- The European session unfolds in mixed tone, with PMI readings shaping sentiment; SPA35 and UK100 lead gains, while DE40 lags, down around 0.2%.

- Most PMI services data from Western Europe came in weaker than expected, though still above the 50-point growth threshold, except in France.

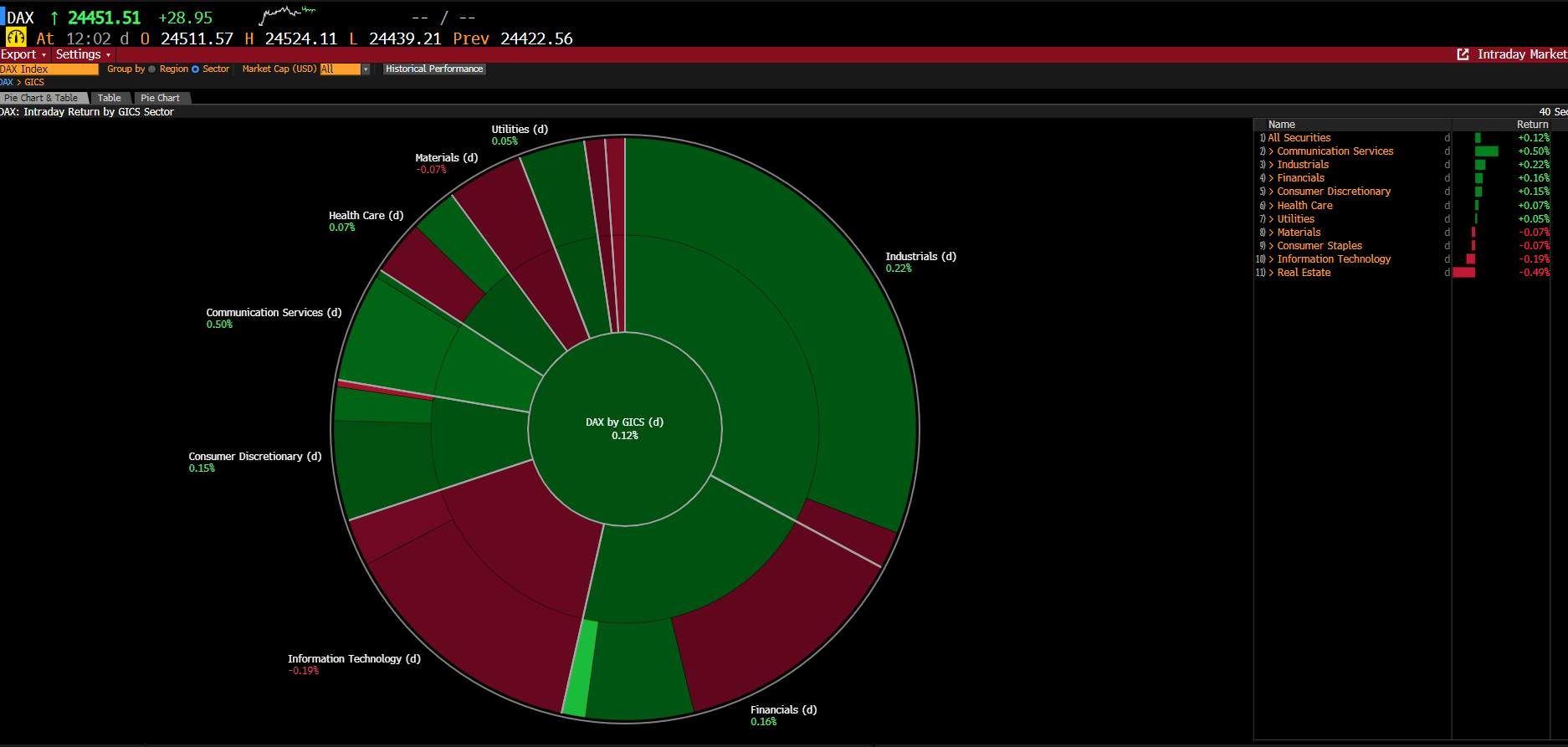

- On the German index, real estate and IT sectors weigh on performance, while telecoms and industry provide support.

- Company updates: Nemetschek gains over +2% on a buy recommendation; Raiffeisen rises more than 2% after the EU decision on Russian assets.

- The European session unfolds in mixed tone, with PMI readings shaping sentiment; SPA35 and UK100 lead gains, while DE40 lags, down around 0.2%.

- Most PMI services data from Western Europe came in weaker than expected, though still above the 50-point growth threshold, except in France.

- On the German index, real estate and IT sectors weigh on performance, while telecoms and industry provide support.

- Company updates: Nemetschek gains over +2% on a buy recommendation; Raiffeisen rises more than 2% after the EU decision on Russian assets.

Today, the European session is unfolding in a positive mood, with investors' main focus remaining on the PMI readings from key economies in the eurozone. These data set the tone for the markets, showing the condition of industry and services, thereby influencing expectations regarding further monetary policy decisions. The SPA35 and UK100 contracts are gaining the most. DE40 is performing worse, down about 0.2%.

Source: Bloomberg Finance Lp

On the German index, the real estate and IT sectors are losing the most today. Telecommunications services and the industrial sector remain supportive for the price.

Macroeconomic Data

Today's session is marked by the publication of PMI data for the services sector from major Western European economies. Below is a summary of key readings:

- Spain, Services PMI September – Expected: 53.2, Published: 54.3, Previous: 53.2

- Italy, Services PMI September – Expected: 51.5, Published: 52.5, Previous: 51.5

- France, Services PMI September – Expected: 48.9, Published: 48.5, Previous: 49.8

- Germany, Services PMI September – Expected: 52.5, Published: 51.5, Previous: 49.3

- Eurozone, PMI September – Expected: 51.4, Published: 51.3, Previous: 50.5

- United Kingdom, Services PMI (final) September – Expected: 51.9, Published: 50.8, Previous: 54.2

Most readings turned out weaker than market forecasts, introducing moderate caution on the trading floors. However, the situation remains under control, with indicators still above the 50-point threshold that separates growth from slowdown, except for France, where services are recording values below this threshold.

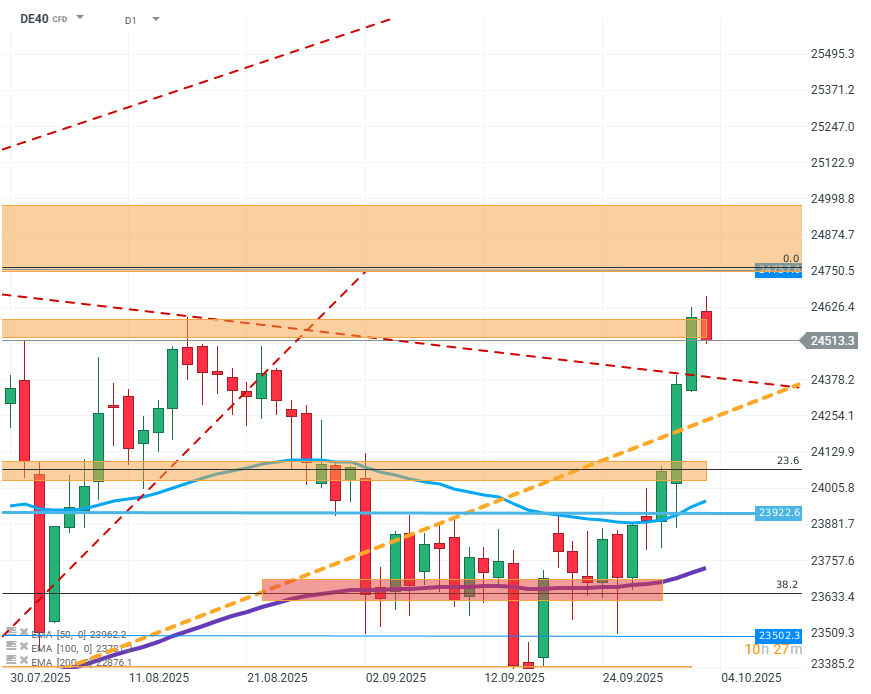

DE40 (D1)

Source: xStation5

The price on the chart briefly broke the resistance around, 24500 but quickly returned below, which is a sign of weakness among buyers after recent increases. A likely scenario is consolidation along the line of the short-term downward trend and another attempt to test the resistance. If the price breaks through the short and medium-term trend lines, the next support for it will only be the FIBO 23.6 level.

Company News:

Nemetschek (NEM.DE) - The company received a buy recommendation from an investment bank. The price is rising by over +2%.

Raiffeisen (RAW.DE) - The European Commission decides to transfer frozen assets of Russian oligarchs under the bank's management. The valuation is rising by over 2%.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.