Deckers Outdoor Corp (DECK.US) initially surged by even 13% (now +11.30%) after the company reported strong fiscal Q2 earnings, with net sales rising 20% year-over-year to $1.31 billion, surpassing analysts' consensus of $1.2 billion. The growth was driven by robust demand for Hoka and UGG brands, with Hoka sales up nearly 35% and UGG up 13%. This positive momentum led Deckers to raise its full-year guidance, now forecasting $4.8 billion in net sales with an adjusted EPS of $5.15 to $5.25.

Financial summary:

- Net Sales: $1.31 billion (+20% YoY), above estimate of $1.2 billion.

- Hoka Sales: $570.9 million (+35% YoY), above estimate of $517.7 million.

- UGG Sales: $689.9 million (+13% YoY), above estimate of $634.4 million.

- Teva Sales: $22 million (+2.3% YoY).

- Sanuk Sales: $2.8 million (-48% YoY).

- Gross Margin: 55.9%, up from 53.4% YoY, estimate was 52.1%.

- Wholesale Sales: $913.7 million (+20% YoY), above estimate of $823.2 million.

- Adjusted EPS: $1.59, well above consensus estimate of $1.2.

- Full-Year Net Sales Guidance: Raised to $4.8 billion.

- Full-Year Adjusted EPS Guidance: $5.15-$5.25.

Management highlighted Deckers’ expanding innovation pipeline and international growth potential, particularly for Hoka and UGG. Despite projecting a seasonal slowdown in the latter half of the fiscal year, the company anticipates ongoing strength from new product launches and increased market presence abroad. Notably, the raised gross margin forecast of 55% to 55.5% reflects disciplined distribution and strong full-price sales momentum across brands, positioning Deckers for continued growth in a competitive footwear market.

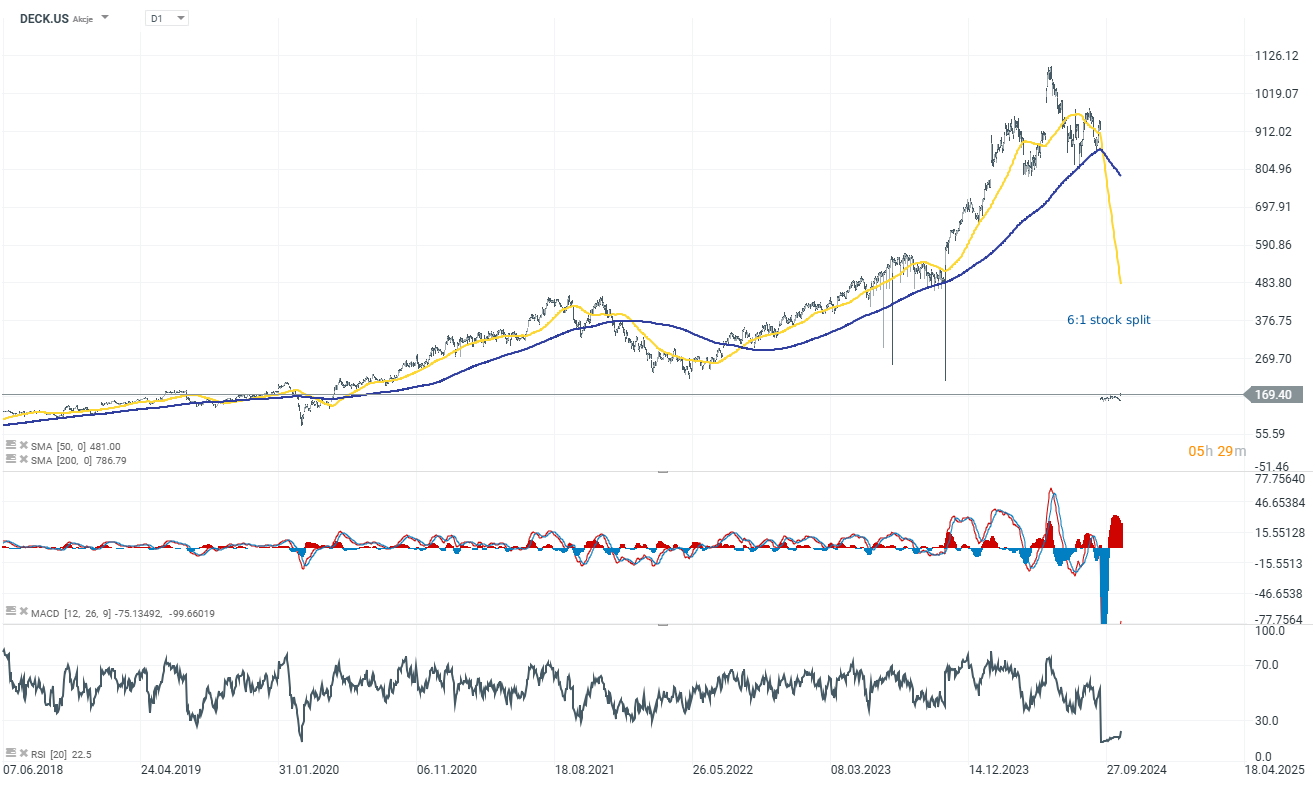

Price Chart (D1 interval)

The company's market capitalization is up by 11.50% today, making it the second-highest gainer in the S&P 500 index, following Tapestry (+14.40%). The stock price has risen to $170, close to its historical all-time high reached before the 6:1 stock split.

Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.