DAX rebounds after lower open; DE40 Up 0.1%, defense sector improves sentiments on German market as media reports around Russia - Ukraine summit in Istanbul suggest low probability of 30-day ceasefire. According to MoscowTimes sources, Russian president Putin will not attempt the summit personally, nor Trump despite Zelenskyy arrival. Futures on Wall Street slightly decline.

-

Following a weaker open, the DAX has returned to gains, with the DE40 index rising by 0.1%. The German market is being buoyed by strength in the defense sector.

-

Shares of Thyssenkrupp are down more than 12% after releasing earnings, as both sales and market conditions in the steel segment disappointed investors.

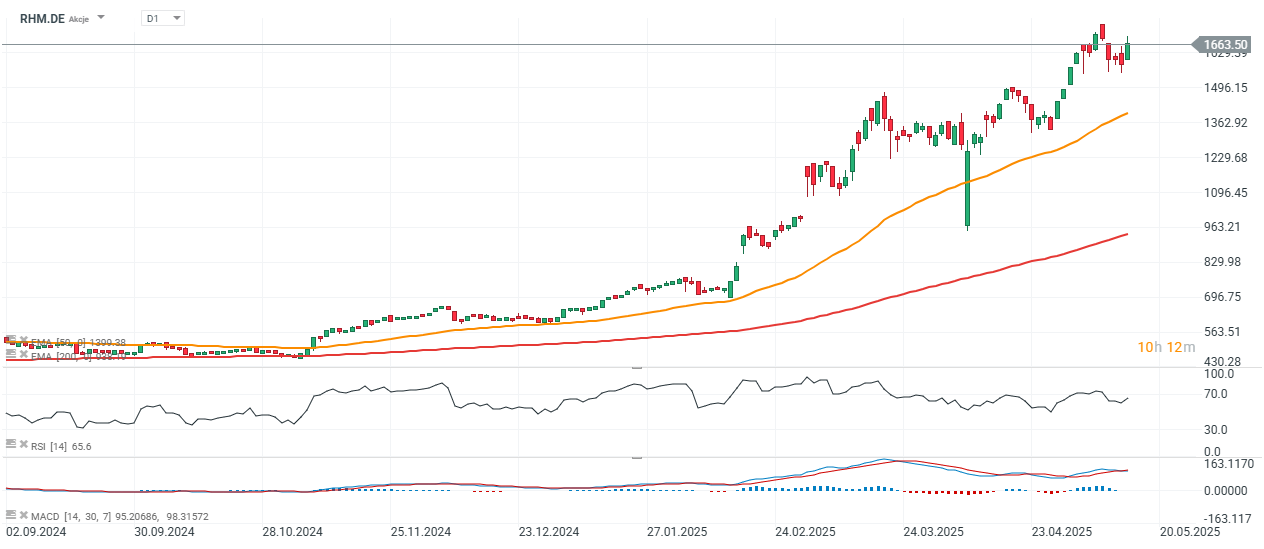

- Germany's defense stocks are in demand amid renewed Russia-Ukraine tensions. Rheinmetall is up nearly 5%, while RENK Group and Hensoldt are also gaining ground.

- Meanwhile, economic data showed that Eurozone GDP missed expectations on a monthly basis (0.3% vs 0.4% forecast), but industrial production came in stronger than anticipated both month-over-month (2.6% vs 2.0%) and year-over-year (3.6% vs 2.5%).

DE40 (Daily Chart)

DAX futures swiftly rebounded following recent sell-offs and are currently holding near historical highs.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appSource: xStation5

Buy-side Volume Regaining Strength

Over the last few hours, buying volume has regained momentum. The key resistance level now stands near 23,650 points.

Source: xStation5

Market Volatility in Europe – BMW Drops, Rheinmetall Gains on Geopolitical Tensions![]()

Source: xStation5

Steel and Automotive Drag Down Thyssenkrupp

Thyssenkrupp shares had rallied strongly in recent months, largely driven by investor optimism over a potential spin-off of its Marine Systems division, which services the German Navy (Kriegsmarine). However, the company’s latest results disappointed due to weak steel demand and a slowdown in the automotive industry.

- Despite these setbacks, the industrial conglomerate maintained its full-year forecast for fiscal 2024/25. When announcing its half-year results, the company said it still expects adjusted EBIT to come in between €600 million and €1 billion.

- In contrast, adjusted operating profit in Q2 came in at just €19 million—a 90% drop from the same period a year ago. This result was significantly impacted by a €23 million loss in the steel division. CEO Miguel Lopez expressed hope for better market conditions in the second half of the year.

- The company attributed the poor performance in Steel Europe to lower revenues and planned shutdowns related to restructuring efforts. Meanwhile, work continues on building a facility for "green" steel production.

- Thanks to the sale of its subsidiary Thyssenkrupp Industries India, the group reported a net profit of €167 million in Q2. For the full year, Thyssenkrupp continues to target net earnings between €100 million and €500 million.

Preparations to spin off the marine division are in full swing, and a sale of a minority stake could be completed before year-end. However, the unchanged guidance disappointed the market, prompting profit-taking after the strong rally in Thyssenkrupp shares earlier this year.

Thyssenkrupp Shares (Daily Chart)

On the daily chart, shares of the German steelmaker and naval supplier are undergoing a significant correction from recent local highs near €11. A major support test could occur around the EMA200, close to €6.50 per share.

Source: xStation5

Rheinmetall Shares (Daily Chart)![]() Source: xStation5

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

Source: xStation5

Source: xStation5