Today at 1:30 pm GMT, we will learn about the PCE inflation data. This is a key measure from the Fed's perspective. Expectations for today's reading:

-

The PCE inflation is expected to remain at 2.6% year-over-year.

-

The core PCE inflation is expected to drop to 3.0% year-over-year, from the level of 3.2% year-over-year.

-

Monthly PCE inflation is expected to increase by 0.2% month-over-month, in line with achieving the Fed's inflation target in the forecast term. Recently, monthly PCE inflation fell by 0.1% month-over-month.

-

Core monthly PCE inflation is also expected to rise by 0.2% month-over-month, after an increase of 0.1% month-over-month in November.

The market fears that if there is a stronger drop in inflation, especially core inflation, expectations of interest rate cuts for March might rise again, and next week the Fed could change its stance to be more dovish. On the other hand, attention should be paid to risk factors for potential inflation rebound. This includes the recent rise in oil prices due to tensions in the Middle East. Additionally, there has been a significant increase in sea freight rates. Moreover, the US economy remains in very good condition, as illustrated by the GDP data for the fourth quarter, although at the same time, regional Fed indicators suggest a slowdown at the beginning of this year.

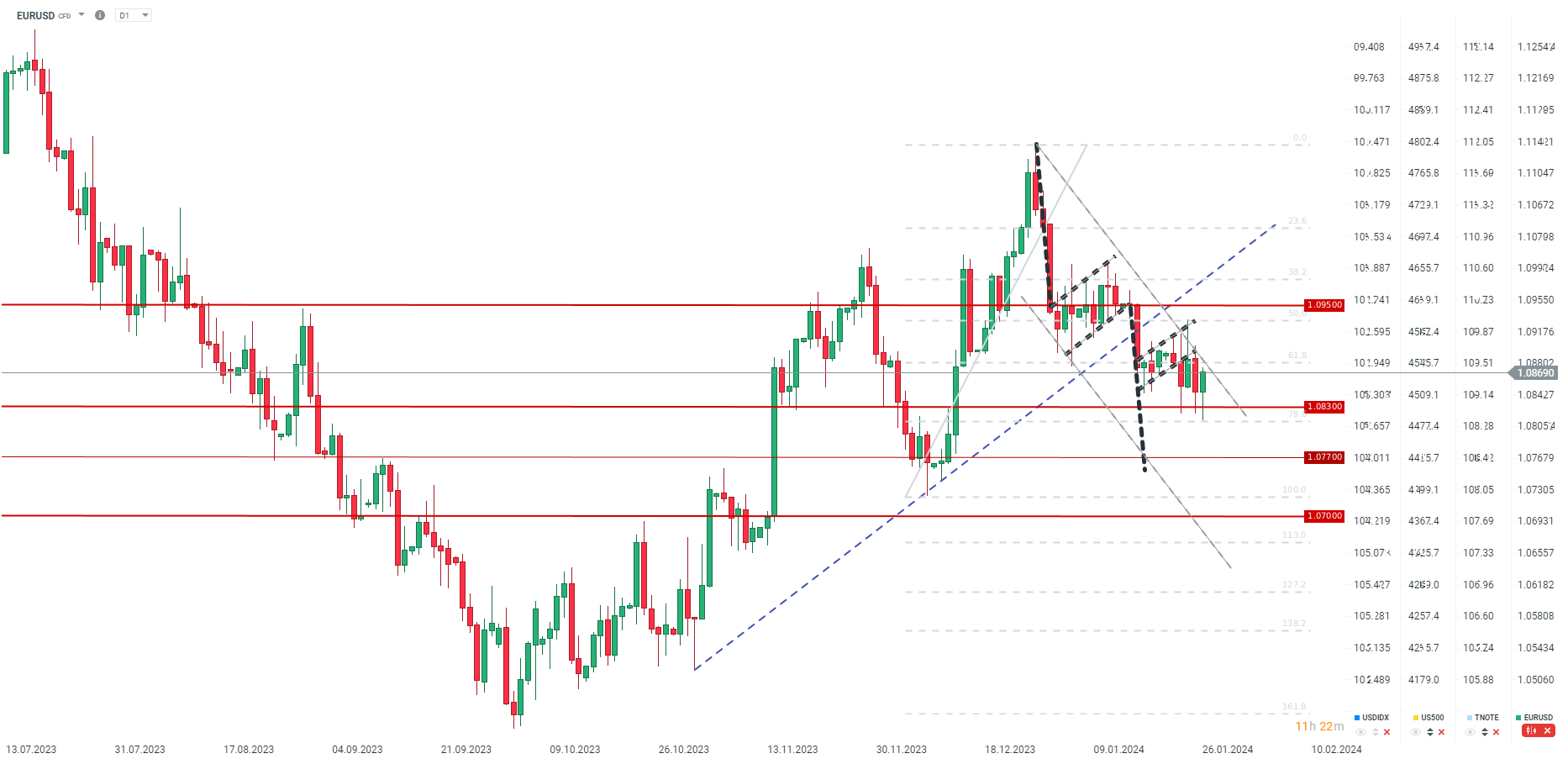

EURUSD has clearly rebounded since the start of the European session, although initially, the pair tested areas close to the 1.0800 level. The key resistance level is around the 61.8% retracement and the upper limit of the downward trend channel. If PCE inflation shows lower readings than expected, even a rise above 1.0900 cannot be ruled out. This level is key from the perspective of the trend for EURUSD next week.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.