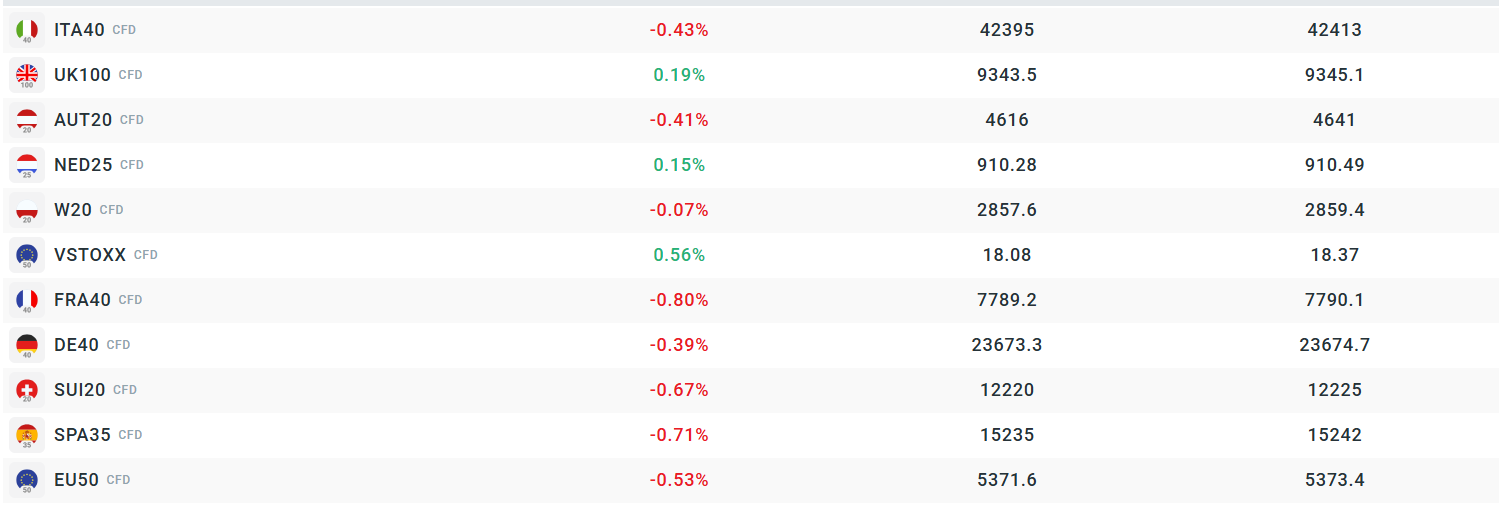

European financial markets are experiencing a wave of pessimism today. Futures on the DE40 index are down more than 0.4%, while the EU50 is declining by over 0.8%. FRA40 and ITA40 futures are also underperforming, with losses of approximately 0.9% and 0.8%, respectively. The market is reacting to today’s inflation reading from Germany and anticipation ahead of the U.S. Federal Reserve's interest rate decision.

German data show consumer inflation (CPI) rose by 2.2% year-over-year, in line with forecasts, and by 0.1% month-over-month, also matching expectations. The harmonized index of consumer prices (HICP) increased by 2.1% y/y and 0.1% m/m. Although inflation remains stable, investors may fear that further price increases could influence the European Central Bank’s monetary policy decisions.

In the context of monetary policy expectations, investors are eagerly awaiting the U.S. Federal Reserve’s decision regarding interest rates. The Fed is expected to move towards further monetary easing, which could impact global financial markets.

Source: xStation5

Volatility Observed Across the Broader European Market

Source: xStation

The German DE40 index is down 0.4% during today’s session and is trading very close to a support level defined by the 100-day exponential moving average (orange curve on the chart). This area acts as a technical support, helping to limit further downside. However, market sentiment remains cautious, as the upcoming Federal Reserve decision next week may significantly impact global market sentiment, including European indices.

Source: xStation

Company News:

-

Hannover Re (HNR.DE) is up nearly 3% today after UBS upgraded the stock from “neutral” to “buy,” highlighting the company’s strong financial resilience. Analysts note that the firm is trading at a 6% discount relative to the sector despite stable earnings growth and solid performance. The company may benefit from investor expectations of a potential market slowdown, as its defensive profile makes it a relatively safe pick in the sector. UBS set a new price target of €280, implying around 16% upside from current levels.

-

Stellantis (STLAM.IT) is down around 1.7% after UBS lowered its forecasts for the company, pointing to a delayed recovery in financial performance. Analysts highlight ongoing challenges such as high costs, weak demand, and strong competition from Chinese manufacturers.

-

BAE Systems (BSP.DE) is up about 1% amid rising demand for weapons and military equipment. Increased defense spending in Europe and ongoing geopolitical tensions are contributing to positive expectations for the company, which is one of the world’s largest defense technology providers.

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.