDA margin target around 21.5%. Looking ahead, Symrise reaffirmed its 2028 mid-term goals — targeting an organic compound annual growth rate (CAGR) of 5%–7% and an EBITDA margin between 21% and 23%. Despite near-term headwinds, Symrise continues to emphasize stable profitability and disciplined execution toward its long-term growth plan.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.