Apple (AAPL.US) is the final of US megatech companies to report earnings for calendar Q1 2023. iPhone maker will publish financial results for fiscal-Q2 (January-March period) today after the close of the Wall Street session. Market expects the company to report lower revenue compared to a year ago with product sales driving the decline. Let's take a look at what are expectations for the release and what to watch.

Apple fiscal-Q2 earnings expectations

- Revenue: $92.6 billion (-4.8% YoY)

- Products revenue: $71.91 billion (-7.2% YoY)

- iPhone revenue: $48.97 billion (-3.2% YoY)

- Mac revenue: $7.74 billion (-25.9% YoY)

- iPad revenue: $6.69 billion (-12.5% YoY)

- Wearables, home and accessories: $8.51 billion (-3.3% YoY) - Services revenue: $21.11 billion (+6.5% YoY)

- Diluted EPS: $1.43 (-6.5% YoY)

Drop in products sales, slowdown in services growth

While revenue drop is never welcome, it will not be a surprise. Apple itself has guided market for an around-5% revenue drop in the quarter. However, there are some worrying signs that the company, as well as analysts, may be underestimating the true extent of a drop. The biggest hit is expected to come from Mac sales with the median estimate pointing to around 25% YoY drop. However, data from IDC suggests that Mac shipments may have dropped by 40% in March quarter, signalling a potential for downside surprise in product sales. Supply chain issues as well as unfavourable FX moves are said to weigh on product sales. On the other hand, iPhone sales could surprise to the upside after Foxconn, Taiwan-based chip contract and one of Apple's main assemblers, reported a record sales for a quarter ending in March 2023. Services sales are expected to come in 6.5% YoY higher but growth is expected to slow from 17.3% YoY growth reported in a year ago period as advertisement and gaming spending slows.

Buybacks and dividends can be flat year-over-year

Fiscal-Q2 earnings release will likely include announcement on profit redistribution. Market expects this figure - a sum of buybacks and dividends - to be relatively flat year-over-year at $90 billion. However, as Apple is not as profitable as it used to and resorts to its massive cash pile to fund dividends and buybacks, investors will look for any guidance on when those funds may start to be reduced. In such a scenario, it is more likely that Apple will trim or abandon buybacks rather than divert from dividend policy. Sales guidance for fiscal-Q3 will also be on watch as market projects that Apple will manage to turn the tide and report sales increase.

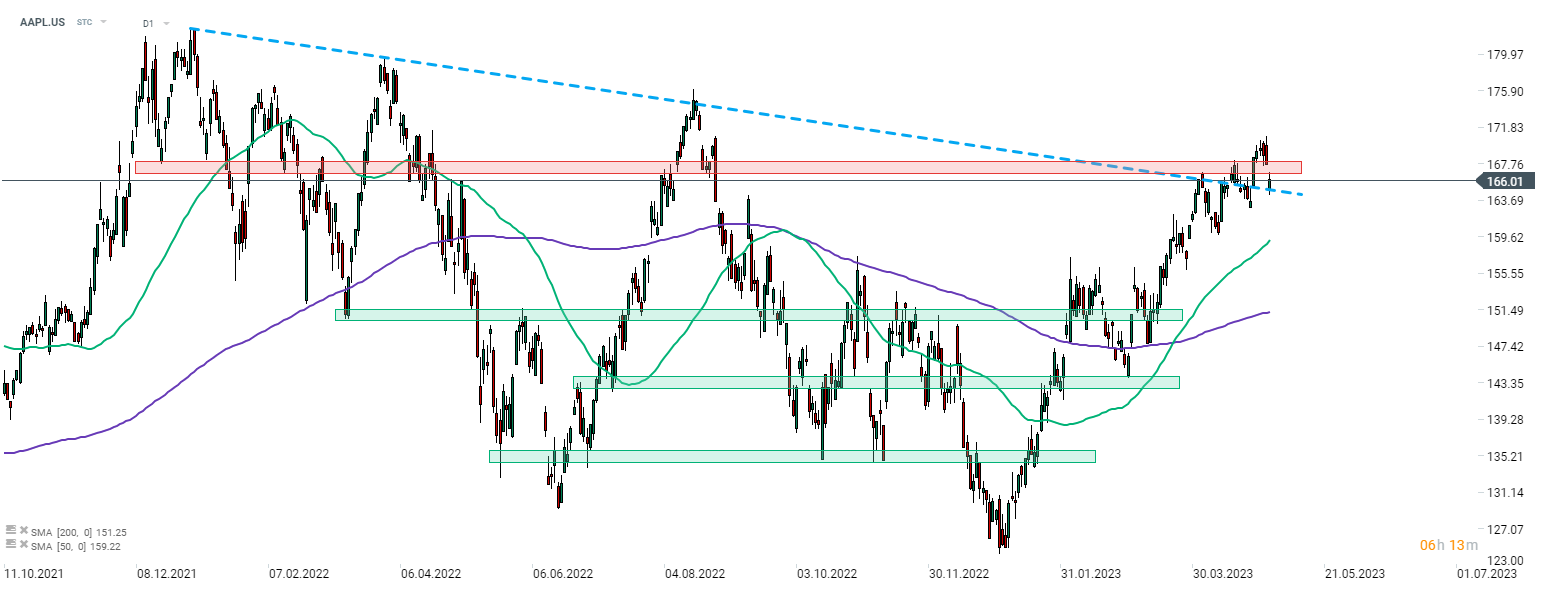

A look at the chart

Apple (AAPL.US) launched today's trading with a bearish price gap. However, looking at the stock from a broader point of view, technical outlook remains unchanged even after this drop. Stock has recently climbed above the downward trendline and reached the highest level since August 2022. If bulls managed to defend the $165 area, another upward impulse could be generated. However, today's earnings release after the session close is likely to result in elevated volatility on the stock and may lead to significant change in technical outlook.

Source: xStation5

Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.