Disney (DIS.US) shares gained more than 7% before the open as the company reported successful quarterly results that reassured analysts despite a higher-than-expected loss from streaming services. Re-assuming the position of CEO, Bob Iger shared with the market a convincing plan to restructure the business and drive Disney's profitability through cost cutting and prudent spending:

- Disney will lay off 7,000 employees to cut costs, decision-making positions unchanged

- Iger pointed to overspending on advertising and focusing on quality content but not 'at all costs'

- Streaming profits down especially outside the US and in India due to loss of cricket broadcast licenses

- Content volume and spending will decline, company will focus on Star Wars, Marvel and Pixar franchises

- ESPN will ultimately not be spun off, Iger wants to find a way to monetize it

- Demand at parks remains high, company will consider additional Avatar-related attractions

Revenues: UDS 23.51 billion vs. forecast of $23.44 billion

Earnings per share (EPS): UDS 0.99 ($1.28 billion) vs UDS 0.77 forecasts and UDS 1.06 in Q4 2021

Theme parks: $8.1 billion in revenue (21% y/y), $3.1 billion in profits (25% y/y)

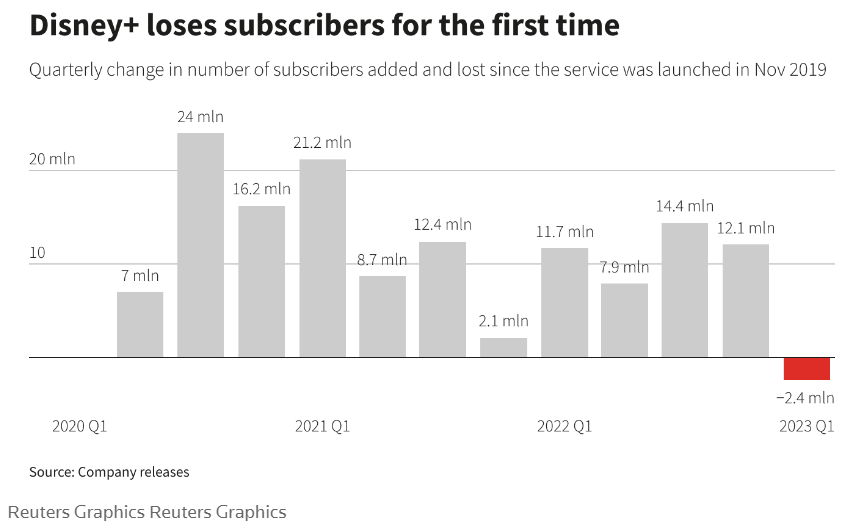

Disney+: $1.5 billion loss vs. $1.5 billion forecast and $1.5 billion in Q3 2022, and 2.4 million subscriber decline

Iger's plan is to split the company into three internal segments - entertainment (film, TV, streaming), ESPN (sports) and parks, (experiences and products). The CEO indicated that he will seek board approval for a small dividend by the end of 2023, and hopes to increase it over time. Disney will no longer give long-term guidance for its streaming subscription targets. 'New ways' of generating profits can't compare to old ways. The CEO stressed that streaming, while it is the future, cannot match the base business through which the company has grown for decades. Since the launch of Disney+, the new business has generated a total of $10 billion in losses.

The company reported 2.4 million subscriber churn from Disney+ in Q4 2022 (fiscal Q1 2023) in the face of rising subscription prices and lower consumer spending. Total subscriptions of 161.8 million disappointed forecasts of 162.7 million (FactSet). Source: Reuters

With streaming competition on the rise (Netflix, WarnerBros Discovery, HBO), companies have to take risks by increasing spending on content that will attract viewers and cater to their 'whims' which poses significant risks to the business;

Technology makes it the consumer who 'has the power' and can move between different platforms destabilizing profitability.

- Disney's chairman stressed that the key to the company's future will be the creativity of the creators and the quality of the content that has led it to the top for more than a century. In doing so, however, he pointed to cost and expense control;

- To drive streaming's profitability, Iger indicated that the company will lay off 7,000 employees (about 3%) as part of a broader plan to reap $5.5 billion in savings. The previous wave of layoffs took place in 2020 and included 32,000 employees from theme parks. With the decision, lower costs will make Disney 'more resilient' in times of economic uncertainty;

- Iger also announced that sequels for top animated films are in the works: Toy Story, Frozen and Zootopia;

- Disney's Media and Entertainment Distribution division, which included 'good friends' of former CEO Bob Chalk, has been eliminated; Iger wants to 'crush the concrete' at the company and get spending under control at last.

Disney (DIS.US), W1 interval. The 'death cross' formation, in 2008, paradoxically heralded a return to the uptrend. Today, the two averages are again close to an intersection, which in theory should herald longer-term weakness, but in practice, as a 'lagging indicator', it may herald the exhaustion of supply. The opening today points to levels above $118 per share. Source: xStation5

Disney (DIS.US), W1 interval. The 'death cross' formation, in 2008, paradoxically heralded a return to the uptrend. Today, the two averages are again close to an intersection, which in theory should herald longer-term weakness, but in practice, as a 'lagging indicator', it may herald the exhaustion of supply. The opening today points to levels above $118 per share. Source: xStation5

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

TSMC launches 2 nm, shares rise 📈

US Open: A Powerful Start to the New Year for Nasdaq!

Fashion giant overshadowed by train accident near Machu Picchu 🚞

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.