-

The Bundestag approves record military orders worth €52 billion, covering 29 contracts for the Bundeswehr; shares of Rheinmetall, Renk, and Hensoldt rise.

-

Orsted and Vestas gain after a U.S. court overturns the ban on new wind projects in the United States, restoring growth prospects for the sector.

-

Thyssenkrupp expects a net loss of €400–800 million in the current fiscal year due to weak steel market conditions and costly restructuring; shares fall by around 10%.

-

The Bundestag approves record military orders worth €52 billion, covering 29 contracts for the Bundeswehr; shares of Rheinmetall, Renk, and Hensoldt rise.

-

Orsted and Vestas gain after a U.S. court overturns the ban on new wind projects in the United States, restoring growth prospects for the sector.

-

Thyssenkrupp expects a net loss of €400–800 million in the current fiscal year due to weak steel market conditions and costly restructuring; shares fall by around 10%.

Next week, the German Bundestag will approve record defense spending worth €52 billion (around $61 billion), covering 29 contracts for the Bundeswehr. This is the largest single-budget decision in the history of the German armed forces and aims to transform it into the strongest conventional military force in Europe. Key planned investments include €22 billion for basic military equipment and uniforms, €4.2 billion for Puma infantry fighting vehicles, €3 billion for advanced Arrow 3 interceptor missiles in cooperation with Israel, and €1.6 billion for reconnaissance satellites, which are expected to significantly enhance intelligence and monitoring capabilities.

The scale of these measures reflects an accelerated military modernization that began after Russia’s full-scale invasion of Ukraine in 2022. At that time, former Chancellor Olaf Scholz announced a “historic turning point” (Zeitenwende), and current Chancellor Friedrich Merz continues this course with even greater determination, allocating hundreds of billions of euros to rebuild neglected armed forces and fundamentally reshape Europe’s security architecture. Merz has repeatedly emphasized that the goal of these measures is to protect the freedom of future generations. During a recent live citizen meeting, he stated: “The world around us has completely changed. We want to be able to defend ourselves so that we never have to.”

Germany’s record defense spending fits into the broader context of European efforts to strengthen security in response to increasing threats from Russia. It includes both the purchase of modern air defense systems and the development of the domestic defense industry, as well as deepening international cooperation. The aim is not only to ensure continental stability but also to create a modern, well-equipped army capable of rapid response to contemporary threats. The unprecedented scale of investment demonstrates that Germany takes European security seriously and is consistently implementing its ambitious military modernization plan.

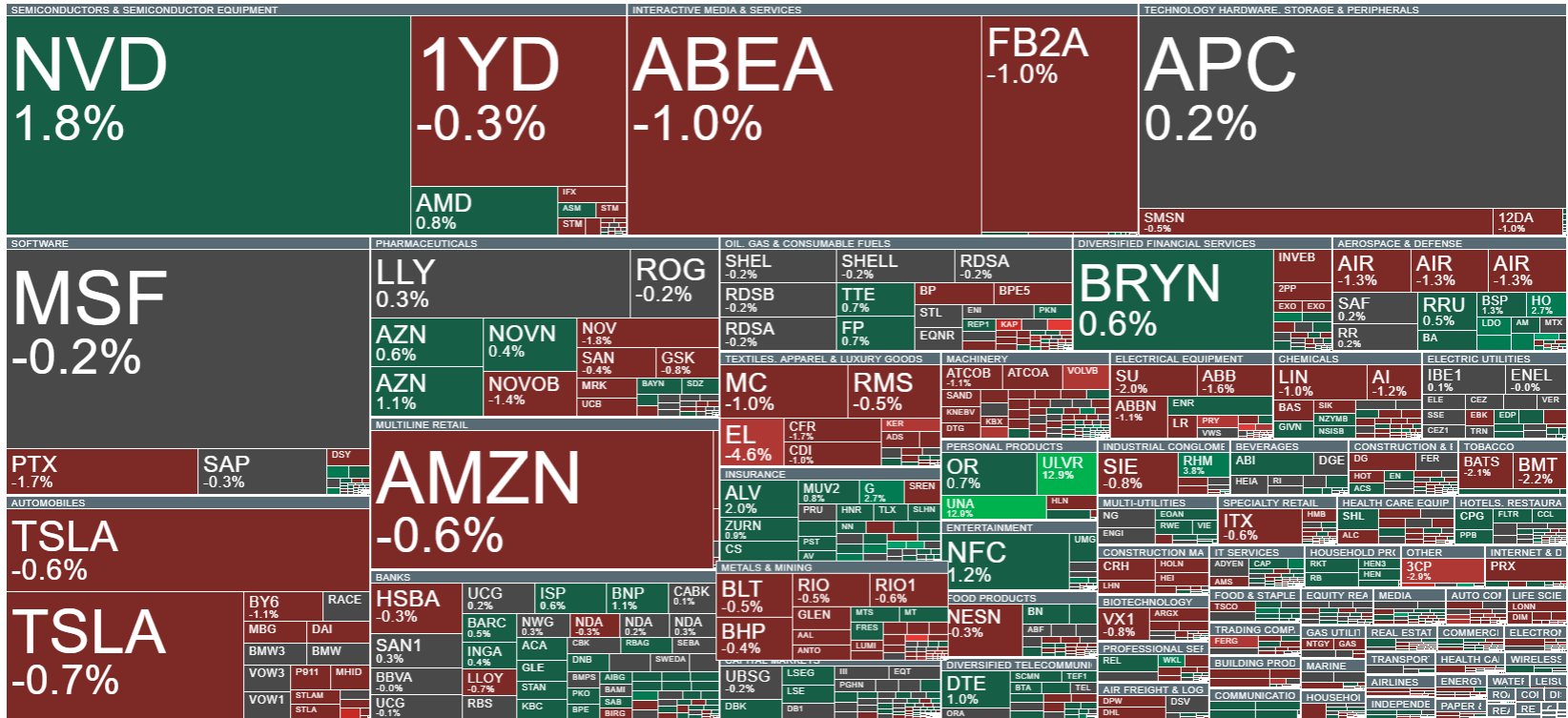

Currently, volatility is observed across the broader European market.

Source: xStation

During today’s session, index futures are rising noticeably, recovering some of the earlier losses and confirming an improvement in short-term market sentiment. However, in a broader context, prices are still moving within a long-term consolidation range, meaning that despite the current rebound, there has not yet been a sustained breakout above the previous trading range or a change in the dominant trend structure.

Source: xStation

Company News:

Shares of Rheinmetall (RHM.DE), Renk (R3NK.DE), Hensoldt (HAG.DE), and other defense companies are rising following the German parliament’s decision on record defense orders worth €52 billion (around $61 billion). The orders cover 29 contracts for equipment and services for the Bundeswehr as part of the plan to transform it into Europe’s strongest conventional army. This represents the largest number and highest value of contracts approved at once in Bundestag history, highlighting the scale of the armed forces’ modernization and boosting investor enthusiasm.

Shares of clean energy companies such as Orsted (ORSTED.DK) and Vestas (VWS.DK) are also rising after a U.S. federal judge overturned the nationwide ban on new wind projects imposed by Donald Trump. The decision allows onshore and offshore wind projects in the U.S. to proceed, giving the sector a boost after months of regulatory uncertainty.

Thyssenkrupp (TKA.DE) expects a significant net loss in the current fiscal year (October 2025 – September 2026) due to weak conditions in the steel industry and high restructuring costs, estimated at around €350 million. As a result, the company anticipates a loss of €400–800 million, which has negatively impacted investor sentiment, with shares falling approximately 10% during today’s session. The restructuring plan includes reducing headcount at steel plants by 40% (around 11,000 employees) and cutting steel production from 11.5 million tons to 8.7–9 million tons, while simultaneously investing in low-carbon steelmaking technologies.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

Stock of the Week: Broadcom Driven by AI Sets Records

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.