- European markets start Wednesday’s session lower, following a correction in the U.S. market and weakness in technology shares.

- Positive macro signals: final eurozone PMI at 52.5, German services PMI at 54.6, German industrial orders up 1.1% month-on-month.

- Investors remain cautious on the technology sector, fueled by comments from Morgan Stanley and Goldman Sachs on high valuations.

- European markets start Wednesday’s session lower, following a correction in the U.S. market and weakness in technology shares.

- Positive macro signals: final eurozone PMI at 52.5, German services PMI at 54.6, German industrial orders up 1.1% month-on-month.

- Investors remain cautious on the technology sector, fueled by comments from Morgan Stanley and Goldman Sachs on high valuations.

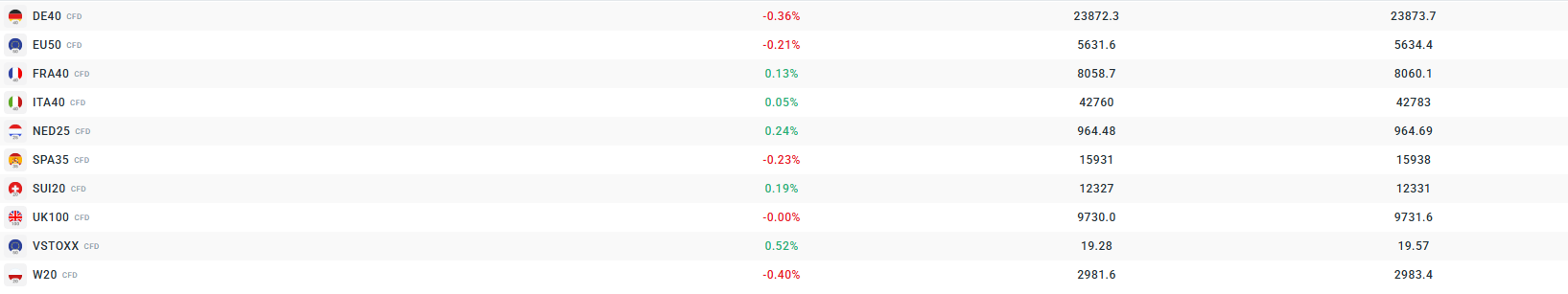

European stocks start Wednesday, November 5, 2025, lower, following a correction in the U.S. market, where technology shares are sharply down. The German DAX index is down around 0.5%, the French CAC 40 falls 0.2%, and the British FTSE 100 about 0.1%. Weakness in the European market continues the trend from the U.S. and Asia, where investors are increasingly concerned about high valuations of technology and AI-related companies.

Additionally, positive macroeconomic signals are arriving from the eurozone. The final composite PMI for the eurozone in October stands at 52.5, exceeding the forecast of 52.2. In the services sector, the eurozone PMI is 53 versus a forecast of 52.6. In Germany, the services PMI rose to 54.6 from 51.5 in September, also above expectations. Despite these economic positives, the equity market remains under pressure, as investors continue to react cautiously to uncertainty in the technology sector.

Global uncertainty and investor concerns about the future of the technology sector are fueled by statements from leaders of major U.S. banks, including Morgan Stanley and Goldman Sachs, who question the sustainability of current high valuations.

Against this backdrop, German industrial orders increased by 1.1% month-on-month in September, after a previous decline of 0.4%, signaling positive momentum in the economy. Oil prices are stabilizing after earlier declines, due to rising U.S. inventories and concerns about weak demand.

Source: xStation

Currently observed volatility in the broader European market.

Source: xStation

In recent weeks, the DE40 index (German DAX) has slowed its rise and entered a correction, falling below the short-term EMA(50) and testing the EMA(100) support. The market has lost some gains from the October peak but remains above the long-term EMA(200), which may indicate stabilization. This situation shows that investors are cautious after rapid gains and are now waiting for new macroeconomic impulses and corporate results.

Source: xStation

Company news:

BMW(BMW.DE) shares rise following third-quarter 2025 results, despite market challenges and a year-on-year profit decline. Investors positively view stable sales in Europe and the U.S. and the growing share of electric vehicles, highlighting the company’s strategic development in electromobility. BMW continues its “Neue Klasse” program, launching new models aimed at strengthening its global position, especially in the premium segment. Despite tougher conditions in China and cost pressures, the company maintains a solid automotive EBIT margin and increasing vehicle deliveries, supporting positive market sentiment.

BMW Q3 2025 financials:

-

Pre-tax profit: €2.3 bn (down 9.1% YoY)

-

Cumulative profit for the first nine months: €8 bn

-

Automotive EBIT margin: 5.2%

-

Vehicle deliveries: 588,000 units (up 8.7%)

-

Europe: +9.3%

-

U.S.: +24.9%

-

China: flat YoY

-

-

Automotive segment revenue: €28.5 bn (up 2.4%)

BMW full-year 2025 guidance:

-

Pre-tax profit: ~€10 bn (slight YoY decline)

-

Automotive EBIT margin: 5–6%

-

Automotive net cash flow: >€2.5 bn

Novo Nordisk (NOVOB.DK), the Danish pharmaceutical giant, continues a deep restructuring, announcing around 9,000 job cuts worldwide. The company lowers full-year 2025 profit guidance due to rising competition in the obesity drug segment and restructuring costs, although it recorded a 5% increase in operating profit in the first three quarters. Sales of its popular drug Wegovy are growing, but competition from Eli Lilly and others is affecting prices and growth rates. In Q3, total sales were DKK 75 bn, and operating profit fell about 30% to DKK 23.7 bn, with Wegovy sales at DKK 20.4 bn.

Siemens Healthineers (SHL.DE) forecasts a decline in net profit for fiscal year 2026, mainly due to higher tariffs and unfavorable exchange rates, especially a strong euro against the dollar. Despite these challenges, the company expects revenue growth of 5–6% and plans to increase dividends, supported by solid cash generation and debt reduction. Siemens Healthineers also emphasizes continued investments in medical technology development, adapting its strategy to the changing market environment. Markets reacted cautiously, with shares falling around 7% on the forecast and uncertainty related to tariffs and currency rates.

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.