- The decline in European indices (1–2%) was caused by growing concerns about the quality of loans in U.S. regional banks and a global risk aversion.

- Eurozone inflation was in line with forecasts (CPI 2.2% year-on-year), but there was no reaction in EUR/USD; concerns about the stability of the financial sector and the political situation in France remain dominant.

- The decline in European indices (1–2%) was caused by growing concerns about the quality of loans in U.S. regional banks and a global risk aversion.

- Eurozone inflation was in line with forecasts (CPI 2.2% year-on-year), but there was no reaction in EUR/USD; concerns about the stability of the financial sector and the political situation in France remain dominant.

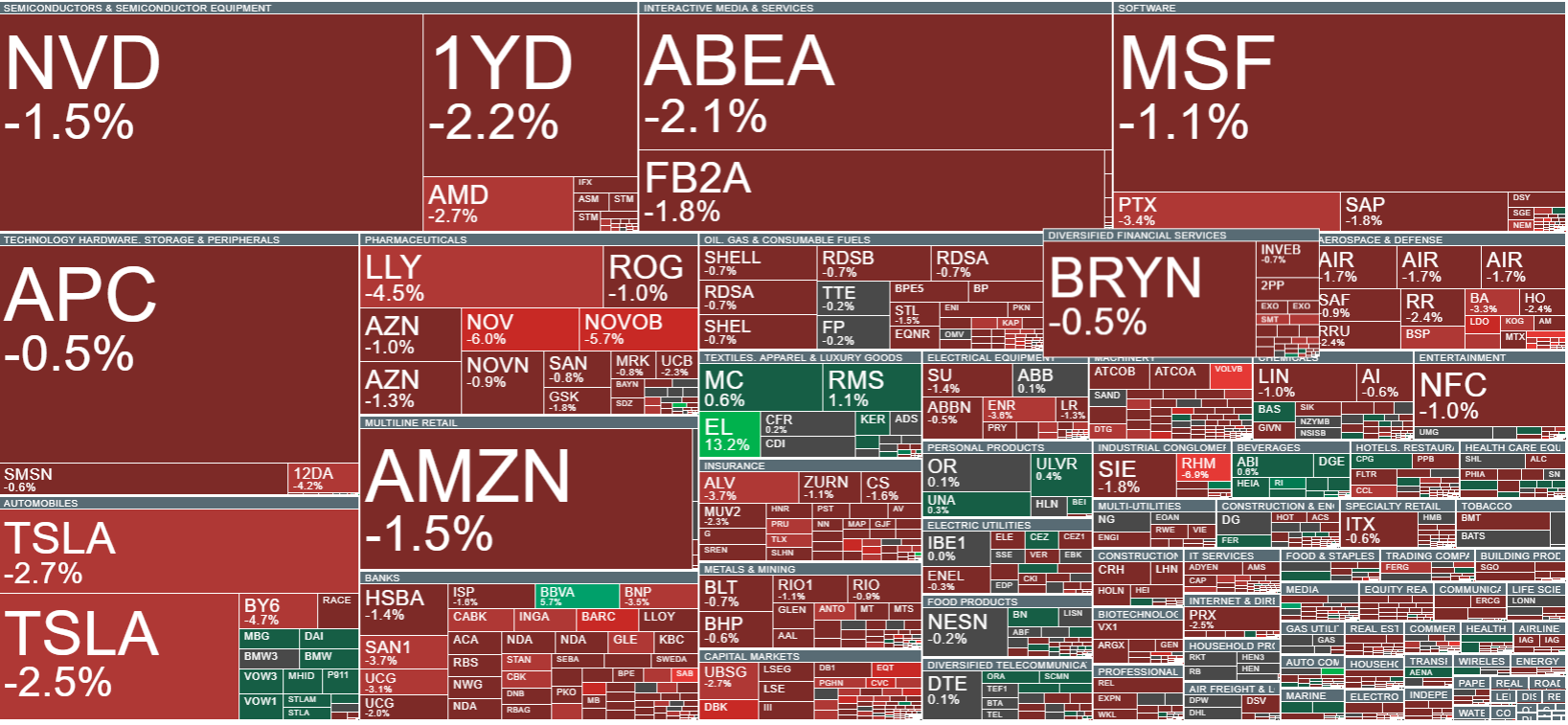

On Friday, European stock indices fell sharply, declining by as much as 1–2%. However, these drops were not triggered by local macroeconomic data but by growing concerns about the banking sector situation in the United States. Negative signals regarding the quality of loan portfolios at some U.S. regional banks (including Zions, Jefferies, Western Alliance) caused a rise in global risk aversion and a flight of investors toward safe-haven assets.

At the same time, final inflation data for the eurozone were released, which aligned with earlier estimates. The CPI rose to 2.2% year-on-year, an increase compared to the previous month (2.0%), while core inflation remained steady at 2.3% year-on-year, unchanged from the previous reading. Despite the expected results, the currency market remained indifferent, and the EUR/USD exchange rate showed no significant reaction.

The lack of volatility in the euro-dollar suggests that investors do not currently view inflation as the primary market driver. The dominant theme remains the banking sector and the related systemic risks. Additionally, political uncertainty in France—although the prime minister survived a vote of no confidence—undermines confidence in the country’s fiscal condition, which does not support stability in European market sentiment.

In this environment, the euro loses ground, while the dollar gains attractiveness as a safe haven. Without new impulses from the ECB or Fed and no surprises in macro data, the EUR/USD exchange rate may remain within a limited range of fluctuations. Market attention is currently shifting from inflation to potential risks stemming from the financial sector — and these will be key for the direction of quotes in the near future.

Source: xStation

Currently observed volatility in the broader European market.

Source: xStation

DAX futures are falling today, mainly under pressure from negative sentiment related to problems in U.S. regional banks. The index is losing value, showing a clear weakening of investor risk appetite in the financial sector. The chart shows a decline following a period of solid gains, with the DAX breaking below key 50-day and testing the 100-day exponential moving averages (EMAs). Key support levels, such as the 50- and 100-day EMA, are under pressure, and maintaining them will be important for market stabilization and potential trend reversal. If the DAX fails to hold above these averages, it may signal further short-term declines.

Source: xStation5

Company News:

Shares of Continental (CON.DE) are up 8% after Deutsche Bank upgraded its recommendation for the company, highlighting better-than-expected Q3 results, mainly due to strong performance in the tire division. The bank also raised the target price from €63 to €65, pointing to the resilience of the tire segment, which, thanks to a favorable product mix and stable prices, compensated for volume declines and external challenges such as tariffs and currency pressures. Q3 2025 results exceeded forecasts in terms of profits, cash flows, and overall group margins. The tire segment, with revenues around €3.5 billion, remained stable year-on-year despite a volume drop of about 1%. The adjusted EBIT margin in this division was 14.3%, significantly above the consensus of 13%, translating to roughly a 10% advantage over forecasts.

Shares of Deutsche Bank (DBK.DE) are down 5.8% amid a global sell-off of bank stocks triggered by concerns over credit quality at U.S. regional banks. Yesterday, Zions Bancorporation reported a $50 million loss on two loans, and Western Alliance filed a fraud lawsuit, which sparked investor worries about credit standards in the banking sector.

Shares of German defense giants Rheinmetall (RHM.DE) and RENK (R3NK.DE) are declining in response to the announced meeting between Presidents Trump and Putin. Investors fear that talks could lead to de-escalation of the conflict in Ukraine, potentially negatively affecting demand for military equipment and thus limiting revenues for companies in the defense sector.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.