- European market holds steady at opening

- Mixed Eurozone PMI

- Defense stocks suffer on unfavorable peace talks

- European tech in decline amid waving AI boom

- European market holds steady at opening

- Mixed Eurozone PMI

- Defense stocks suffer on unfavorable peace talks

- European tech in decline amid waving AI boom

Yesterday's session was not successful for buyers, as American indices clearly lost ground, and many commentators and analysts expected the declines to transfer to Europe after the market opened. European indices on the cash market opened with moderate declines, but futures contracts are already in growth territory. The SUI20 contracts are rising the most in the morning hours, by almost 1%. Smaller increases can be observed in the FRA40, ITA40, and UK100 contracts, where they are limited to 0.4-0.6%.

European markets will be pricing further direction today based on yesterday's strong Wall Street movements, a solid dose of macroeconomic data from the old continent, and some comments from central bankers.

ECB bankers had their speeches today. The bank's president, Christine Lagarde, strongly criticized the reluctance of European countries to implement key reforms and pointed out that the current level of interest rates allows for growth noticeably greater than what is being observed.

Macroeconomic Data:

- The situation in the United Kingdom continues to deteriorate. Retail sales fell month-to-month by -1.1% against expectations of 0%.

- In France, industrial PMI readings are significantly falling and remain in contraction territory (47.8). The composite PMI also remains in contraction (49.9), supported by a relatively good Services reading (50.8).

- The German reading remains ambivalent. The composite and industrial PMI falls more than expected but remains in growth territory (52.1 and 52.7). The industrial reading performs worse, with a decline to 48.4 against expectations of growth to around 49.8.

- In the Eurozone, services remain the strength of the economy with PMI rising above expectations to 53.1, but industry continues to disappoint, falling to 49.7.

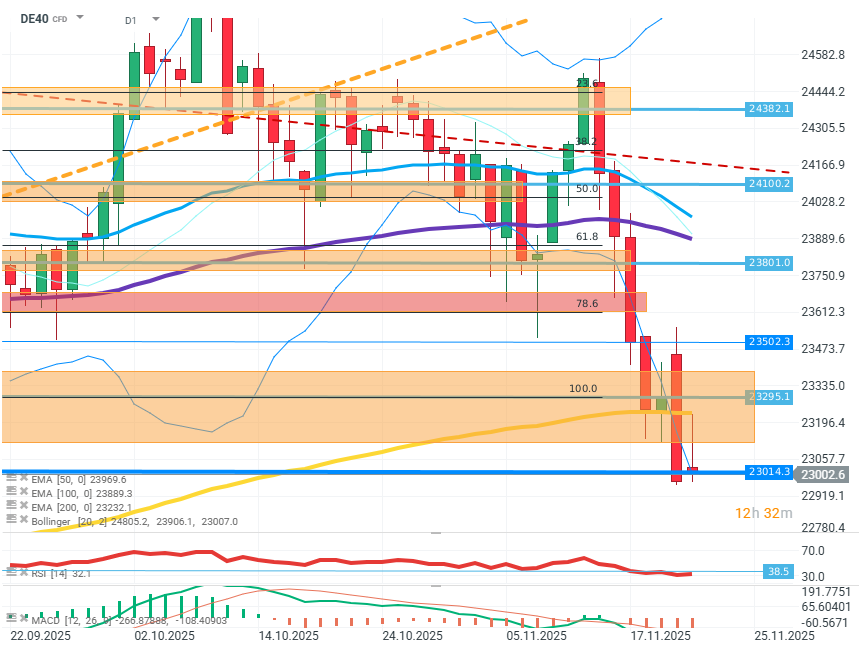

DE40 (D1)

Source: xStation5

The price on the index continues a strong downward movement, passing through the resistance zone around the FIBO 100 retracement and the EMA200 average. Buyers managed to halt the declines only at the level of 23000, the last minimum from May. The RSI's transition into the oversold territory (38) and the lower limit of the Bollinger bands favor an attempt at a corrective increase.

Company News:

- The extremely unfavorable peace proposal for Ukraine recently proposed by the USA is negatively impacting the valuations of European defense companies. RENK (R3NK.DE), Hensoldt (HAG.DE) are losing about 3%. Rheinmetall AG (RHM.DE) is losing as much as 7%.

- The retreat from risk and shaken faith in the AI boom is putting pressure on the valuations of European tech companies. Infineon (IFX.DE) is losing 4%, ASML (ASML.NL) is down over 7%, Siemens (SIE.DE) is depreciating by 8%.

- Babcock (BAB.UK) - The producer of nuclear and military equipment published very good results, exceeding expectations and showing, among other things, a 27% profit increase. However, amid weak sentiment, the company is still losing over 2% of its capitalization.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.