- European indices trade lower

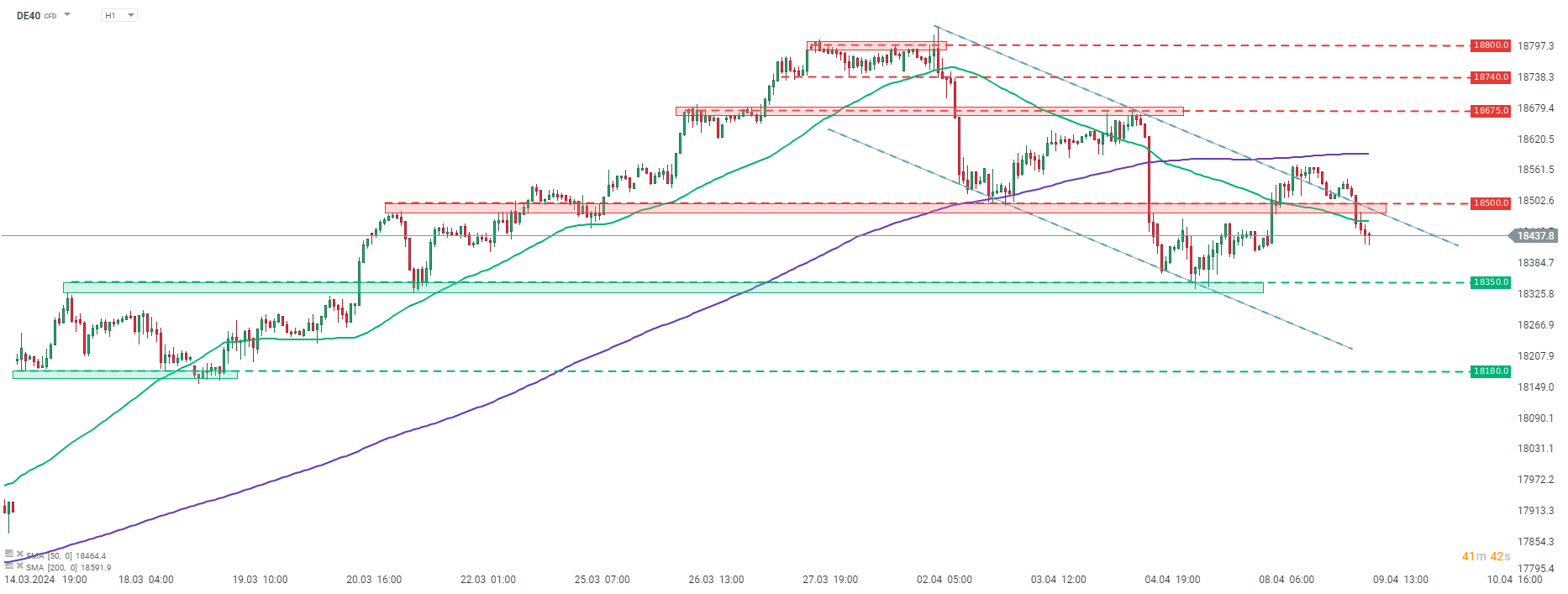

- DE40 returns to short-term downward channel

- Pullback on defense sector stocks

European stock market indices trade lower today. German DAX trades 0.7% lower, UK FTSE 100 gains 0.1%, French CAC40 drops 0.6%, Dutch AEX declines 0.2% and Italian FTSE MIB plunges 0.9%. Defense stock are lagging, with Rheinmetall dropping around 9%.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appSource: xStation5

German DAX futures (DE40) attempted to break above the upper limit of the short-term bearish channel yesterday. Bulls managed to push the price above it but failed to sustain the momentum and the index is back within the channel now. Short-term technical outlook still favors bears and should declines continues, the first near-term support zone to watch can be found in the 18,350 pts area.

Company News

Rheinmetall (RHM.DE) as well as other European defense companies are pulling back today, with German companies shares plunging 9%. There was no negative news to justify the drop. On the contrary, Bloomberg reported that Germany plans to order ships and armor vehicles worth €7 billion as well as report on approval for Rheinmetall for further infantry fighting vehicle deliveries to Ukraine. Defense companies, including Rheinmetall, have been performing very well recently and today's pullback could be driven by profit taking following recent rally, and may be just a correction. Also a note from Goldman Sachs suggesting that the sector is trading at peak multiples is providing fuel for a sell-off.

Daimler Truck (DTG.DE) reported a 13% drop in Q1 2024 sales. In unit terms, Daimler Truck sold 108,911 trucks in the first quarter, compared to 125,172 a year ago. The company said that lower sales reflect normalization in global truck markets as well as weakness in key Asian markets.

Analysts' actions

- Hugo Boss (BOSS.DE) rated 'buy' at Bankhaus Metzler. Price target set at €86.00

Rheinmetall (RHM.DE) launched today's trading higher but have erased all the gains shortly after session launch and plunged later on. Stock was trading as much as 12% lower on the day at one point but has managed to recover. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.