One of the large companies in the dry commodity freight sector (raw materials including steel, coal and wheat) Eagle Bulk Shipping (EGLE.US) reported financial results above forecasts, surprisingly reporting still relatively strong revenue and earnings per share despite a slowdown in the freight sector and below-average rates. The company specializes in operating medium-sized vessels.

Revenues: $101.4 million vs. $72.8 million forecasts

Earnings per share: $1.21 vs. $0.44 forecasts

Net profit: $18 million

- The company pointed out that the decline in freight rates lasting from 2022 is surprisingly large even given the overall economic uncertainty.

- The opening of China's economy surprises negatively but still positively impacts the dry bulk carrier sector, with hopes for further improvement in the seasonally better second part of the year

- The company is operating at a relatively low w debt relative to industry competitors. The company intends to use 30% of earnings to pay dividends ($0.56 per share).

- In Q2, it repurchased 28% of its strategic stake in the company from the OakTree fund for cash (3.8 million shares)

- 95% of the company's fleet (about 90 vessels) is equipped with scrubbers to reduce operating costs

- The company expects freight rates to return to the vicinity of average, in the medium term, and expects an upturn in the current and next quarter of the year.

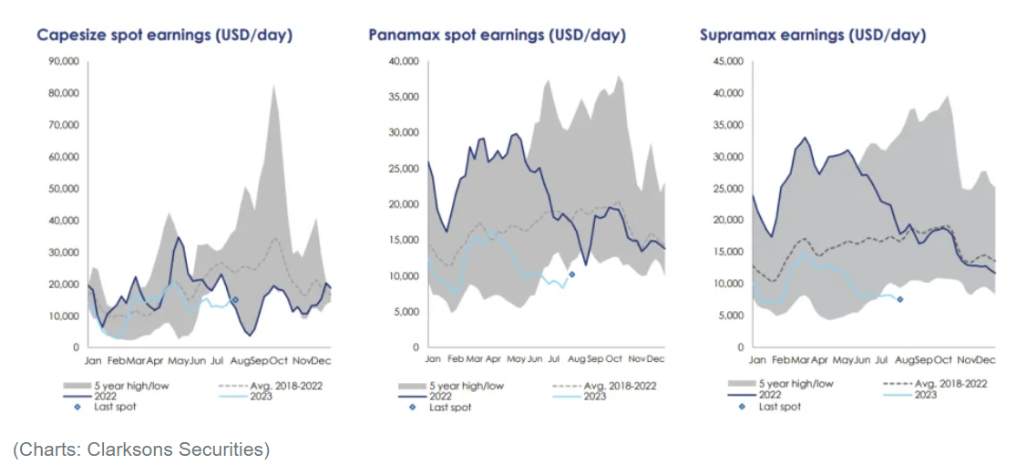

Seasonally, freight rates for all three types of container ships (3 different sizes) are well below average). Source: Clarkson Securities

Eagle Bulk's shares are holding support set by previous price reactions near $40 - this coincides with the 61.8 Fibonacci retracement of the upward wave from the spring of 2020. The price is below the SMA200 (red line) - a rise above it may herald a possible longer rebound. Source: xStation5

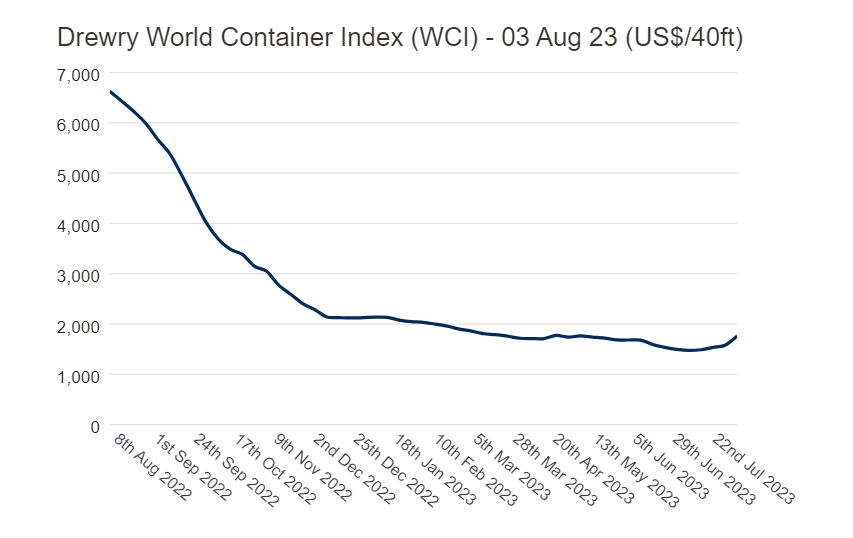

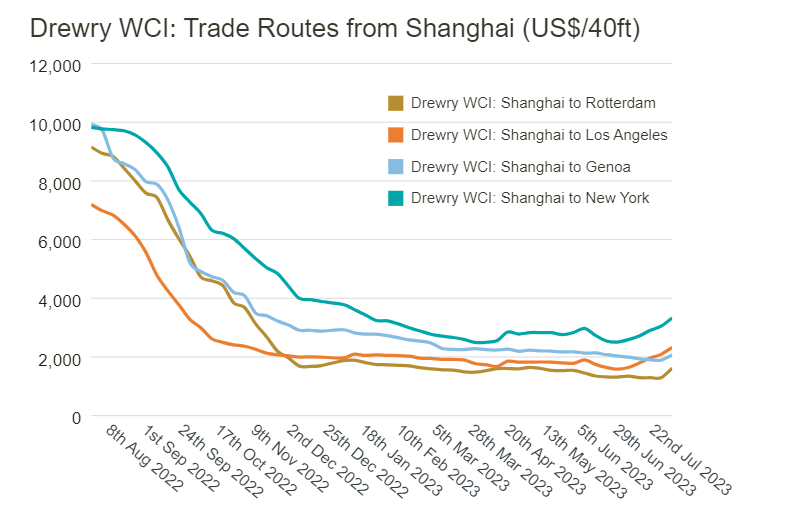

Container freight rates according to Drewry data are gradually increasing which potentially reflects the relatively still strong demand in the economy and the opening of China (although this is running well below expectations).

Source: Drewry

However, the Baltic Dry index tracking average dry freight prices on the world's 20 largest trade routes is still trading around 1,100 points - well below the March-May levels but still more than 100% above the March 2023 500 points.

Source: CNBC

Daily summary: The Market recovers losses and awaits rate cuts

IBM Goes Against the Tide: Three Times More Entry-Level Employees

US OPEN: The market looks for direction after inflation data

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.